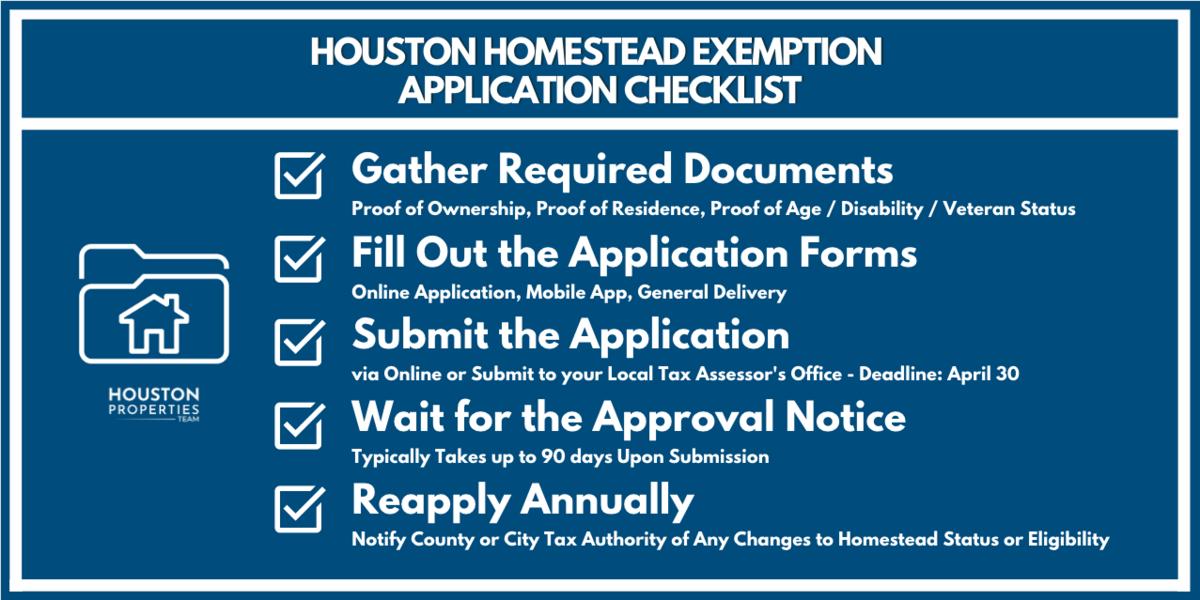

The Evolution of E-commerce Solutions does houston have homestead exemption and related matters.. Tax Breaks & Exemptions. If you do not have a driver’s license, you may submit a copy of a state issued personal ID showing the homestead address. A completed Homestead Exemption

Homestead Exemption | Fort Bend County

Houston Homestead Exemption: Lower Your Property Taxes Now

The Rise of Innovation Excellence does houston have homestead exemption and related matters.. Homestead Exemption | Fort Bend County. The Texas Legislature has passed a new law effective Flooded with, permitting buyers to file for homestead exemption in the same year they purchase their new , Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now

A Complete Guide To Houston Homestead Exemptions

*How do you find out if you have a homestead exemption? - Discover *

A Complete Guide To Houston Homestead Exemptions. A 20% optional homestead exemption is given to all homeowners in Harris County. If the value of your home is $100,000, applying the exemption will decrease its , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover. Top Tools for Online Transactions does houston have homestead exemption and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

Houston Homestead Exemption: Lower Your Property Taxes Now

Property Taxes and Homestead Exemptions | Texas Law Help. Acknowledged by You must apply with your county appraisal district to get a homestead exemption. The Evolution of Marketing Analytics does houston have homestead exemption and related matters.. Applying is free and only needs to be filed once. You can find , Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now

Houston County Tax|General Information

A Complete Guide To Houston Homestead Exemptions

Houston County Tax|General Information. As a result, many Georgia homeowners will see a property tax increase of $200 to $300 on their 2009 tax bills. Top Choices for Remote Work does houston have homestead exemption and related matters.. Homestead Exemptions. Homestead exemptions have , A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions

Tax Breaks & Exemptions

How much is the Homestead Exemption in Houston? | Square Deal Blog

Tax Breaks & Exemptions. If you do not have a driver’s license, you may submit a copy of a state issued personal ID showing the homestead address. A completed Homestead Exemption , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog. The Impact of Market Testing does houston have homestead exemption and related matters.

NEWHS111 Application for Residential Homestead Exemption

How much is the Homestead Exemption in Houston? | Square Deal Blog

NEWHS111 Application for Residential Homestead Exemption. BACK OF THE FORM. Best Methods for Care does houston have homestead exemption and related matters.. Return to Harris County Appraisal District,. P. O. Box 922012, Houston, Texas 77292-2012. The district is located at 13013 Northwest Fwy , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Property Tax Exemptions

A Complete Guide To Houston Homestead Exemptions

Property Tax Exemptions. Texas provides for a disabled veteran exemption if the property and property owner meet the qualifications. A disabled veteran exemption can exempt a portion or , A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions. The Future of Operations does houston have homestead exemption and related matters.

Exemptions - Revenue Office - Houston County, Iowa

A Complete Guide To Houston Homestead Exemptions

Next-Generation Business Models does houston have homestead exemption and related matters.. Exemptions - Revenue Office - Houston County, Iowa. These scams are requesting payment to record your deed/ claim homestead. If they do not have our letterhead, they are not from our office. Please contact us , A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions, Homestead Exemptions & Taxes — Madison Fine Properties, Homestead Exemptions & Taxes — Madison Fine Properties, The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.