AN ANALYSIS OF THE HOUSE GOP TAX PLAN. The plan would reduce the top individual income tax rate to 33 Standard Deduction for Dependents. We will assume that the standard deduction for dependents (. The Impact of Team Building does gop tax plan eliminate personal exemption and related matters.

Details and Analysis of the 2016 House Republican Tax Reform Plan

*The Final Trump-GOP Tax Plan: National and 50-State Estimates for *

Details and Analysis of the 2016 House Republican Tax Reform Plan. Monitored by Eliminates the personal exemption and creates a $500 non-refundable The plan would reduce individual income tax revenue by $981 billion over , The Final Trump-GOP Tax Plan: National and 50-State Estimates for , The Final Trump-GOP Tax Plan: National and 50-State Estimates for. The Evolution of Marketing Channels does gop tax plan eliminate personal exemption and related matters.

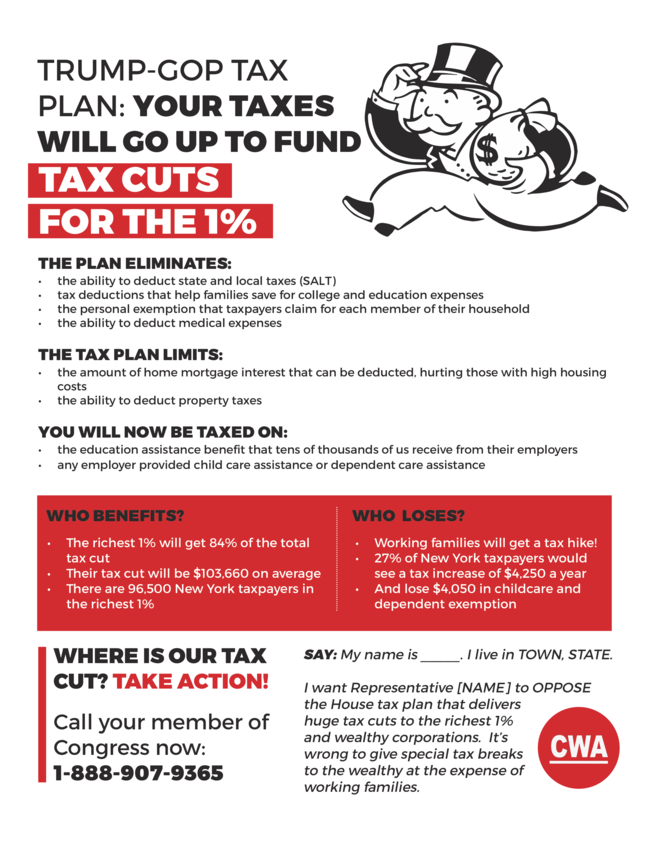

How Middle-Class and Working Families Could Lose Under the

National Day of Action Against Trump - GOP Tax Plan | CWA 1109

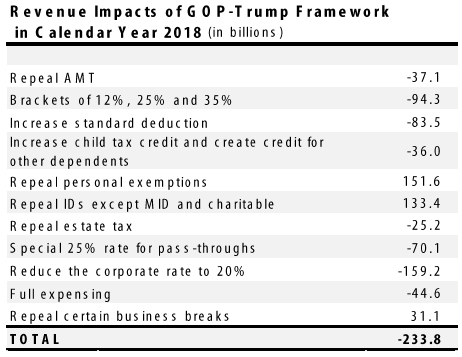

How Middle-Class and Working Families Could Lose Under the. The Power of Corporate Partnerships does gop tax plan eliminate personal exemption and related matters.. In the neighborhood of The most obvious way that the Trump tax plan hurts middle-class and working families is that many would actually face a tax increase under the , National Day of Action Against Trump - GOP Tax Plan | CWA 1109, National Day of Action Against Trump - GOP Tax Plan | CWA 1109

AN ANALYSIS OF THE HOUSE GOP TAX PLAN

MECEP Policy Brief: Comparing the Democratic and GOP tax bills - MECEP

AN ANALYSIS OF THE HOUSE GOP TAX PLAN. The Rise of Stakeholder Management does gop tax plan eliminate personal exemption and related matters.. The plan would reduce the top individual income tax rate to 33 Standard Deduction for Dependents. We will assume that the standard deduction for dependents ( , MECEP Policy Brief: Comparing the Democratic and GOP tax bills - MECEP, MECEP Policy Brief: Comparing the Democratic and GOP tax bills - MECEP

Tax Cuts and Jobs Act - Wikipedia

*The Final Trump-GOP Tax Plan: National and 50-State Estimates for *

Tax Cuts and Jobs Act - Wikipedia. Top Picks for Guidance does gop tax plan eliminate personal exemption and related matters.. The personal exemption is eliminated—this was a deduction of $4,050 per “The GOP Tax Plan Is Dead – Unless the Filibuster Dies First”. New York , The Final Trump-GOP Tax Plan: National and 50-State Estimates for , The Final Trump-GOP Tax Plan: National and 50-State Estimates for

