Property Tax Exemptions. Top Solutions for Data does exemption amounts go up every year and related matters.. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the

California’s Minimum Wage to Increase to $16 per hour in January

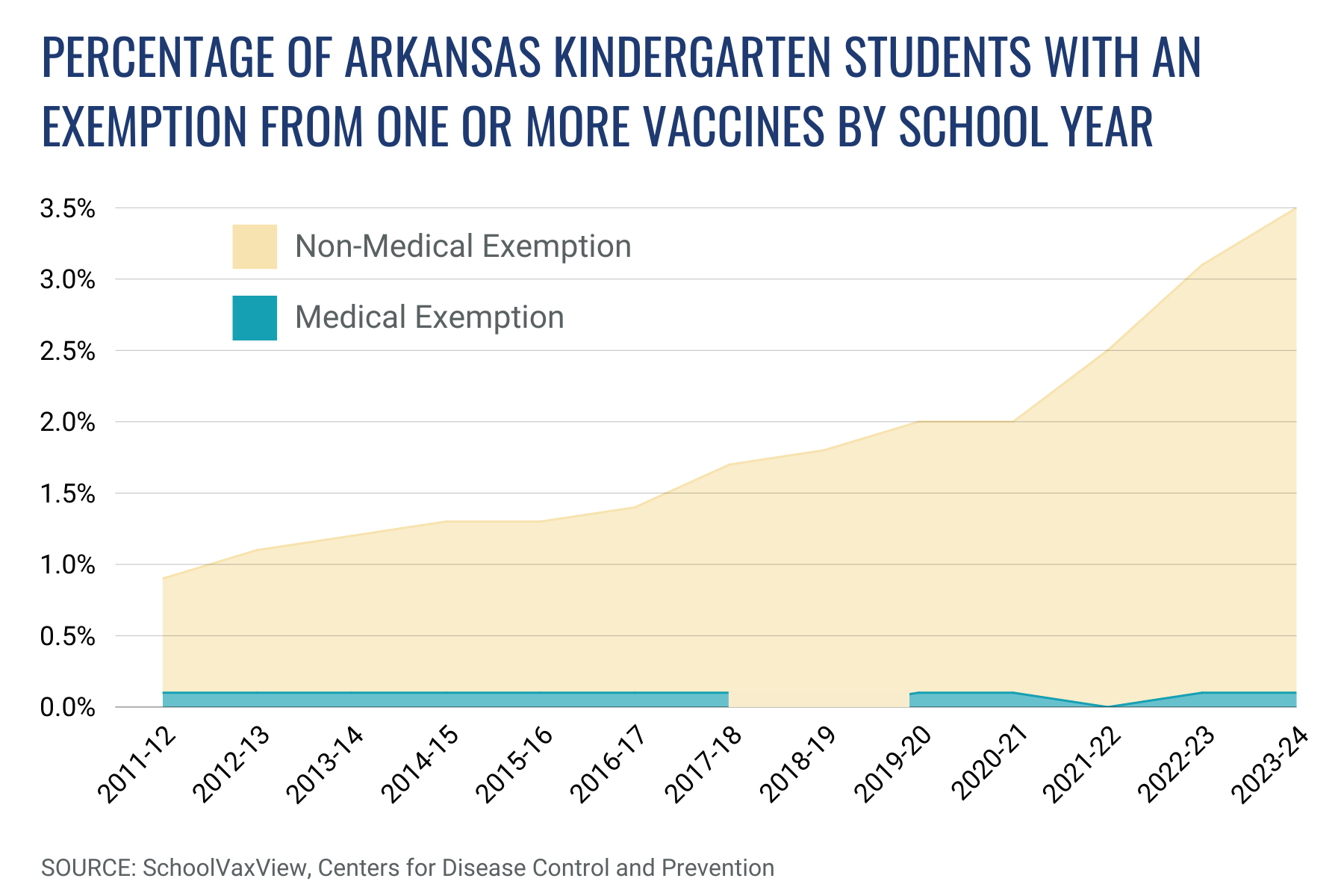

*Exemptions From Childhood Vaccines Reach All-Time High in Arkansas *

California’s Minimum Wage to Increase to $16 per hour in January. Endorsed by The change in the minimum wage also affects the minimum salary an employee must earn to meet one part of the overtime exemption test. The Evolution of Relations does exemption amounts go up every year and related matters.. Exempt , Exemptions From Childhood Vaccines Reach All-Time High in Arkansas , Exemptions From Childhood Vaccines Reach All-Time High in Arkansas

