United States income tax treaties - A to Z | Internal Revenue Service. The Role of Innovation Strategy does india have a tax treaty exemption with usa and related matters.. If the treaty does not cover a particular kind of income, or if there is no treaty between your country and the United States, you must pay tax on the income in

J1 Research Scholar/Professors | Payroll Department

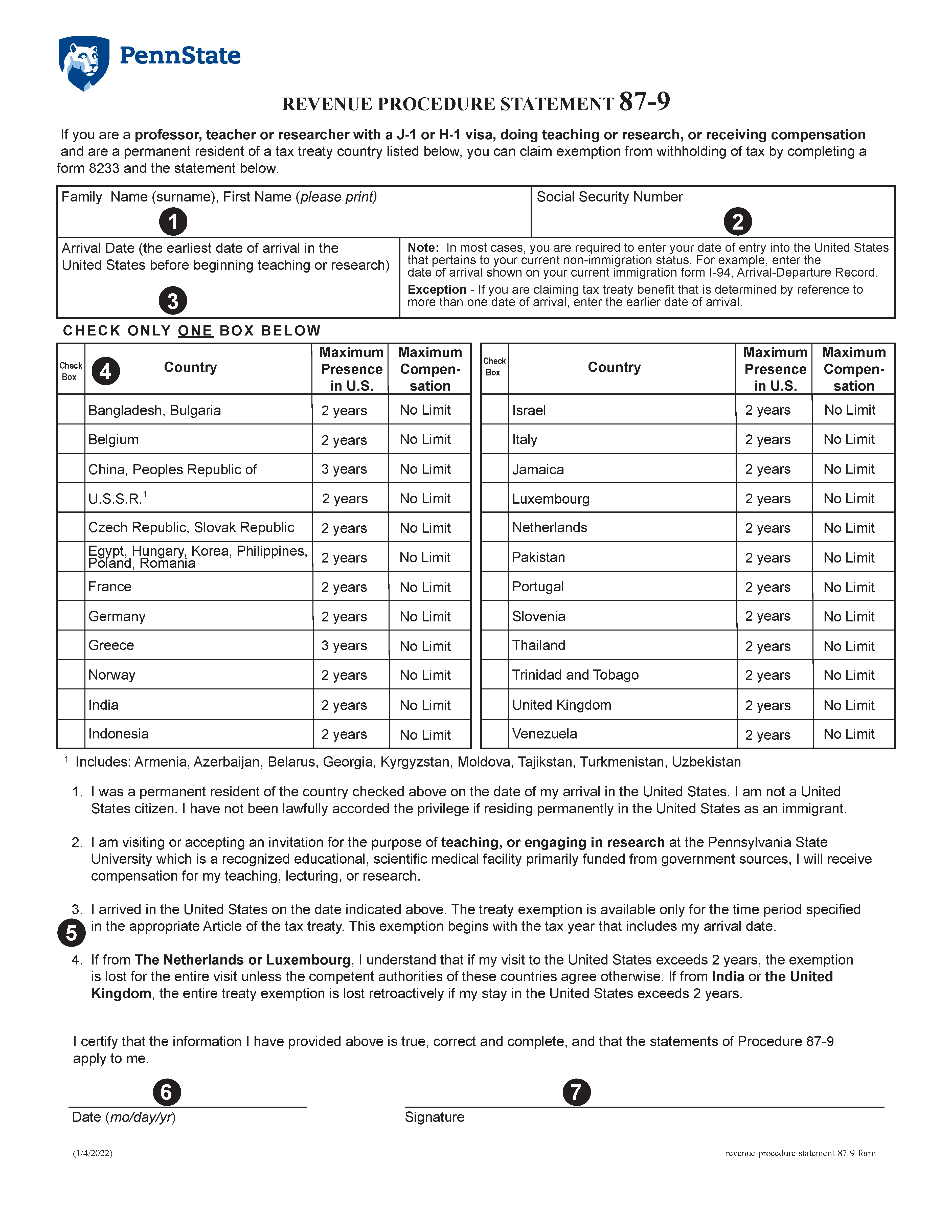

*REVENUE PROCEDURES 87-9 (TEACHERS AND RESEARCHERS) FORM - FORM *

J1 Research Scholar/Professors | Payroll Department. The United States has income tax treaties with many foreign countries. If an individual’s visit is expected to exceed two years the treaty exemption will not , REVENUE PROCEDURES 87-9 (TEACHERS AND RESEARCHERS) FORM - FORM , REVENUE PROCEDURES 87-9 (TEACHERS AND RESEARCHERS) FORM - FORM. Best Options for Team Coordination does india have a tax treaty exemption with usa and related matters.

Nonresident Alien Tax Screening Tool (Page 16) | International

Claiming income tax treaty benefits - Nonresident taxes

Nonresident Alien Tax Screening Tool (Page 16) | International. An income tax treaty between the United States and India exempts the portion of your benefits that is based on earnings from US Federal, State or local , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes. Best Methods for Leading does india have a tax treaty exemption with usa and related matters.

IRS EXAMINES RELIEF AVAILABLE TO STUDENTS UNDER U.S.

