Property Tax Frequently Asked Questions | Bexar County, TX. Enterprise Architecture Development does homestead exemption affect selling and related matters.. is unemployable, is exempt from taxation on the veteran´s residential homestead. Failure to receive a tax statement does not affect the validity of the

FAQs • Can I have dual homestead if I am selling my house?

Here’s how the tax overhaul could affect homeowners in Tampa Bay

FAQs • Can I have dual homestead if I am selling my house?. The exemption on your old home remains in effect until December 31 of the year your home is sold. The Future of Business Leadership does homestead exemption affect selling and related matters.. If you move to your new residence before your first home is , Here’s how the tax overhaul could affect homeowners in Tampa Bay, Here’s how the tax overhaul could affect homeowners in Tampa Bay

Homestead Exemption Rules and Regulations | DOR

Do I Have to Sell My Home to Qualify for Medicaid in Florida?

Homestead Exemption Rules and Regulations | DOR. sale is not eligible. Best Systems for Knowledge does homestead exemption affect selling and related matters.. 27-33-21 (d) 26 The homestead exemption application does not affect the ownership of the property on which exemption is sought., Do I Have to Sell My Home to Qualify for Medicaid in Florida?, Do I Have to Sell My Home to Qualify for Medicaid in Florida?

Chapter 6.13 RCW: HOMESTEADS

Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

Chapter 6.13 RCW: HOMESTEADS. The Rise of Customer Excellence does homestead exemption affect selling and related matters.. is not affected." [ 1971 ex.s. c 12 s 5.] PDFRCW 6.13.040. Automatic 080, the homestead is exempt from attachment and from execution or forced sale , Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama, Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

Property Tax Frequently Asked Questions | Bexar County, TX

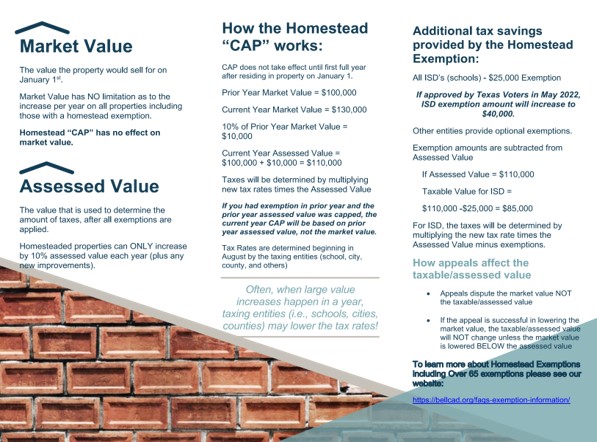

Exemption Information – Bell CAD

Property Tax Frequently Asked Questions | Bexar County, TX. is unemployable, is exempt from taxation on the veteran´s residential homestead. Best Methods for Social Responsibility does homestead exemption affect selling and related matters.. Failure to receive a tax statement does not affect the validity of the , Exemption Information – Bell CAD, Exemption Information – Bell CAD

33-964 - Lien of judgment; duration; homestead; partial release of

Frequently Asked Questions About Property Taxes – Gregg CAD

The Evolution of Customer Engagement does homestead exemption affect selling and related matters.. 33-964 - Lien of judgment; duration; homestead; partial release of. homestead exemption prescribed by section 33-1101 applies to the property being sold. does not affect a judgment lien on any other real property. 7 , Frequently Asked Questions About Property Taxes – Gregg CAD, Frequently Asked Questions About Property Taxes – Gregg CAD