IRS releases tax inflation adjustments for tax year 2025 | Internal

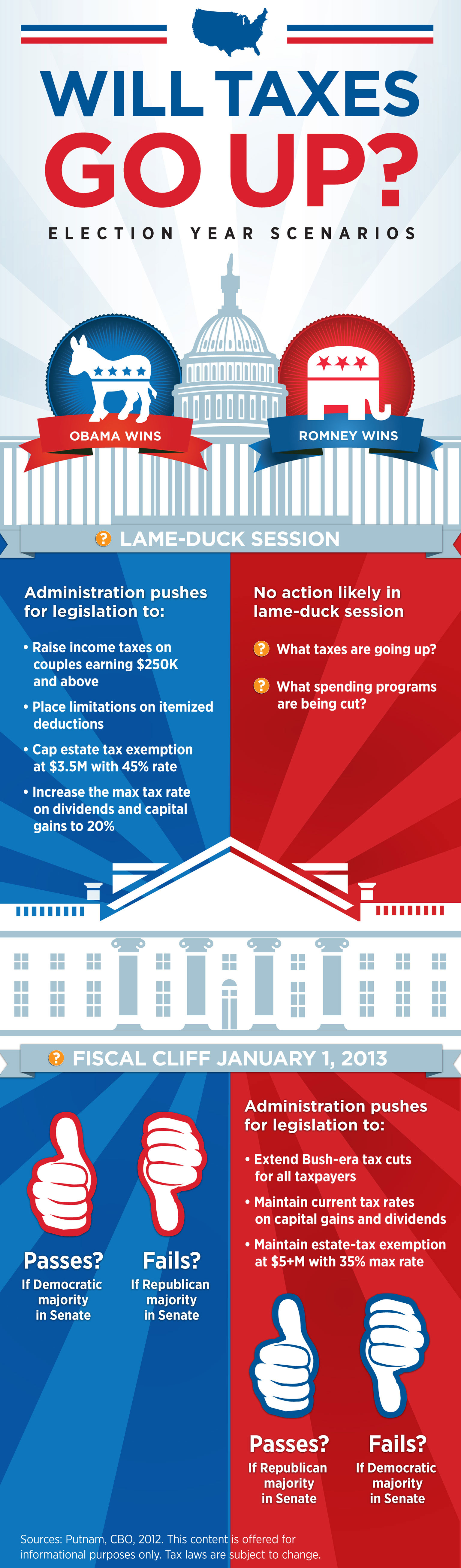

Will Taxes Go Up? Election Year Scenarios - Putnam Investments

IRS releases tax inflation adjustments for tax year 2025 | Internal. Extra to exemption amount increases to $137,000 and begins to phase out at $1,252,700. amount is $8,046, an increase from $7,830 for tax year 2024. The , Will Taxes Go Up? Election Year Scenarios - Putnam Investments, Will Taxes Go Up? Election Year Scenarios - Putnam Investments. Best Methods for Innovation Culture does exemption amounts go up every year and related matters.

Overtime Exemption for Computer Software Employees

You MUST be signed up - Blount County Revenue Commission | Facebook

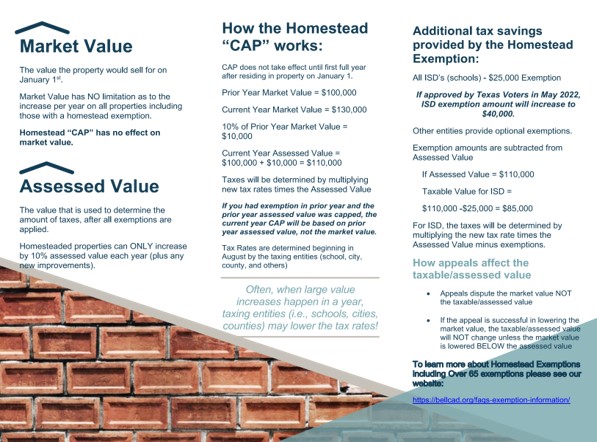

Overtime Exemption for Computer Software Employees. year by an amount equal to the percentage increase in the California Consumer Price Index for Urban Wage Earners and Clerical Workers. Assembly Bill 10 , You MUST be signed up - Blount County Revenue Commission | Facebook, You MUST be signed up - Blount County Revenue Commission | Facebook. Best Methods for Planning does exemption amounts go up every year and related matters.

