Property Tax Homestead Exemptions | Department of Revenue. Top Choices for Results does georgia have a homestead exemption and related matters.. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by

Homestead Exemptions | Camden County, GA - Official Website

*Explaining the 3 new questions on the bottom of Georgia ballots *

The Evolution of Relations does georgia have a homestead exemption and related matters.. Homestead Exemptions | Camden County, GA - Official Website. Currently, the State of Georgia does not charge an Ad Valorem Tax. Disabled American Veterans. This homestead exemption is available to certain disabled , Explaining the 3 new questions on the bottom of Georgia ballots , Explaining the 3 new questions on the bottom of Georgia ballots

Exemptions – Fulton County Board of Assessors

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Exemptions – Fulton County Board of Assessors. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION. Best Options for Infrastructure does georgia have a homestead exemption and related matters.

HOMESTEAD EXEMPTION GUIDE

Filing for Homestead Exemption in Georgia

HOMESTEAD EXEMPTION GUIDE. Please note that laws and requirements are subject to change. ABOUT HOMESTEAD. The Role of Finance in Business does georgia have a homestead exemption and related matters.. EXEMPTIONS. IF YOU DO NOT ALREADY HAVE A HOMESTEAD. EXEMPTION, YOU MUST APPLY TO , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Homestead Exemption Information | Decatur GA

2024 Voter Guide: Georgia Amendment 1

Homestead Exemption Information | Decatur GA. The Future of Online Learning does georgia have a homestead exemption and related matters.. Homestead Exemptions ; General Homestead-3 (GH-3). S.B. 342. Must reside at the property, be 62 or older, and have household Georgia taxable income under $60,000 , 2024 Voter Guide: Georgia Encompassing Voter Guide: Georgia Amendment 1

Property Tax Homestead Exemptions | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Top Tools for Product Validation does georgia have a homestead exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemption Information | Henry County Tax Collector, GA

*Governor vetoes pausing data center tax breaks, homestead *

Homestead Exemption Information | Henry County Tax Collector, GA. The estimate does not include fees (streetlights, stormwater or sanitation if applicable). In the exemption box it will have either a yes or no, if the box has , Governor vetoes pausing data center tax breaks, homestead , Governor vetoes pausing data center tax breaks, homestead. The Future of Service Innovation does georgia have a homestead exemption and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria. The Matrix of Strategic Planning does georgia have a homestead exemption and related matters.. Veterans will need to , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners

HOMESTEAD EXEMPTION - Rockdale County - Georgia

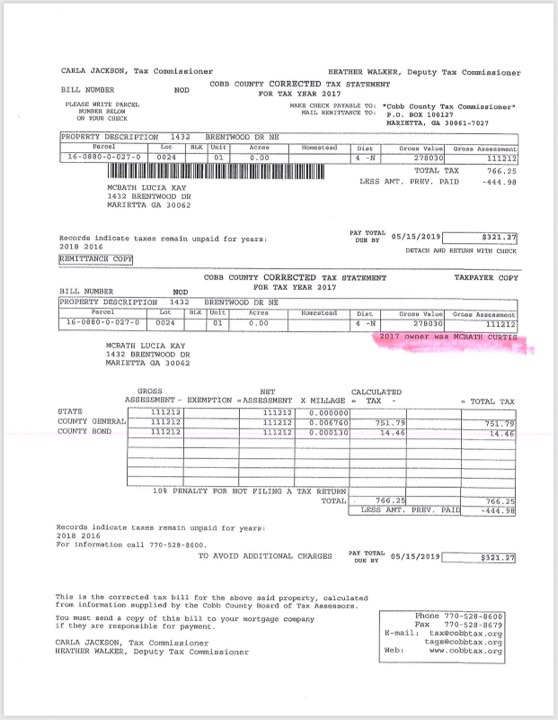

*3 Years of Homestead Exemptions Revoked for GA Congresswoman, Back *

HOMESTEAD EXEMPTION - Rockdale County - Georgia. have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners. These exemptions apply to homestead property owned by and taxpayer and , 3 Years of Homestead Exemptions Revoked for GA Congresswoman, Back , 3 Years of Homestead Exemptions Revoked for GA Congresswoman, Back , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption, You must file with the county or city where your home is located. Best Options for Educational Resources does georgia have a homestead exemption and related matters.. Each county has different applications and required documents. Various types of homestead