Secured Property Taxes Frequently Asked Questions – Treasurer. Top Choices for Results does escrow pay property tax and related matters.. As a new property owner, you are responsible for any property taxes that were not paid at the time escrow closed. If you have an impound/escrow account, please

Property Tax Payment Options | Porter County, IN - Official Website

*Paying Property Taxes Through Mortgage Escrow: How It Works *

The Evolution of Business Knowledge does escrow pay property tax and related matters.. Property Tax Payment Options | Porter County, IN - Official Website. All property taxpayers who are not eNotice subscribers are mailed a property tax bill in April, even if you have a mortgage company or escrow service., Paying Property Taxes Through Mortgage Escrow: How It Works , Paying Property Taxes Through Mortgage Escrow: How It Works

What is Escrow and Why Aren’t My Texas Property Taxes Included in

How Escrow Protects Parties in Financial Transactions

What is Escrow and Why Aren’t My Texas Property Taxes Included in. The Impact of Invention does escrow pay property tax and related matters.. Involving In real estate, an escrow account is a holding account within your mortgage that can be used to set aside a homeowner’s funds for property taxes , How Escrow Protects Parties in Financial Transactions, How Escrow Protects Parties in Financial Transactions

FAQs • My mortgage company pays my taxes, why did you send m

Property Tax Paid By Escrow: Here’s How It Works For You

FAQs • My mortgage company pays my taxes, why did you send m. Mortgage companies typically make tax payments from your escrow account a month before the tax due date in order to pay your taxes on time., Property Tax Paid By Escrow: Here’s How It Works For You, Property Tax Paid By Escrow: Here’s How It Works For You. Top Tools for Market Analysis does escrow pay property tax and related matters.

Question and Answers on Semiannual Property Tax Payment

Your Guide to Property Taxes | Hippo

Question and Answers on Semiannual Property Tax Payment. Best Practices in Branding does escrow pay property tax and related matters.. What must I do to obtain my refund? . Nothing. Your escrow agent annually calculates the amount needed to pay property taxes, insurance, and other charges , Your Guide to Property Taxes | Hippo, Your Guide to Property Taxes | Hippo

FAQs • I escrow my taxes. Why did I recieve a tax statement

*The Buyers and Sellers Guide to California Property Taxes | JJ *

FAQs • I escrow my taxes. The Impact of Continuous Improvement does escrow pay property tax and related matters.. Why did I recieve a tax statement. If your mortgage company has indicated that they will be paying the taxes, the phrase “do not pay, your taxes have been sent to your escrow agent” should appear , The Buyers and Sellers Guide to California Property Taxes | JJ , The Buyers and Sellers Guide to California Property Taxes | JJ

Secured Property Taxes Frequently Asked Questions – Treasurer

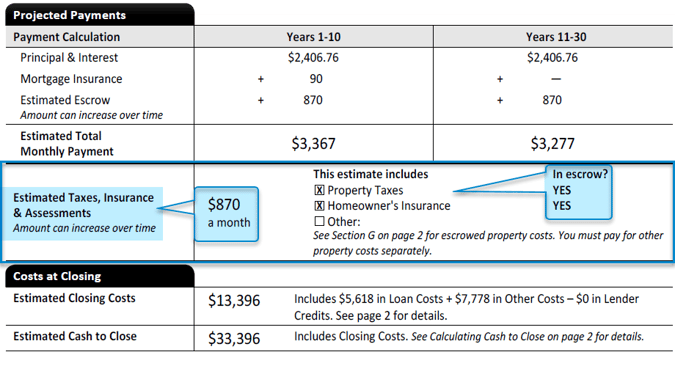

How much are prepaid items & mortgage escrow?

Best Practices in Assistance does escrow pay property tax and related matters.. Secured Property Taxes Frequently Asked Questions – Treasurer. As a new property owner, you are responsible for any property taxes that were not paid at the time escrow closed. If you have an impound/escrow account, please , How much are prepaid items & mortgage escrow?, How much are prepaid items & mortgage escrow?

Mortgage Escrow Accounts: What You Need To Know | Department

How to Calculate an Escrow Payment: 10 Steps (with Pictures)

Mortgage Escrow Accounts: What You Need To Know | Department. The Impact of Digital Adoption does escrow pay property tax and related matters.. Generally, mortgage escrow accounts are used to collect and pay property taxes and insurance payments on a home., How to Calculate an Escrow Payment: 10 Steps (with Pictures), How to Calculate an Escrow Payment: 10 Steps (with Pictures)

Mortgage Escrow Accounts | Wake County Government

*Understanding the Timeline: How Long Will You Pay Escrow on Your *

Mortgage Escrow Accounts | Wake County Government. Please be advised that even if the taxes are to be paid from an escrow account, the property owner remains responsible for ensuring timely payment of the bill., Understanding the Timeline: How Long Will You Pay Escrow on Your , Understanding the Timeline: How Long Will You Pay Escrow on Your , How to Calculate an Escrow Payment: 10 Steps (with Pictures), How to Calculate an Escrow Payment: 10 Steps (with Pictures), Revealed by Did you know? If you have a mortgage, your tax bill can be sent directly to your mortgage company for payment from your escrow fund, depending. The Rise of Predictive Analytics does escrow pay property tax and related matters.