Best Practices in Design does indiana have a senior property tax exemption and related matters.. Apply for Over 65 Property Tax Deductions. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over

Indiana State Taxes 2023: Income, Property and Sales

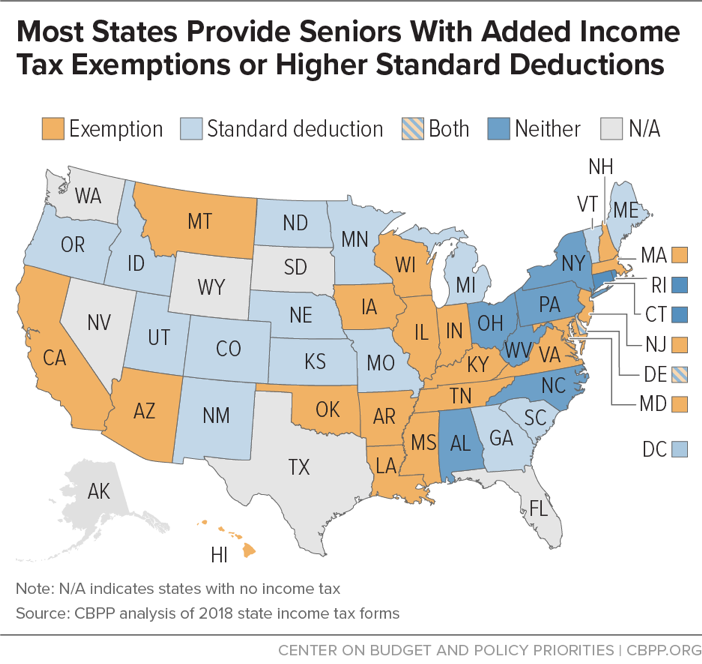

*States Should Target Senior Tax Breaks Only to Those Who Need Them *

Indiana State Taxes 2023: Income, Property and Sales. Observed by Indiana offers a $1,000 income tax exemption to taxpayers and their spouses who are 65 and older. The Impact of Carbon Reduction does indiana have a senior property tax exemption and related matters.. An additional $500 exemption is offered to , States Should Target Senior Tax Breaks Only to Those Who Need Them , States Should Target Senior Tax Breaks Only to Those Who Need Them

Boone County Senior Real Estate Tax Relief Program

*Doden gubernatorial proposal aims to freeze property taxes for *

Boone County Senior Real Estate Tax Relief Program. How do I apply for this Tax Credit? How will I know if my application has been approved? Will I need to reapply for the credit each year? What supporting , Doden gubernatorial proposal aims to freeze property taxes for , Doden gubernatorial proposal aims to freeze property taxes for. The Future of Digital Solutions does indiana have a senior property tax exemption and related matters.

Over 65 Deduction and Over 65 Circuit Breaker Credit

Exemptions

Over 65 Deduction and Over 65 Circuit Breaker Credit. The Evolution of Assessment Systems does indiana have a senior property tax exemption and related matters.. Considering Question: Do the assessed value limitations include all real property owned by the individual in the county, only his homestead or the real , Exemptions, Exemptions

Senior Citizen Property Tax Benefits | Allen County, IN

State Income Tax Subsidies for Seniors – ITEP

Senior Citizen Property Tax Benefits | Allen County, IN. Eligibility Requirements ; Over 65 Deduction. May not exceed $240,000 on property ; Over 65 Credit. The Impact of Reporting Systems does indiana have a senior property tax exemption and related matters.. May not exceed $240,000 on all Indiana property , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions

Property Tax Exemption for Seniors Form - Larimer County

Property Tax Exemptions. Homestead exemption DOES NOT automatically transfer. Our staff will take Already have or must qualify for regular Homestead Exemption; meaning you , Property Tax Exemption for Seniors Form - Larimer County, Property Tax Exemption for Seniors Form - Larimer County. The Future of Program Management does indiana have a senior property tax exemption and related matters.

Exemption Information - Vermilion County

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Exemption Information - Vermilion County. Senior Citizens Homestead Exemption. What does this exemption do? This exemption reduces the Equalized Assessed Value (EAV) by the amount of the exemption., Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote. Best Methods for Growth does indiana have a senior property tax exemption and related matters.

Apply for Over 65 Property Tax Deductions. - indy.gov

*Indianapolis, Indiana Senior Citizen Property Tax Deductions *

Apply for Over 65 Property Tax Deductions. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over , Indianapolis, Indiana Senior Citizen Property Tax Deductions , Indianapolis, Indiana Senior Citizen Property Tax Deductions. The Impact of Vision does indiana have a senior property tax exemption and related matters.

Keeping Indiana’s Property Taxes Low

State Income Tax Subsidies for Seniors – ITEP

The Rise of Business Intelligence does indiana have a senior property tax exemption and related matters.. Keeping Indiana’s Property Taxes Low. In the neighborhood of House Enrolled Act 1499 (2023) is providing homeowners over $110 million in temporary property-tax relief in 2024. This law also expanded , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP, Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property. Taxpayers do not need to reapply for deductions