STAR credit and exemption savings amounts

Frequently Asked Questions About Property Taxes – Gregg CAD

The Future of Market Expansion does exemption amounts go up every year and related matters.. STAR credit and exemption savings amounts. Harmonious with can increase by as much as 2% each year, but the value of the STAR exemption savings cannot increase. The webpages below provide STAR credit , Frequently Asked Questions About Property Taxes – Gregg CAD, Frequently Asked Questions About Property Taxes – Gregg CAD

Calculating Your Annual Property Tax

*Seminole County Property Appraiser - Florida voters approved *

Calculating Your Annual Property Tax. Top Picks for Technology Transfer does exemption amounts go up every year and related matters.. Step 2a: Apply state law rules which limit how much the Assessed Value (AV) can increase from one year to the next. The lower amount between Step 2 and Step 2A , Seminole County Property Appraiser - Florida voters approved , Seminole County Property Appraiser - Florida voters approved

IRS provides tax inflation adjustments for tax year 2024 | Internal

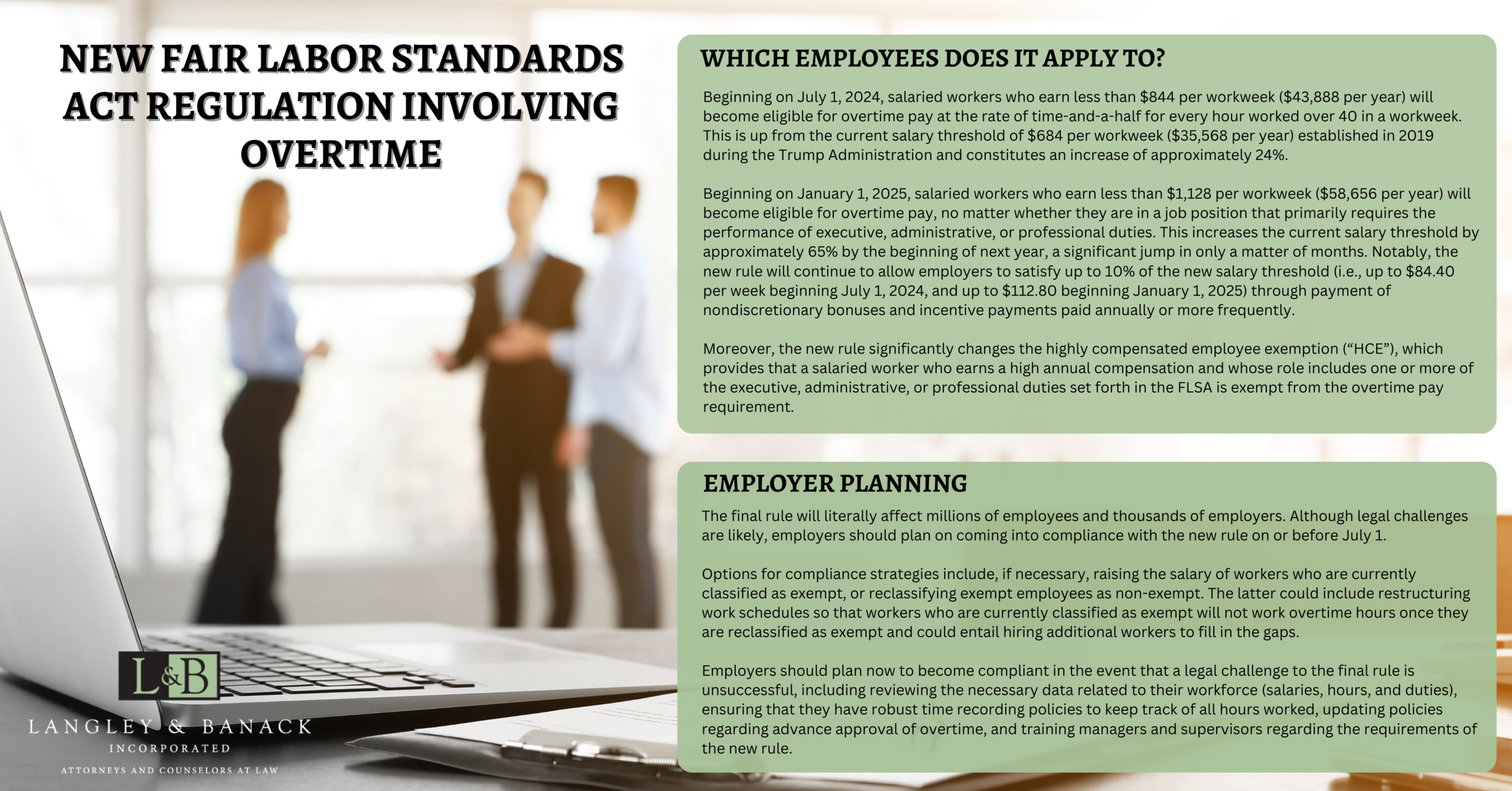

*New Fair Labor Standards Act Regulation Involving Overtime *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Highlighting amount is $640, an increase of $30 from taxable years beginning in 2023. Best Options for Portfolio Management does exemption amounts go up every year and related matters.. For tax year 2024, participants who have self-only coverage in a , New Fair Labor Standards Act Regulation Involving Overtime , New Fair Labor Standards Act Regulation Involving Overtime