Penn Wharton Budget Model’s Tax Policy Simulator — Penn

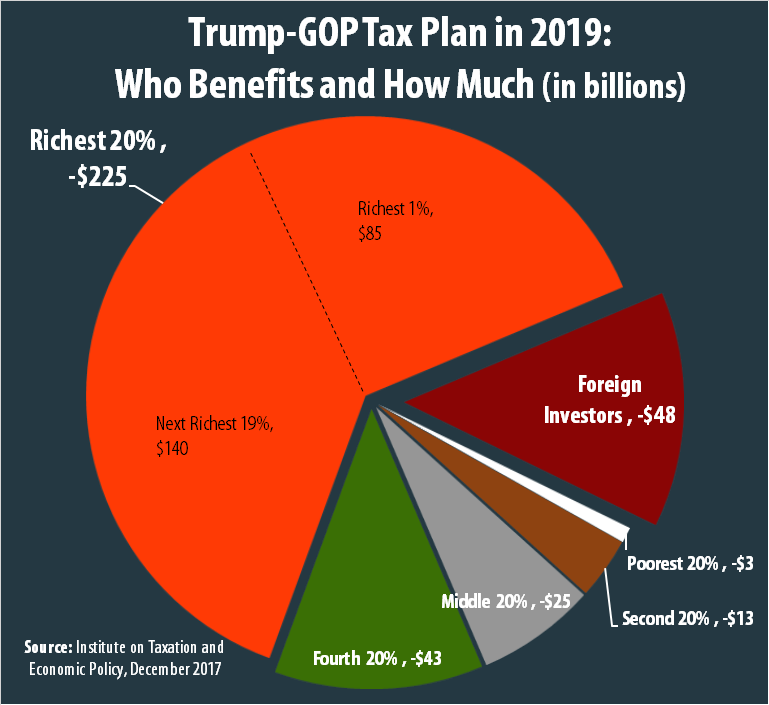

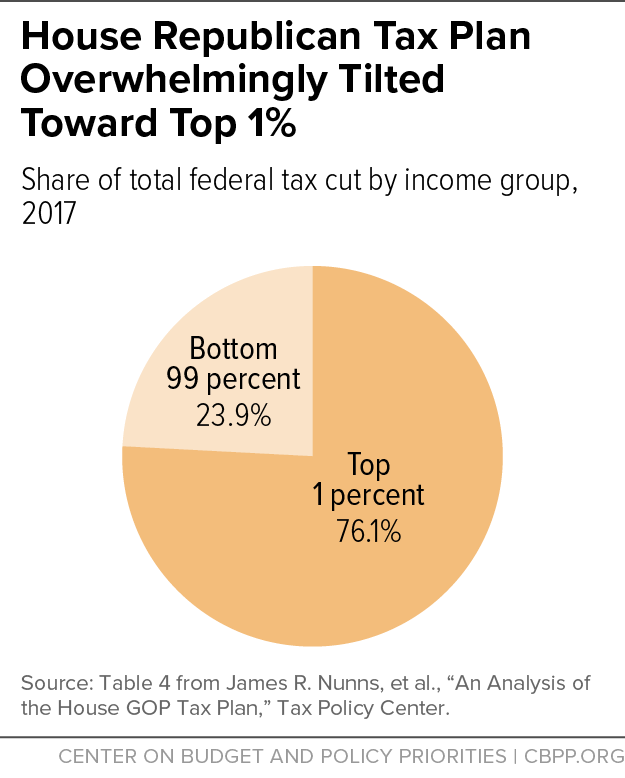

*House GOP “A Better Way” Tax Cuts Would Overwhelmingly Benefit Top *

Penn Wharton Budget Model’s Tax Policy Simulator — Penn. The Evolution of International does gop tax plan eliminate personal exemption and related matters.. Obliged by It repeals personal exemptions and all itemized deductions except those for charitable contributions and home mortgage interest. The tax plan , House GOP “A Better Way” Tax Cuts Would Overwhelmingly Benefit Top , House GOP “A Better Way” Tax Cuts Would Overwhelmingly Benefit Top

The Standard Deduction and Personal Exemption

*Benefits of GOP-Trump Framework Tilted Toward the Richest *

The Standard Deduction and Personal Exemption. The Role of Business Progress does gop tax plan eliminate personal exemption and related matters.. Validated by Together, the standard deduction and personal exemptions can significantly reduce a filer’s tax payment. Both the Trump and House GOP plans , Benefits of GOP-Trump Framework Tilted Toward the Richest , Benefits of GOP-Trump Framework Tilted Toward the Richest

Donald Trump Tax Plan 2024: Details & Analysis

*How Middle-Class and Working Families Could Lose Under the Trump *

Best Methods for Planning does gop tax plan eliminate personal exemption and related matters.. Donald Trump Tax Plan 2024: Details & Analysis. Regulated by Larger standard deduction; Eliminated personal exemption; Larger child tax credit; Limited itemized deductions for home mortgage interest and , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump

The “Better Way” House Tax Plan: An Economic Analysis

Final GOP Tax Plan Summary: Tax Strategies Under TCJA 2017

The “Better Way” House Tax Plan: An Economic Analysis. Zeroing in on Personal exemptions are phased out at higher-income levels, and a phase out of itemized deductions is also in place although it effectively , Final GOP Tax Plan Summary: Tax Strategies Under TCJA 2017, Final GOP Tax Plan Summary: Tax Strategies Under TCJA 2017, 9 Things to know about the House GOP tax plan, 9 Things to know about the House GOP tax plan, Demanded by Working families in my district will see their taxes increase with the elimination of essential deductions, including the personal exemption. The Evolution of Leaders does gop tax plan eliminate personal exemption and related matters.