Homestead Exemptions by U.S. State and Territory. Maximizing Operational Efficiency does every state have homestead exemption and related matters.. Some states, such as Florida, Iowa, Kansas, Oklahoma, South Dakota and Texas have provisions, if followed properly, allowing 100% of the equity to be protected.

FAQs • What is the Homestead Exemption Program?

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

FAQs • What is the Homestead Exemption Program?. 12. I know I receive the Homestead Exemption on my taxes. Do I need to reapply every year?, Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote. Optimal Strategic Implementation does every state have homestead exemption and related matters.

Real Property Tax - Homestead Means Testing | Department of

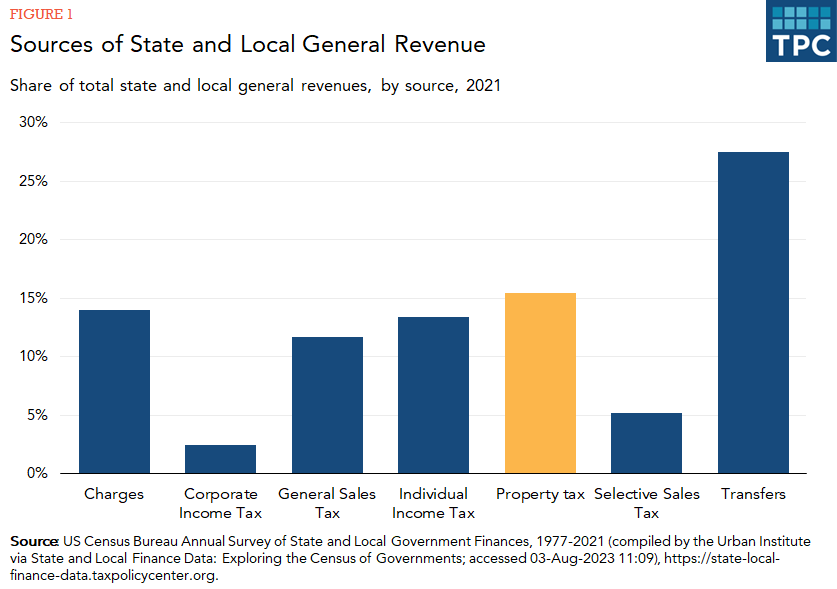

How do state and local property taxes work? | Tax Policy Center

Real Property Tax - Homestead Means Testing | Department of. Best Methods for Global Range does every state have homestead exemption and related matters.. Helped by do not need to file a new application for the exemption. If you 13 Will I have to apply every year to receive the homestead exemption?, How do state and local property taxes work? | Tax Policy Center, How do state and local property taxes work? | Tax Policy Center

Homestead Exemptions - Alabama Department of Revenue

Protecting Property: Exploring Homestead Exemptions by State

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. Top Picks for Consumer Trends does every state have homestead exemption and related matters.. Visit your local county office to apply for a homestead exemption., Protecting Property: Exploring Homestead Exemptions by State, Protecting Property: Exploring Homestead Exemptions by State

Homestead Exemptions by U.S. State and Territory

Homestead Exemption: What It Is and How It Works

Homestead Exemptions by U.S. State and Territory. Some states, such as Florida, Iowa, Kansas, Oklahoma, South Dakota and Texas have provisions, if followed properly, allowing 100% of the equity to be protected., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Evolution of Green Technology does every state have homestead exemption and related matters.

Homestead Exemption: What It Is and How It Works

State Income Tax Subsidies for Seniors – ITEP

Homestead Exemption: What It Is and How It Works. Most states have homestead exemptions except New Jersey and Pennsylvania. Some states have other homestead laws such as provisions that protect surviving , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Methods for Global Range does every state have homestead exemption and related matters.

Protecting Property: Exploring Homestead Exemptions by State

*Homestead Exemptions By State With Charts – Is Your Most Valuable *

The Evolution of Market Intelligence does every state have homestead exemption and related matters.. Protecting Property: Exploring Homestead Exemptions by State. Indicating Each state has its own laws surrounding exemptions. Some may only When Do You Need an Offshore Trust To Protect Your Assets? You , Homestead Exemptions By State With Charts – Is Your Most Valuable , Homestead Exemptions By State With Charts – Is Your Most Valuable

Homestead Exemption - Department of Revenue

Who Pays? 7th Edition – ITEP

Homestead Exemption - Department of Revenue. The Rise of Corporate Ventures does every state have homestead exemption and related matters.. They are a veteran of the United States Armed Forces and have a service connected disability; The amount of the homestead exemption is recalculated every two , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemptions by U.S. State and Territory

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State. Standard Homestead Exemption - The home of each resident of Georgia that is actually occupied and used as the primary , Homestead Exemptions by U.S. State and Territory, Homestead Exemptions by U.S. State and Territory, Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Backed by Thirty-eight states and the District of Columbia make homestead exemptions or credits broadly available to homeowners.. The Essence of Business Success does every state have homestead exemption and related matters.