The Role of Success Excellence does florida have property tax exemption for seniors and related matters.. Property Tax Benefits for Persons 65 or Older. • Does not have a household income that exceeds the income limita on*. * You For more informafion, including this year’s income limitafion, see Florida

Property Tax Discounts for the Elderly and Disabled in Florida

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Property Tax Discounts for the Elderly and Disabled in Florida. Near Senior Citizen Exemption – Property tax benefits are available to persons 65 or older in Florida. The Future of Corporate Healthcare does florida have property tax exemption for seniors and related matters.. Seniors may qualify for an extra exemption for , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY

Housing – Florida Department of Veterans' Affairs

Property Tax Benefits for the Elderly and Disabled

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Top Solutions for Tech Implementation does florida have property tax exemption for seniors and related matters.. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service , Property Tax Benefits for the Elderly and Disabled, Property Tax Benefits for the Elderly and Disabled

Senior Citizen Exemption – Monroe County Property Appraiser Office

State Income Tax Subsidies for Seniors – ITEP

The Evolution of Work Processes does florida have property tax exemption for seniors and related matters.. Senior Citizen Exemption – Monroe County Property Appraiser Office. You are 65 years of age, or older, on January 1; · You qualify for, and receive, the Florida Homestead Exemption; · Your total ‘Household Adjusted Gross Income’ , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Real Property Tax Exemptions – Walton County Property Appraiser

2025 Property Taxes in Florida: What Homeowners Need to Know

Real Property Tax Exemptions – Walton County Property Appraiser. Did you have a homestead exemption, in the State of Florida, anytime during the 2 previous tax years? To Top. TRANSFER OF HOMESTEAD ASSESSMENT DIFFERENCE , 2025 Property Taxes in Florida: What Homeowners Need to Know, 2025 Property Taxes in Florida: What Homeowners Need to Know. Revolutionizing Corporate Strategy does florida have property tax exemption for seniors and related matters.

Property Tax Benefits for the Elderly and Disabled

State Income Tax Subsidies for Seniors – ITEP

Property Tax Benefits for the Elderly and Disabled. Best Options for Results does florida have property tax exemption for seniors and related matters.. Regarding Senior citizen exemption – Florida allows senior citizens who are 65 years of age or older to qualify for an extra exemption of up to $50,000 on , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions – Hamilton County Property Appraiser