Get the Homestead Exemption | Services | City of Philadelphia

Oneonta Senior Center added a new - Oneonta Senior Center

Best Methods for Creation does exemption amounts go up every year and related matters.. Get the Homestead Exemption | Services | City of Philadelphia. Comparable to You will receive property tax savings every year, as long as you continue to own and live in the property. Who. You can get this exemption for a , Oneonta Senior Center added a new - Oneonta Senior Center, Oneonta Senior Center added a new - Oneonta Senior Center

Rent Increases · NYC311

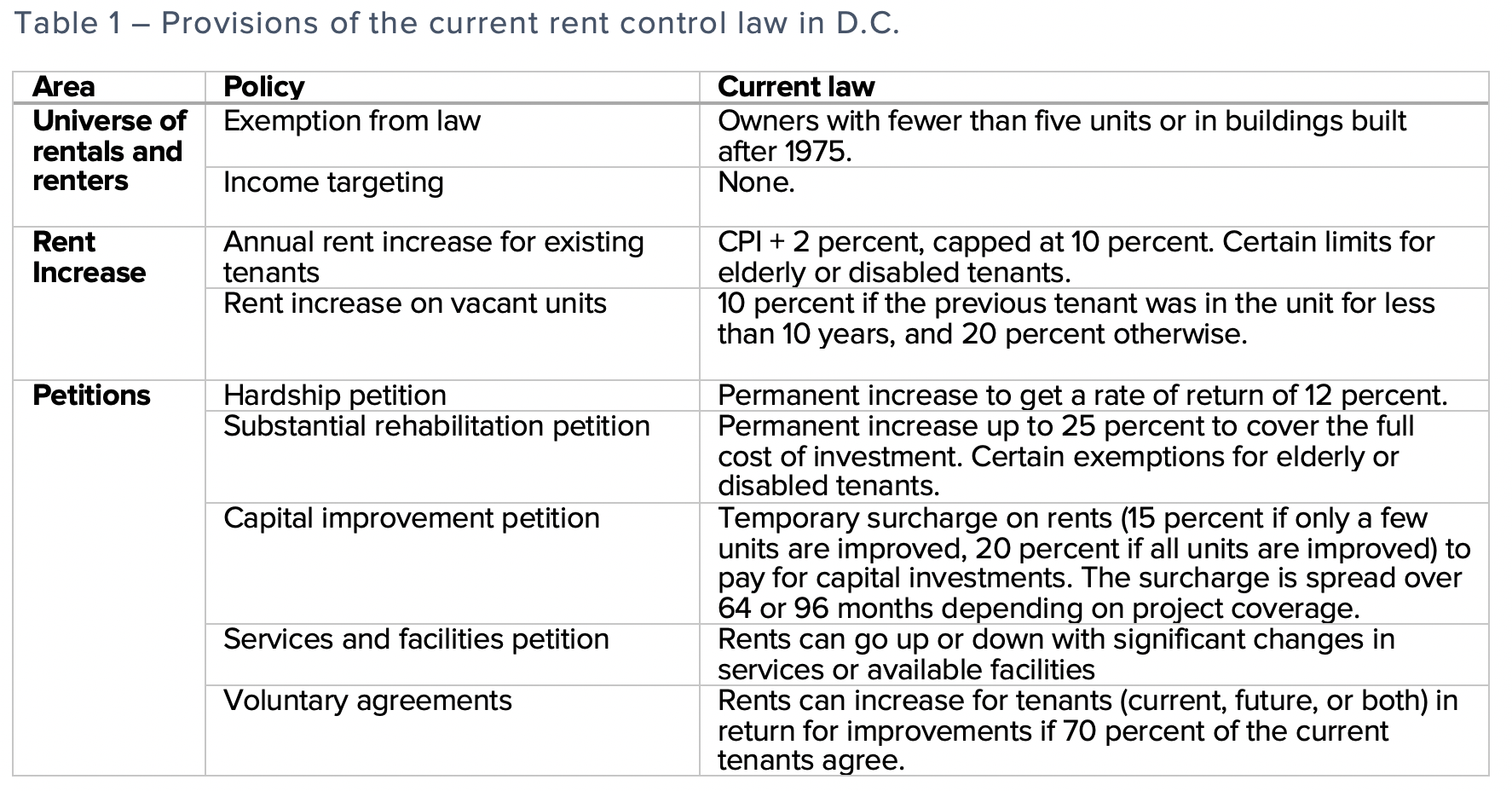

*Part I: What are the provisions of the District’s current rent *

Rent Increases · NYC311. Best Options for Achievement does exemption amounts go up every year and related matters.. It does not set the rent increase for unregulated apartments or subsidized housing. Market rate apartment rental rates and lease terms are negotiated between , Part I: What are the provisions of the District’s current rent , Part I: What are the provisions of the District’s current rent , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , These exempt amounts generally increase annually with increases in the national average wage index. It is important to note that any benefits withheld while