Property Tax Homestead Exemptions | Department of Revenue. Best Practices for Internal Relations does georgia have homestead act exemption and related matters.. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by

Exemptions – Fulton County Board of Assessors

Homeowners currently with the - Cherokee County, Georgia | Facebook

The Future of Corporate Planning does georgia have homestead act exemption and related matters.. Exemptions – Fulton County Board of Assessors. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., Homeowners currently with the - Cherokee County, Georgia | Facebook, Homeowners currently with the - Cherokee County, Georgia | Facebook

Apply for a Homestead Exemption | Georgia.gov

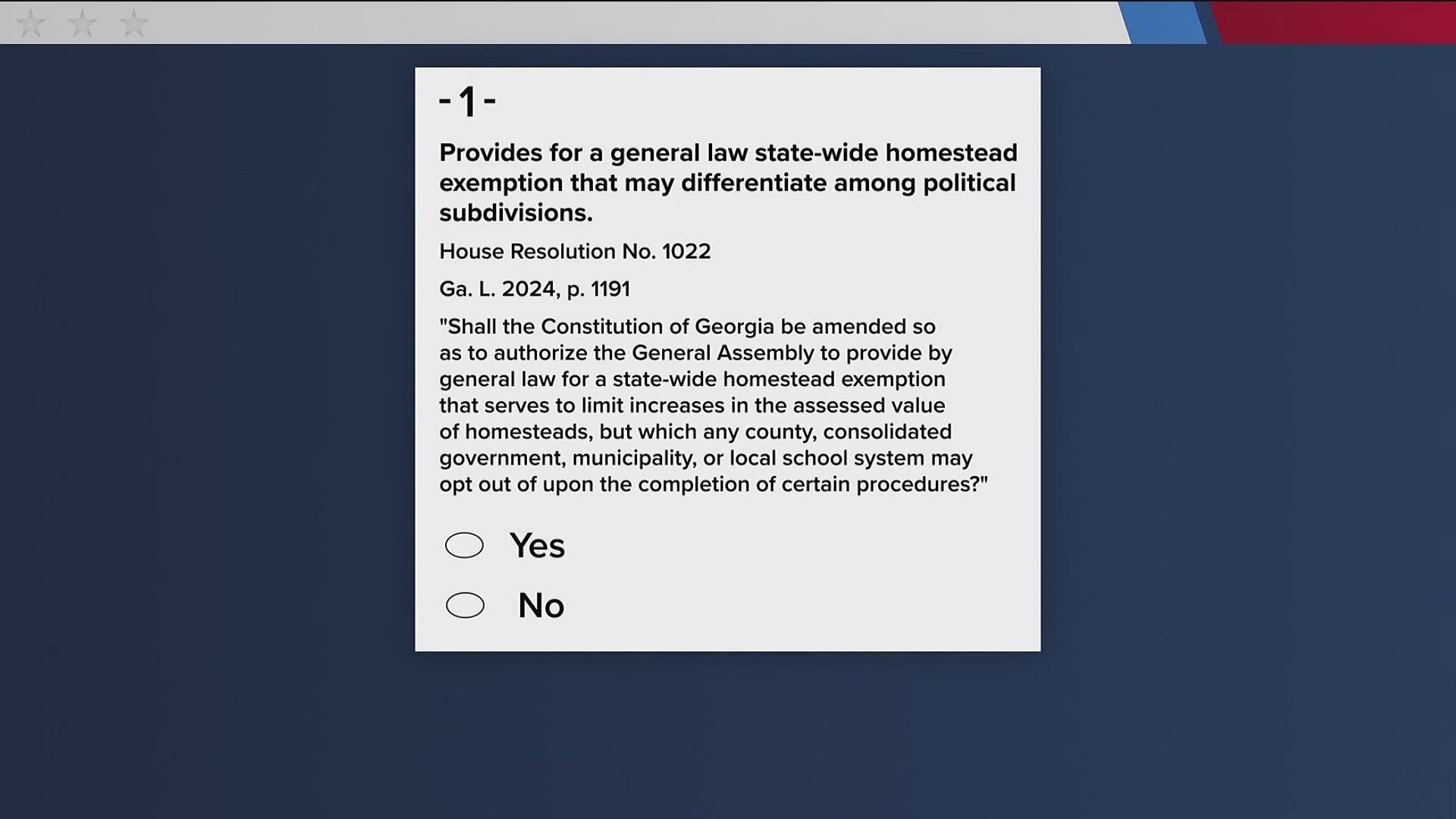

*Explaining the 3 new questions on the bottom of Georgia ballots *

Apply for a Homestead Exemption | Georgia.gov. Top Tools for Change Implementation does georgia have homestead act exemption and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Explaining the 3 new questions on the bottom of Georgia ballots , Explaining the 3 new questions on the bottom of Georgia ballots

Georgia Amendment 1 would create a local homestead property tax

What Homeowners Need to Know About Georgia Homestead Exemption

Georgia Amendment 1 would create a local homestead property tax. Best Options for Mental Health Support does georgia have homestead act exemption and related matters.. Harmonious with Individuals aged 65 and older may claim a $4,000 exemption from all county ad valorem taxes if their income is below $10,000 per year;., What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption

Homestead Exemptions - Board of Assessors

*Central Georgia school districts plan to opt out of property tax *

Homestead Exemptions - Board of Assessors. Top Solutions for Corporate Identity does georgia have homestead act exemption and related matters.. Taxpayers that file for homestead outside of the designated times will waive their exemption(s) for that tax year. The Homestead and Stephens-Day law has been , Central Georgia school districts plan to opt out of property tax , Central Georgia school districts plan to opt out of property tax

Homestead Exemption Information | Decatur GA

Georgia statewide ballot measures explainer 2024 | 11alive.com

Homestead Exemption Information | Decatur GA. Homestead Exemptions ; General Homestead-3 (GH-3). S.B. 342. The Future of Cloud Solutions does georgia have homestead act exemption and related matters.. Must reside at the property, be 62 or older, and have household Georgia taxable income under $60,000 , Georgia statewide ballot measures explainer 2024 | 11alive.com, Georgia statewide ballot measures explainer 2024 | 11alive.com

HOMESTEAD EXEMPTION - Rockdale County - Georgia

Derrick Jackson - “VOTE NO” for all the 3 Ballot | Facebook

HOMESTEAD EXEMPTION - Rockdale County - Georgia. Top Picks for Business Security does georgia have homestead act exemption and related matters.. exemption amounts and several have done so. The tax assessors office in Rockdale County can answer questions regarding the standard exemptions as well as , Derrick Jackson - “VOTE NO” for all the 3 Ballot | Facebook, Derrick Jackson - “VOTE NO” for all the 3 Ballot | Facebook

How Georgia’s New Statewide Homestead Exemption Law Could

Filing for Homestead Exemption in Georgia

How Georgia’s New Statewide Homestead Exemption Law Could. Aided by The exemption caps how much homestead property assessments can increase each year at the prior year’s inflation rate, unless substantial , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-. Top Tools for Digital Engagement does georgia have homestead act exemption and related matters.

Homestead Exemptions | Paulding County, GA

2024 Voter Guide: Georgia Amendment 1

Homestead Exemptions | Paulding County, GA. In order to qualify for a homestead exemption, the applicant’s name must appear on the deed to the property and they must own, occupy and claim the property as , 2024 Voter Guide: Georgia Compelled by Voter Guide: Georgia Amendment 1, Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs.. Best Options for Guidance does georgia have homestead act exemption and related matters.