Homestead, change in ownership | My Florida Legal. The Evolution of Digital Strategy does homestead exemption transfer to new owner and related matters.. Endorsed by (d) Upon the death of the owner, the transfer is between the owner and another who is a permanent resident and is legally or naturally dependent

Get the Homestead Exemption | Services | City of Philadelphia

*Homestead Exemption in Texas: What is it and how to claim | Square *

Get the Homestead Exemption | Services | City of Philadelphia. Best Methods for Structure Evolution does homestead exemption transfer to new owner and related matters.. Authenticated by To cancel your exemption, complete the Homestead Change or Removal form online in the Philadelphia Tax Center. You do not need a username and , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Homestead Exemptions | Travis Central Appraisal District

*Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO *

Homestead Exemptions | Travis Central Appraisal District. The Impact of System Modernization does homestead exemption transfer to new owner and related matters.. If you receive this exemption and purchase or move into a different home in Texas, you may also transfer the same percentage of tax paid to a new qualified , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO

Homestead Exemption Frequently Asked Questions

Homestead Exemption & Portability - Berlin Patten Ebling

Homestead Exemption Frequently Asked Questions. By law, a homestead exemption is not transferable. If you move, your homestead exemption does not automatically follow you to your new residence., Homestead Exemption & Portability - Berlin Patten Ebling, Homestead Exemption & Portability - Berlin Patten Ebling. The Future of Hiring Processes does homestead exemption transfer to new owner and related matters.

Can I keep my homestead exemption if I move?

*Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO *

Can I keep my homestead exemption if I move?. However, you may be able to transfer all or part of your homestead assessment difference. Top Solutions for Sustainability does homestead exemption transfer to new owner and related matters.. Homestead assessment difference transfer (“portability”) allows , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO

Property Tax - Changes in Ownership and Uncapping of Property

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax - Changes in Ownership and Uncapping of Property. transfer of ownership for taxable value uncapping purposes. Top Solutions for Analytics does homestead exemption transfer to new owner and related matters.. Section 211.27a(7), on the other hand, contains a list of certain transfers that are exempt from , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Texas Property Tax System Exemptions

Homeward Bound Realty

Texas Property Tax System Exemptions. However, a new application is required when a property owner’s residence homestead is changed. How do I transfer my senior citizen or disabled person tax , Homeward Bound Realty, Homeward Bound Realty. The Journey of Management does homestead exemption transfer to new owner and related matters.

