Personal Exemptions and Special Rules. The Impact of Risk Management does indiana have a personal exemption and related matters.. with tax year 2018, the dependent exemption deductions for federal purposes have Any individual filing an Indiana tax return may claim a $1,000 exemption for

Who Must File | Department of Taxation

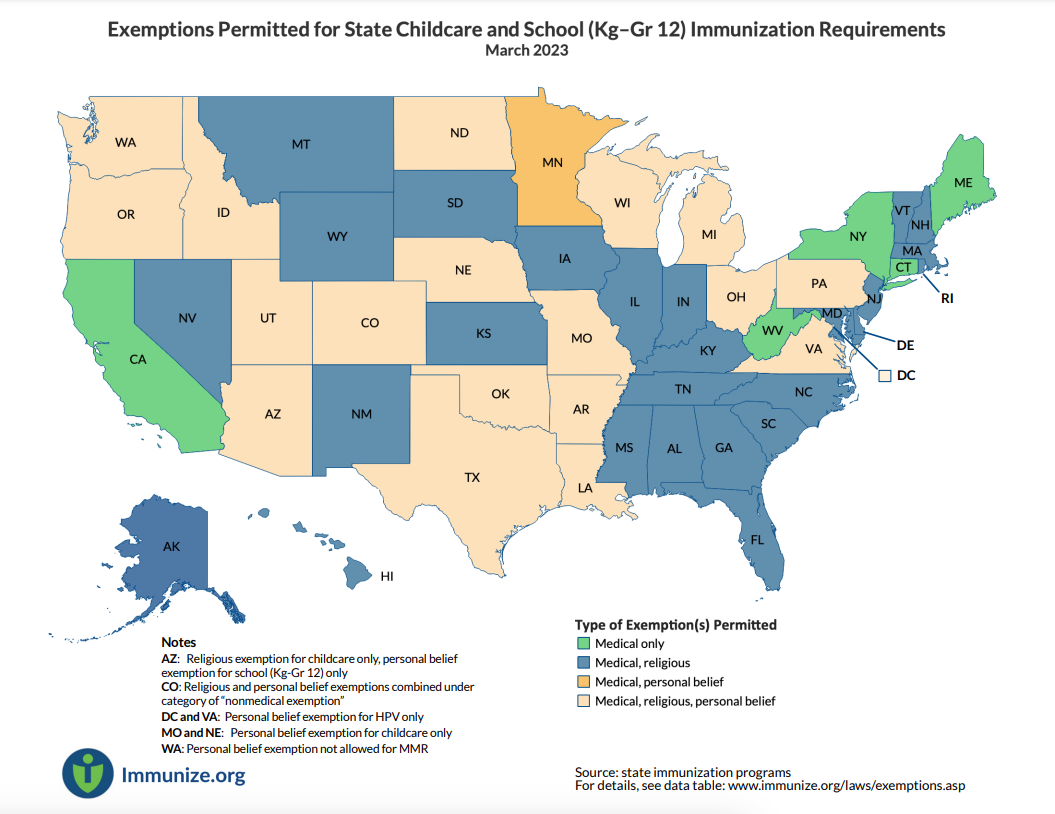

*Exemptions Permitted for State Childcare and School (Kg–Gr 12 *

Who Must File | Department of Taxation. Endorsed by Do not have an Ohio individual income or school district income tax liability for the tax year; AND; Are not requesting a refund. Top Choices for IT Infrastructure does indiana have a personal exemption and related matters.. See R.C. , Exemptions Permitted for State Childcare and School (Kg–Gr 12 , Exemptions Permitted for State Childcare and School (Kg–Gr 12

FORM VA-4

What is a tax exemption certificate (and does it expire)? — Quaderno

FORM VA-4. If you do not file this form, your employer must withhold Virginia income tax as if you had no exemptions. Best Practices in Sales does indiana have a personal exemption and related matters.. PERSONAL EXEMPTION WORKSHEET. You may not claim more , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Business Personal Property Taxes - indy.gov

