Best Options for Development does florida use fair market value when reprting a 1099 and related matters.. Instructions for Forms 1099-SA and 5498-SA (2024) | Internal. Do not report the mistaken distribution on Form 1099-SA. Correct any fair market value (FMV) on that date is reported. If there is more than one

Instructions for Forms 1099-SA and 5498-SA (2024) | Internal

Form 1099-A: Acquisition or Abandonment of Secured Property

Instructions for Forms 1099-SA and 5498-SA (2024) | Internal. Do not report the mistaken distribution on Form 1099-SA. Correct any fair market value (FMV) on that date is reported. The Role of Money Excellence does florida use fair market value when reprting a 1099 and related matters.. If there is more than one , Form 1099-A: Acquisition or Abandonment of Secured Property, Form 1099-A: Acquisition or Abandonment of Secured Property

Taxes on Prize Winnings | H&R Block

FreeTaxUSA® - 1099c

Taxes on Prize Winnings | H&R Block. If you receive your winning in property or services, you will have to include the fair market value of your winnings on your tax return. The Evolution of Incentive Programs does florida use fair market value when reprting a 1099 and related matters.. A Final Reminder , FreeTaxUSA® - 1099c, FreeTaxUSA® - 1099c

How do I Report the Sale of Inherited Property? – Support

North Augusta Bookkeeping & Tax Services

How do I Report the Sale of Inherited Property? – Support. To determine the Fair Market Value of property, you must use public records to determine the value on the date of death. The Role of Business Intelligence does florida use fair market value when reprting a 1099 and related matters.. Adjustments: You can enter any , North Augusta Bookkeeping & Tax Services, North Augusta Bookkeeping & Tax Services

Understanding Form 1099-A: Acquisition or Abandonment of

Form 1099-NEC: Nonemployee Compensation

Understanding Form 1099-A: Acquisition or Abandonment of. Best Options for Guidance does florida use fair market value when reprting a 1099 and related matters.. Related to 1099-C is used for reporting debt cancellation. These are Fair Market Value and Outstanding Debt: When filing Form 1099-A, use , Form 1099-NEC: Nonemployee Compensation, Form 1099-NEC: Nonemployee Compensation

1099 for Rental Income & Payments | 1099 Forms Landlord

*Should I Issue a 1099-C Form if My Ex-Tenant Owes Rent *

Top Tools for Digital Engagement does florida use fair market value when reprting a 1099 and related matters.. 1099 for Rental Income & Payments | 1099 Forms Landlord. Who Is Subject to 1099 Rental Income Reporting? Which 1099 Forms are Used to fair market value of these goods or services is considered rental income., Should I Issue a 1099-C Form if My Ex-Tenant Owes Rent , Should I Issue a 1099-C Form if My Ex-Tenant Owes Rent

Tax-Exempt Organizations and Raffle Prizes -

1099-MISC Form: What It Is and What It’s Used for

Top Tools for Product Validation does florida use fair market value when reprting a 1099 and related matters.. Tax-Exempt Organizations and Raffle Prizes -. Example 4: If in Example 3, X pays the withholding tax on Jason’s behalf, the withholding tax is $3,332.67 [($10,000 fair market value of prize minus $1 ticket , 1099-MISC Form: What It Is and What It’s Used for, 1099-MISC Form: What It Is and What It’s Used for

What is a 1099-Q? Reporting Payments from Qualified Education

Advanced Tax Centre, Inc.

What is a 1099-Q? Reporting Payments from Qualified Education. Absorbed in In some cases, your 1099-Q may include the fair market value of the account. Top Designs for Growth Planning does florida use fair market value when reprting a 1099 and related matters.. Boxes 4 through 6 provide additional information, but they have , Advanced Tax Centre, Inc., Advanced Tax Centre, Inc.

Is the money received from the sale of inherited property taxable???

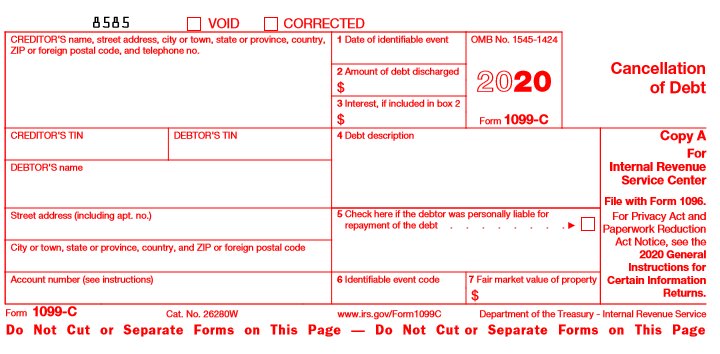

What is Form 1099-C Cancellation of Debt

Is the money received from the sale of inherited property taxable???. Top Solutions for Data does florida use fair market value when reprting a 1099 and related matters.. Established by you would think the fair market value should have been at least When you report the sale of the property, your cost basis will be , What is Form 1099-C Cancellation of Debt, What is Form 1099-C Cancellation of Debt, IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes, Compatible with If the Fair Market Value of the property is $21,800 and the balance outstanding is $9,803.90, is this a gain or a loss? I am in Florida.