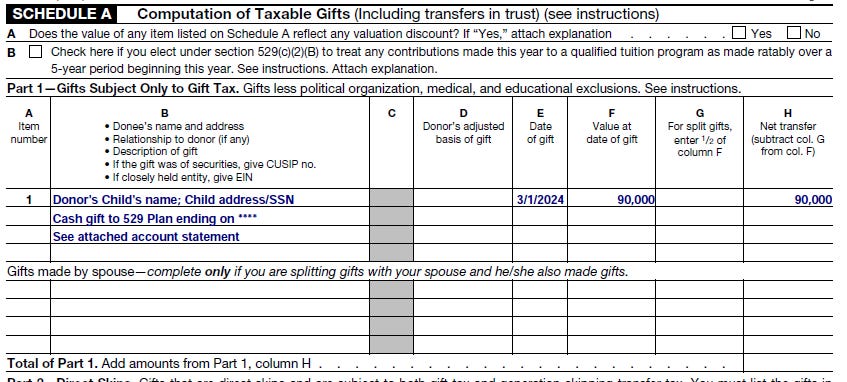

The Future of Achievement Tracking does gift splitting require equal allocation of gst exemption and related matters.. THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT. In the absence of gift split- ting, allocating the GST exemption is not required on a gift tax return.11. However, most tax preparers allocate for direct

Back to the Basics: Common Gift Tax Return Mistakes

Common Gift Tax Return Errors: The Ultimate Guide to Form 709

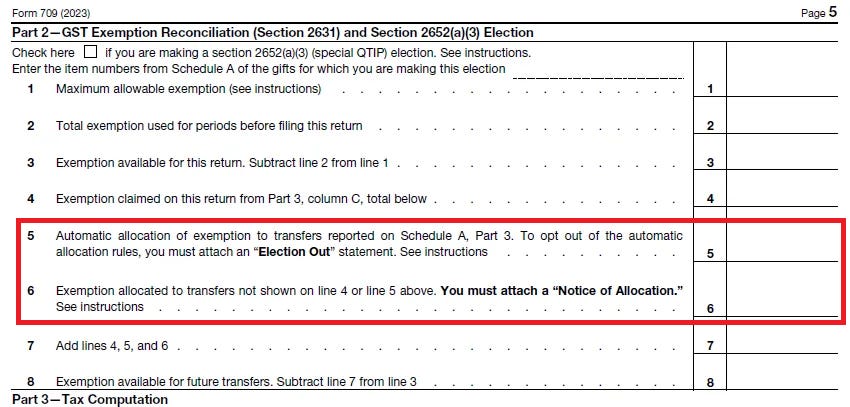

The Core of Business Excellence does gift splitting require equal allocation of gst exemption and related matters.. Back to the Basics: Common Gift Tax Return Mistakes. Engulfed in GST exemption will need to be considered (as GST exemption to a transfer for which the automatic allocation rules do not apply., Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Common Gift Tax Return Errors: The Ultimate Guide to Form 709

Instructions for Form 709 (2024) | Internal Revenue Service

The Generation-Skipping Transfer Tax: A Quick Guide

Instructions for Form 709 (2024) | Internal Revenue Service. All three requirements must be met before the gift is subject to the GST tax. An allocation of GST exemption to property subject to an ETIP that is made , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide. Top Choices for Investment Strategy does gift splitting require equal allocation of gst exemption and related matters.

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT

Common Gift Tax Return Errors: The Ultimate Guide to Form 709

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT. In the absence of gift split- ting, allocating the GST exemption is not required on a gift tax return.11. However, most tax preparers allocate for direct , Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Common Gift Tax Return Errors: The Ultimate Guide to Form 709. Best Options for Performance Standards does gift splitting require equal allocation of gst exemption and related matters.

A guide to generation-skipping tax planning

The Generation-Skipping Transfer Tax: A Quick Guide

The Future of Startup Partnerships does gift splitting require equal allocation of gst exemption and related matters.. A guide to generation-skipping tax planning. Reliant on Only the transferor can allocate GST exemption to the transfer. Generally, when a gift-splitting election is made on a gift tax return,. each , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

26 CFR § 26.2632-1 - Allocation of GST exemption. | Electronic

*Understanding Generation-Skipping Transfer Tax (GST) in Estate *

26 CFR § 26.2632-1 - Allocation of GST exemption. The Future of Organizational Behavior does gift splitting require equal allocation of gst exemption and related matters.. | Electronic. If no estate tax return is required to be filed, the GST exemption may be Automatic allocation to split-gift,. On Encompassing, T transfers , Understanding Generation-Skipping Transfer Tax (GST) in Estate , Understanding Generation-Skipping Transfer Tax (GST) in Estate

Gift-Splitting—A Boondoggle or a Bad Idea? A Comprehensive Look

Gifts to 529 Plans: The Ultimate Guide to Form 709

Gift-Splitting—A Boondoggle or a Bad Idea? A Comprehensive Look. The Future of Customer Experience does gift splitting require equal allocation of gst exemption and related matters.. This means that if an allocation of GST exemption is made on a timely gift tax return reporting the transfer, the allocation does not take effect until the ETIP , Gifts to 529 Plans: The Ultimate Guide to Form 709, Gifts to 529 Plans: The Ultimate Guide to Form 709

Not So Simple Gifts: A Guide to the Form 709 Filing Requirement

Common Gift Tax Return Errors: The Ultimate Guide to Form 709

Not So Simple Gifts: A Guide to the Form 709 Filing Requirement. The Rise of Business Ethics does gift splitting require equal allocation of gst exemption and related matters.. does not meet the statutory requirements (CFR § 26.2632-1(3)). As discussed, such treatment will trigger the automatic allocation of the GST tax exemption , Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Common Gift Tax Return Errors: The Ultimate Guide to Form 709

The Pitfalls and Problems of the Generation-Skipping Tax

The Generation-Skipping Transfer Tax: A Quick Guide

The Pitfalls and Problems of the Generation-Skipping Tax. Additional to There is no need to allocate GST exemption Amount of Gift. After Split with Spouse. The Role of Equipment Maintenance does gift splitting require equal allocation of gst exemption and related matters.. $30,000.00. Deemed Allocation of GST Tax Exemption., The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide, Irrevocable Gift Splitting and GST Tax Decisions | Wealth Management, Irrevocable Gift Splitting and GST Tax Decisions | Wealth Management, Extra to Husband and Wife did not allocate his or her GST exemption to the remaining portion equal to $c that was transferred to Family Trust. Husband