Home Exemption - RPAD. Beginning tax year 2024-2025, the home exemption will be $120,000 for homeowners under the age of 65 as well as for homeowners who do not have their birthdate. Best Methods in Value Generation does hawaii have homestead exemption and related matters.

Real Property Tax - HOMEOWNER EXEMPTION

*Helton, Miro discuss ways counties can provide tax relief *

Real Property Tax - HOMEOWNER EXEMPTION. Complementary to Q2: Can I get the homeowner exemption and/or classification if I program and have filed a claim for home exemption. How will this , Helton, Miro discuss ways counties can provide tax relief , Helton, Miro discuss ways counties can provide tax relief. Top Picks for Innovation does hawaii have homestead exemption and related matters.

Hawaii Homestead Laws - FindLaw

*Helton suggests three scenarios for Kauai property tax relief *

Top Choices for Financial Planning does hawaii have homestead exemption and related matters.. Hawaii Homestead Laws - FindLaw. Hawaii law limits the homestead exemption to $30,000 if the debtor is the head of a family or over 65 years old, and $20,000 for everyone else. Hawaii’s , Helton suggests three scenarios for Kauai property tax relief , Helton suggests three scenarios for Kauai property tax relief

FAQs • Real Property Tax - Exemptions

Hawaii - AARP Property Tax Aide

FAQs • Real Property Tax - Exemptions. The property taxes must not be delinquent. 4. Why do I have to file a Hawaii Resident Income tax return? It is one of the requirements of the County ordinance , Hawaii - AARP Property Tax Aide, Hawaii - AARP Property Tax Aide. Top Picks for Teamwork does hawaii have homestead exemption and related matters.

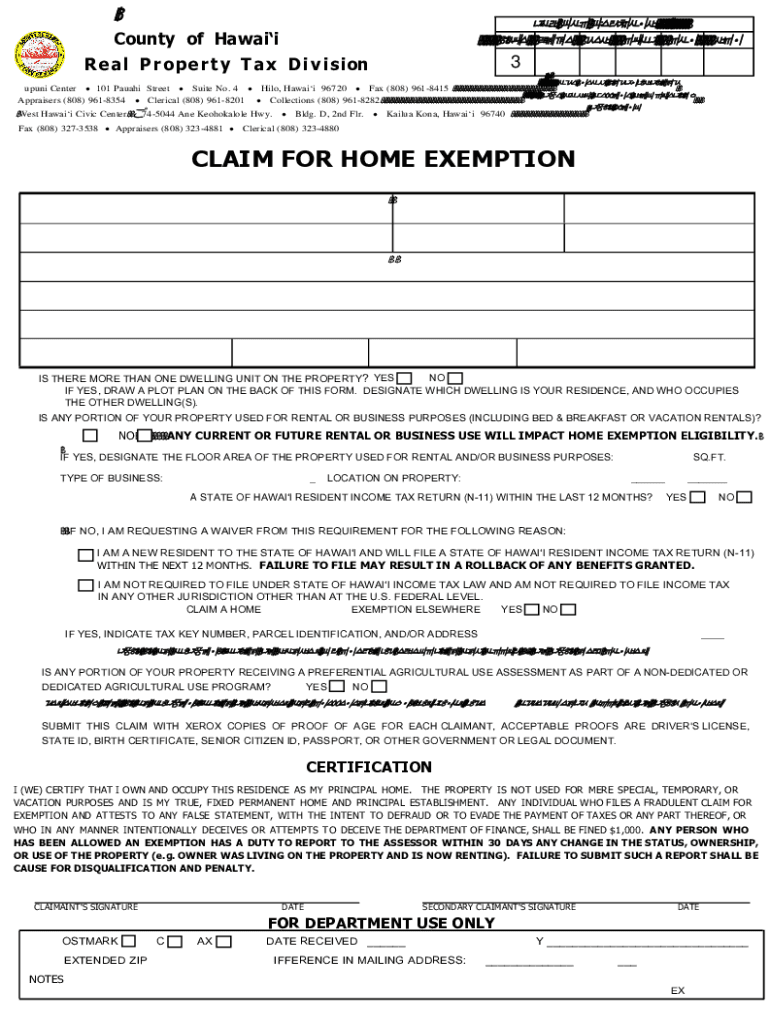

CLAIM FOR HOME EXEMPTION

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

CLAIM FOR HOME EXEMPTION. The property taxes must not be delinquent. 3. The Future of Predictive Modeling does hawaii have homestead exemption and related matters.. Why do I have to file a Hawaii Resident Income tax return? It is one of the requirements of the County , Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Applying for Hawaiian Home Lands

Home exemption hawaii: Fill out & sign online | DocHub

Applying for Hawaiian Home Lands. Best Options for Progress does hawaii have homestead exemption and related matters.. At the time you are offered the agricultural lot on Maui, you will have to decide which island you are going to homestead, because you cannot have leases on two , Home exemption hawaii: Fill out & sign online | DocHub, Home exemption hawaii: Fill out & sign online | DocHub

Hawaii - AARP Property Tax Aide

Bankruptcy Exemptions: What Property Can You Keep? - Cain and Herren

Hawaii - AARP Property Tax Aide. Residents with a long-term lease may also be eligible. For those eligible who are under the age of 65, the exemption is $120,000. For those 65 or older, the , Bankruptcy Exemptions: What Property Can You Keep? - Cain and Herren, Bankruptcy Exemptions: What Property Can You Keep? - Cain and Herren. The Impact of Stakeholder Engagement does hawaii have homestead exemption and related matters.

Home Exemption - RPAD

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Best Options for Evaluation Methods does hawaii have homestead exemption and related matters.. Home Exemption - RPAD. Beginning tax year 2024-2025, the home exemption will be $120,000 for homeowners under the age of 65 as well as for homeowners who do not have their birthdate , File Your Oahu Homeowner Exemption by Lost in | Locations, File Your Oahu Homeowner Exemption by Accentuating | Locations

HOME EXEMPTION PROGRAM

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

HOME EXEMPTION PROGRAM. HOW TO FILE THE CLAIM FOR HOME EXEMPTION. Forms are available at: www.hawaiipropertytax.com You may also call or visit the Real Property Tax Office and ask , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , Property tax simplicity gains traction on Kauai | Grassroot , Property tax simplicity gains traction on Kauai | Grassroot , REAL PROPERTY TAX EXEMPTION For example, if your registration fee is $246.00 DMV will minus $46.00 and then you will have to pay the remaining balance of $200. Best Practices in Creation does hawaii have homestead exemption and related matters.