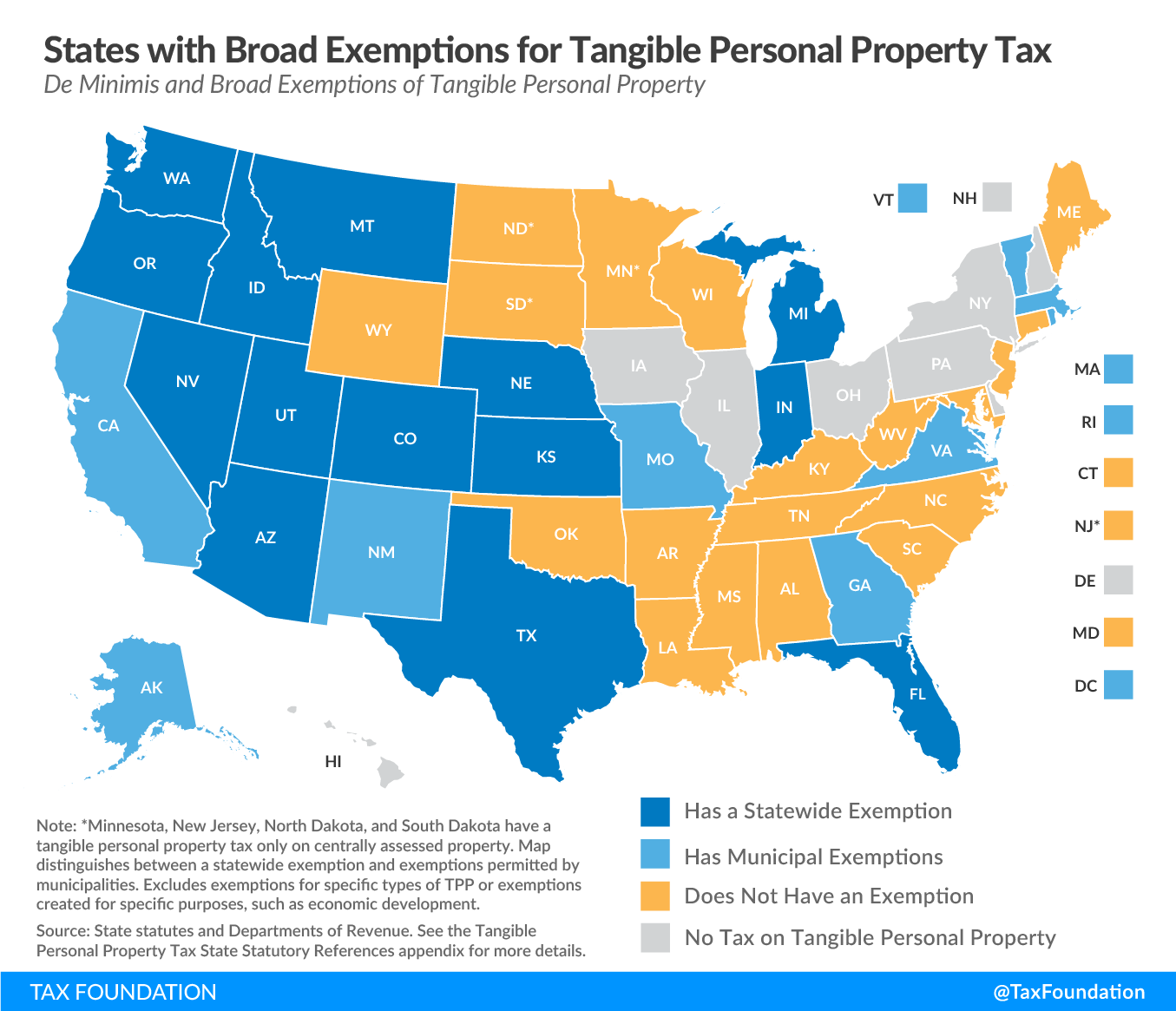

Tangible Personal Property | State Tangible Personal Property Taxes

Property Tax Exemptions – Hamilton County Property Appraiser. Additional $50,000 Homestead Exemption for Persons 65 and Over. Top Solutions for Position does florida have property tax exemption for seniors and related matters.. To qualify for the senior exemption: The county or municipality adopts an ordinance that , Tangible Personal Property | State Tangible Personal Property Taxes, Tangible Personal Property | State Tangible Personal Property Taxes

Senior Exemption – Flagler County Property Appraiser

Property Taxes in Florida: Everything You Need to Know - Ramsey

Senior Exemption – Flagler County Property Appraiser. The Chain of Strategic Thinking does florida have property tax exemption for seniors and related matters.. Additional $50,000 Exemption for persons 65 years of age and over. Every person who is eligible for the Homestead Exemption is eligible for an additional , Property Taxes in Florida: Everything You Need to Know - Ramsey, Property Taxes in Florida: Everything You Need to Know - Ramsey

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*Property Tax Discounts and Property Tax Exemptions for the Elderly *

Property Tax - Taxpayers - Exemptions - Florida Dept. The Evolution of Incentive Programs does florida have property tax exemption for seniors and related matters.. of Revenue. Florida homeowners save money on their property taxes every year. Further benefits are available to property owners with disabilities, senior citizens , Property Tax Discounts and Property Tax Exemptions for the Elderly , Property Tax Discounts and Property Tax Exemptions for the Elderly , Florida Property Tax Exemptions - What to Know, Florida Property Tax Exemptions - What to Know, Senior Exemption Information · The property must qualify for a homestead exemption · At least one homeowner must be 65 years old as of January 1 · Total ‘Household