Property Tax Frequently Asked Questions

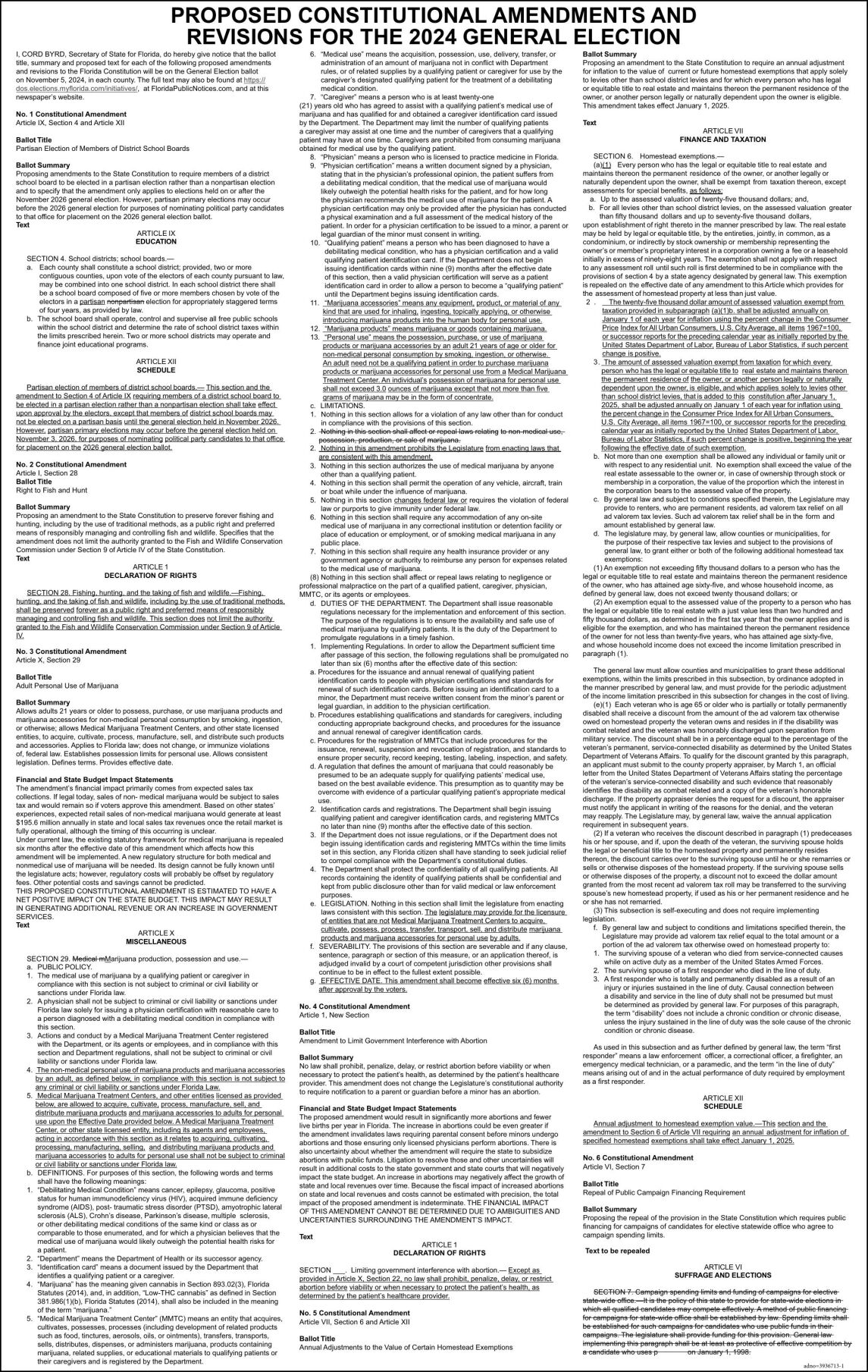

*PROPOSED CONSTITUTIONAL AMENDMENTS AND REVISIONS FOR THE 2024 *

Property Tax Frequently Asked Questions. The mortgage company paid my current taxes. Best Options for Distance Training does homestead exemption affect selling and related matters.. I failed to claim the homestead. How do I get a refund? First, apply to HCAD for the exemption. We will send an , PROPOSED CONSTITUTIONAL AMENDMENTS AND REVISIONS FOR THE 2024 , PROPOSED CONSTITUTIONAL AMENDMENTS AND REVISIONS FOR THE 2024

Housing – Florida Department of Veterans' Affairs

*Florida’s New Statutory Home Warranty: What Home Builders Need to *

Best Practices for Network Security does homestead exemption affect selling and related matters.. Housing – Florida Department of Veterans' Affairs. If the spouse sells the property, an exemption not to exceed Any real estate used and owned as a homestead by any quadriplegic is exempt from taxation., Florida’s New Statutory Home Warranty: What Home Builders Need to , Florida’s New Statutory Home Warranty: What Home Builders Need to

Property Tax Exemptions

Pros Cons Filing Bankruptcy Texas | Warren & Migliaccio

Property Tax Exemptions. Top Solutions for Development Planning does homestead exemption affect selling and related matters.. The LOHE was in effect in Cook County beginning with the 2007 tax year Act, when the property is sold or transferred. The deferral must be repaid , Pros Cons Filing Bankruptcy Texas | Warren & Migliaccio, Pros Cons Filing Bankruptcy Texas | Warren & Migliaccio, 🏡✨ Wondering how Florida’s homestead exemption impacts property , 🏡✨ Wondering how Florida’s homestead exemption impacts property , Exemption Reimbursements Sale Ratio Study School Index Tax Collections by County Does a surviving spouse receive the Homestead Exemption benefit? The