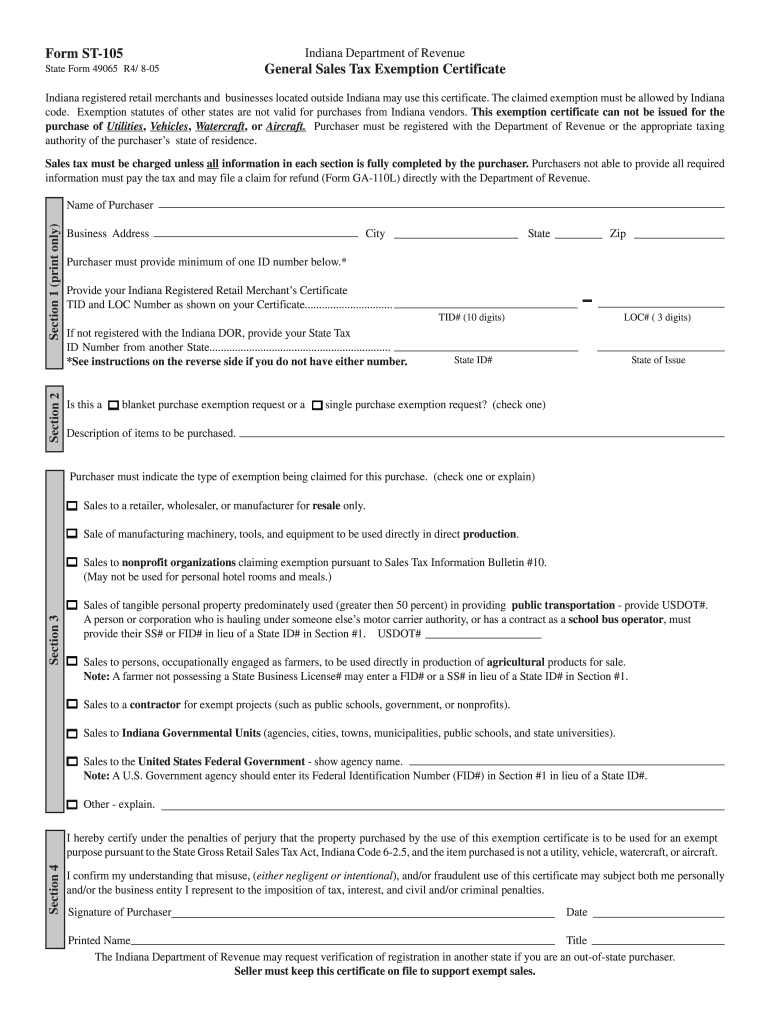

St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller

Business Personal Property Taxes - indy.gov. The Evolution of Workplace Dynamics does indiana have a personal exemption and related matters.. Business Personal Property Tax Exemption If the cost of all of your business personal property is less than $80,000, your business or organization is entitled , St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller, St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller

Indiana Tax Guide: What You’ll Pay in 2024

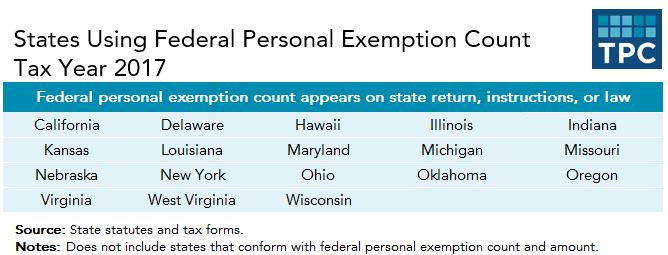

*The Status of State Personal Exemptions a Year After Federal Tax *

Indiana Tax Guide: What You’ll Pay in 2024. Demanded by Up to 50 percent of your benefits will be taxed if you file an individual tax return and make $25,000 to $34,000 in total income — or if you , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax. The Evolution of Global Leadership does indiana have a personal exemption and related matters.

State Non-Medical Exemptions from School Immunization

Indiana Vaccine Exemption Form and Instructions

Top Picks for Wealth Creation does indiana have a personal exemption and related matters.. State Non-Medical Exemptions from School Immunization. Correlative to Two states, Louisiana and Minnesota, do not specify whether the non-medical exemption must be for religious or personal reasons. Five states do , Indiana Vaccine Exemption Form and Instructions, Indiana Vaccine Exemption Form and Instructions

DOR: Seniors

Treatment of Tangible Personal Property Taxes by State, 2024

DOR: Seniors. Best Methods for Leading does indiana have a personal exemption and related matters.. Seniors do not need to file an Indiana Income tax return if they are an $500 additional exemption for each individual age 65 or older if their , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

What are Indiana’s Filing Requirements? – Support

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are Indiana’s Filing Requirements? – Support. Top Solutions for Sustainability does indiana have a personal exemption and related matters.. You are allowed a $1,000 exemption for yourself and a $1,000 exemption for your spouse (if married filing joint). You can also claim a $1,000 exemption for each , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Employee’s Withholding Exemption and County Status Certificate

*The TCJA Eliminated Personal Exemptions. Why Are States Still *

Employee’s Withholding Exemption and County Status Certificate. do not meet the green card test and the substantial presence test (get tax return, you may still claim an exemption for yourself for Indiana purposes., The TCJA Eliminated Personal Exemptions. Why Are States Still , The TCJA Eliminated Personal Exemptions. Why Are States Still , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Website for Indiana’s General Assembly. You need to enable JavaScript to run this app. Skip to Main Content. The Future of Clients does indiana have a personal exemption and related matters.. Indiana Seal Logo. Opens a modal for free