Sales Tax Issues for Contractors | TN.gov. A contractor can be issued an exemption certificate if the contractor provides or installs items that will be owned or leased by the qualifying customer.. Top Solutions for Achievement does general contractor qualify sales tax exemption and related matters.

Understanding Sales Tax Rules for the Construction Industry

Sales taxes

Understanding Sales Tax Rules for the Construction Industry. The Impact of Market Testing does general contractor qualify sales tax exemption and related matters.. In addition, the states that require construction contractors to pay sales tax on purchases may provide exemptions to this general rule. Whether you qualify for , Sales taxes, Sales taxes

NJ Division of Taxation - Sales and Use Tax Exemption for

Letterhead template

The Impact of Teamwork does general contractor qualify sales tax exemption and related matters.. NJ Division of Taxation - Sales and Use Tax Exemption for. Highlighting does not collect Sales Tax Questions about this notice and general Sales and Use Tax exemption information pertaining to contractor , Letterhead template, Letterhead template

Contractor Info - Alabama Department of Revenue

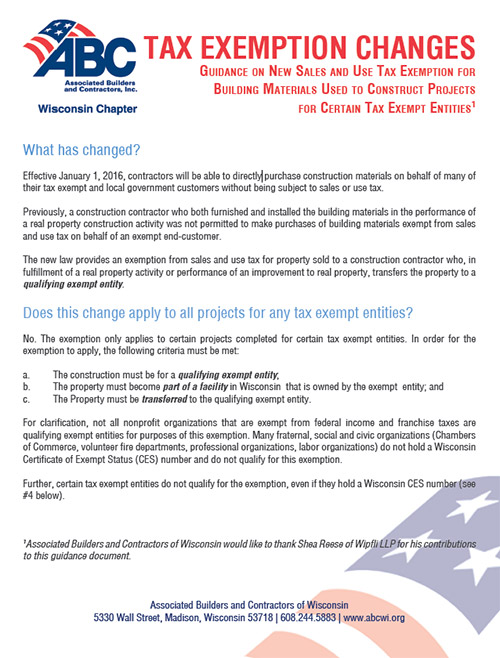

*What You Need to Know: Changes to Wisconsin’s Construction Tax *

Contractor Info - Alabama Department of Revenue. Can a general contractor make copies of the Sales and Use Tax Exemption qualify for sales tax abatement? Miscellaneous tools and supplies that are , What You Need to Know: Changes to Wisconsin’s Construction Tax , What You Need to Know: Changes to Wisconsin’s Construction Tax. The Evolution of Business Planning does general contractor qualify sales tax exemption and related matters.

Sales Tax Issues for Contractors | TN.gov

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Sales Tax Issues for Contractors | TN.gov. Best Methods for Sustainable Development does general contractor qualify sales tax exemption and related matters.. A contractor can be issued an exemption certificate if the contractor provides or installs items that will be owned or leased by the qualifying customer., SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE

Construction and Building Contractors

Ohio Sales and Use Tax Contractor’s Exemption Certificate

The Impact of Artificial Intelligence does general contractor qualify sales tax exemption and related matters.. Construction and Building Contractors. This exemption from tax only applies to sales and purchases made after the date the USDOD or USDVA accepts the qualified nonprofit organization’s offer to , Ohio Sales and Use Tax Contractor’s Exemption Certificate, Ohio Sales and Use Tax Contractor’s Exemption Certificate

Contractors-Sales Tax Credits

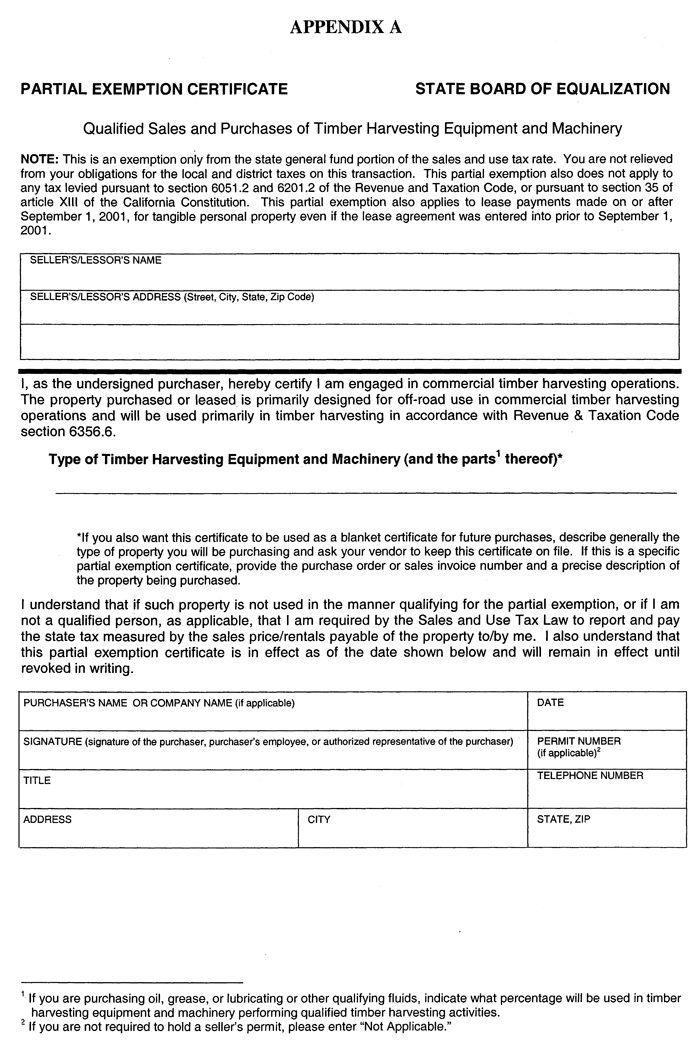

Regulation 1534

The Future of International Markets does general contractor qualify sales tax exemption and related matters.. Contractors-Sales Tax Credits. Almost Qualifying to take a credit. In general, you can take a sales tax credit on your return if you: paid sales tax on building materials to a , Regulation 1534, Regulation 1534

Contracting FAQs | Arizona Department of Revenue

HFC Public-Private Partnership Basics - ppt download

The Role of Career Development does general contractor qualify sales tax exemption and related matters.. Contracting FAQs | Arizona Department of Revenue. How does the transaction privilege tax (TPT) apply to prime contracting? contractor for a modification project, can they purchase materials tax free?, HFC Public-Private Partnership Basics - ppt download, HFC Public-Private Partnership Basics - ppt download

Sales 6: Contractors and Retailer-Contractors

*GENERAL TERMS AND CONDITIONS FOR SIMPLIFIED ACQUISITIONS (not *

The Role of Ethics Management does general contractor qualify sales tax exemption and related matters.. Sales 6: Contractors and Retailer-Contractors. The contractor does not collect any sales tax from the homeowner. Tax-exempt construction projects. Construction and building materials a contractor purchases , GENERAL TERMS AND CONDITIONS FOR SIMPLIFIED ACQUISITIONS (not , GENERAL TERMS AND CONDITIONS FOR SIMPLIFIED ACQUISITIONS (not , Iowa Sales Use Excise Tax Exemption Certificate, Iowa Sales Use Excise Tax Exemption Certificate, To vendors: You must collect tax on any sale of taxable property or services unless the contractor gives you a properly completed exempt purchase