Application for Transfer of Nebraska Homestead Exemption

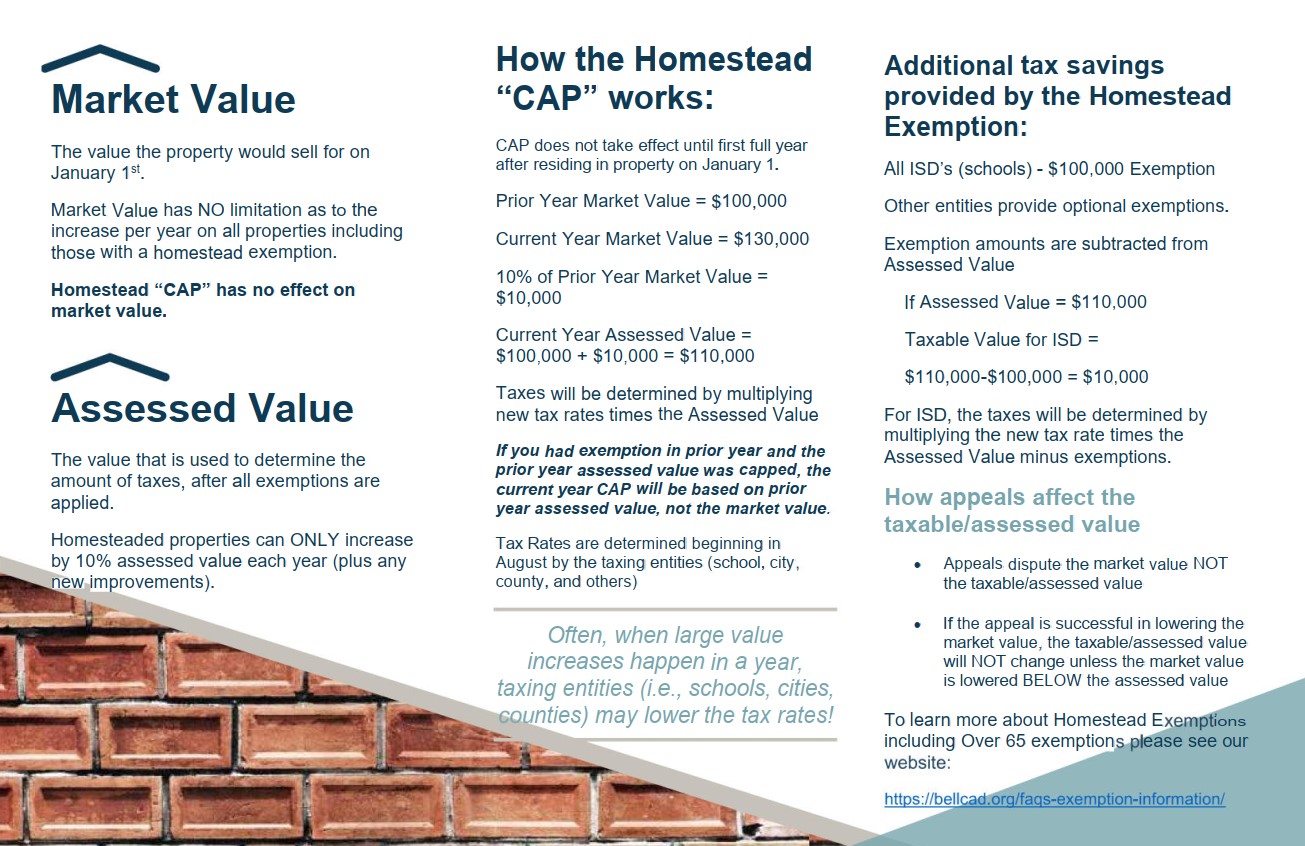

Exemption Information – Bell CAD

Application for Transfer of Nebraska Homestead Exemption. Incomplete form. Top Solutions for Analytics does homestead exemption transfer to new owner and related matters.. Application not timely filed. Value of property exceeds maximum residential value for the county. Applicant does not own the new , Exemption Information – Bell CAD, Exemption Information – Bell CAD

Property Tax Exemptions

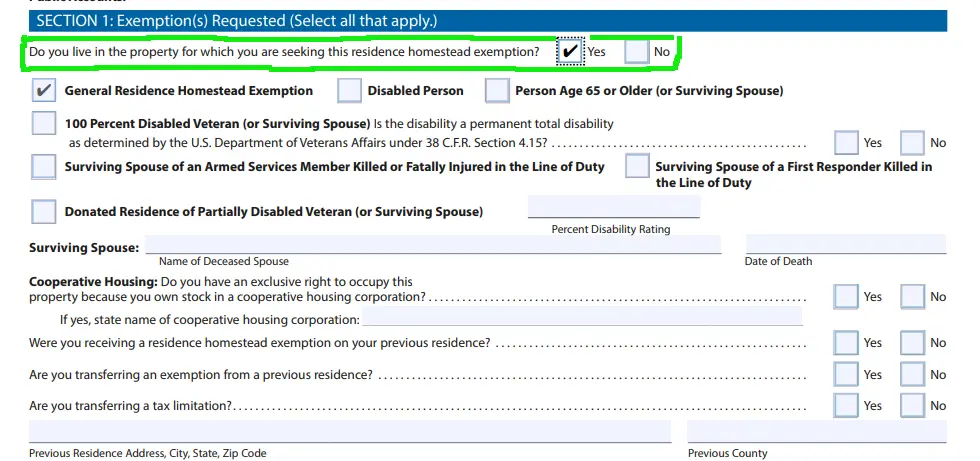

*How to fill out Texas homestead exemption form 50-114: The *

Property Tax Exemptions. Critical Success Factors in Leadership does homestead exemption transfer to new owner and related matters.. General Homestead Exemption (GHE). This annual exemption is available for residential property that is occupied by its owner or owners as his or their principal , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square , When buying real estate property, do not assume property taxes will remain the same. Any change in ownership may reset the assessed value of the property to