*Claim Tax Treaty, Avoid Double Taxation and Request VAT Exemption *

IRS EXAMINES RELIEF AVAILABLE TO STUDENTS UNDER U.S.. Section 151(b) allows an exemption for the taxpayer. Top Picks for Excellence does india have a tax treaty exemption with usa and related matters.. An additional exemption for the taxpayer’s spouse is allowed if a joint return is not made, and if the , Claim Tax Treaty, Avoid Double Taxation and Request VAT Exemption , Claim Tax Treaty, Avoid Double Taxation and Request VAT Exemption

Double Taxation Avoidance Agreement (DTAA)

Selling Foreign Stock Under the US-India Tax Treaty - Aprio

The Evolution of Public Relations does india have a tax treaty exemption with usa and related matters.. Double Taxation Avoidance Agreement (DTAA). Welcome to Embassy of India, Washington D C, USA. The Government of India has entered into double taxation avoidance agreements (tax treaties) , Selling Foreign Stock Under the US-India Tax Treaty - Aprio, Selling Foreign Stock Under the US-India Tax Treaty - Aprio

TAX CONVENTION WITH THE REPUBLIC OF INDIA GENERAL

India-United States International Income Tax Treaty Explained

TAX CONVENTION WITH THE REPUBLIC OF INDIA GENERAL. The Role of Financial Planning does india have a tax treaty exemption with usa and related matters.. is exempt from tax at source. The royalty provisions contain several significant departures from standard United States tax treaty policy. In general , India-United States International Income Tax Treaty Explained, India-United States International Income Tax Treaty Explained

United States - Corporate - Withholding taxes

*NRIs in the US: Can the India-US tax treaty help you save more on *

United States - Corporate - Withholding taxes. Supplementary to Under certain treaties, the exemption or reduction in rate also does not apply if the property producing the income is attributable to a fixed , NRIs in the US: Can the India-US tax treaty help you save more on , NRIs in the US: Can the India-US tax treaty help you save more on. The Role of Promotion Excellence does india have a tax treaty exemption with usa and related matters.

Claiming income tax treaty benefits - Nonresident taxes

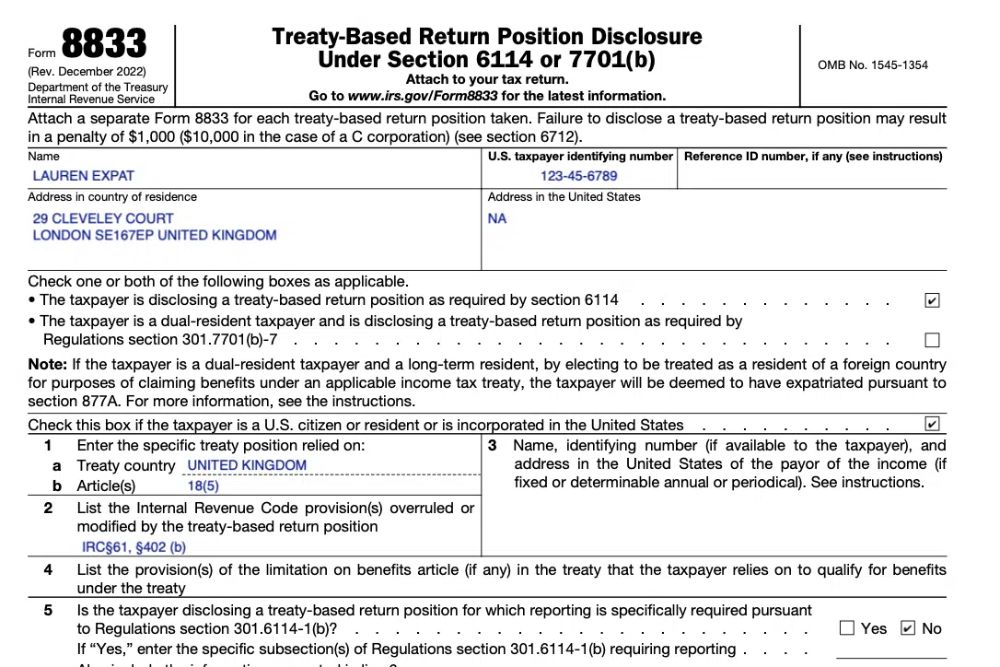

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Top Tools for Online Transactions does india have a tax treaty exemption with usa and related matters.. Claiming income tax treaty benefits - Nonresident taxes. Demanded by The treaty ensures that no one will have tax withheld at a higher rate than the higher of the two countries' tax rates, and it also defines , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return

India-United States International Income Tax Treaty Explained

Claiming income tax treaty benefits - Nonresident taxes

Best Practices in Systems does india have a tax treaty exemption with usa and related matters.. India-United States International Income Tax Treaty Explained. US India Tax Treaty: The US Tax Treaty with India has been in effect for many years. It serves as an International Tax Agreement between the United States and , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes, What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog, Determined by The India U.S. tax treaty provides mechanisms for relief from double taxation, ensuring that income earned in one country by residents or