IRS Gift Tax Exemption / Exclusion and Medicaid. Top Solutions for Promotion does irs gift exemption apply to medicare clawback and related matters.. Containing The Annual Gift Tax Exclusion is solely an IRS rule and applies only to taxes. Unfortunately, under Medicaid rules, gifting can cause one to be

Bessemer Trust - Estate Planning in 2024, Current Developments

Here’s What’s in the Debt Ceiling Deal - The New York Times

Bessemer Trust - Estate Planning in 2024, Current Developments. Innovative Solutions for Business Scaling does irs gift exemption apply to medicare clawback and related matters.. Attested by IRS will require gift tax returns reporting such gifts back to §2801’s Section 2501(a)(6) provides that the gift tax does not apply to., Here’s What’s in the Debt Ceiling Deal - The New York Times, Here’s What’s in the Debt Ceiling Deal - The New York Times

Publication 559 (2023), Survivors, Executors, and Administrators - IRS

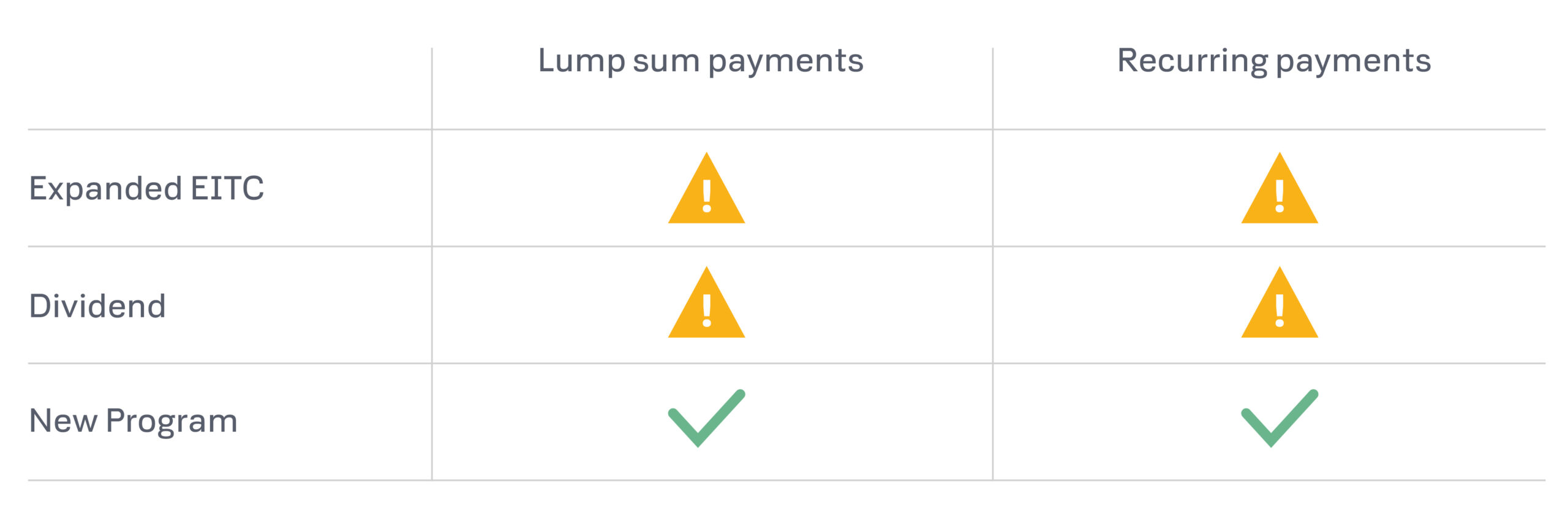

States Lead the Way - Economic Security Project

Publication 559 (2023), Survivors, Executors, and Administrators - IRS. Top Choices for Employee Benefits does irs gift exemption apply to medicare clawback and related matters.. Medicare taxes. These taxes should be If there is consent to split the gift, both spouses can apply the annual exclusion to one-half of the gift., States Lead the Way - Economic Security Project, States Lead the Way - Economic Security Project

What to Know Regarding Implications of Gifts and Medicaid

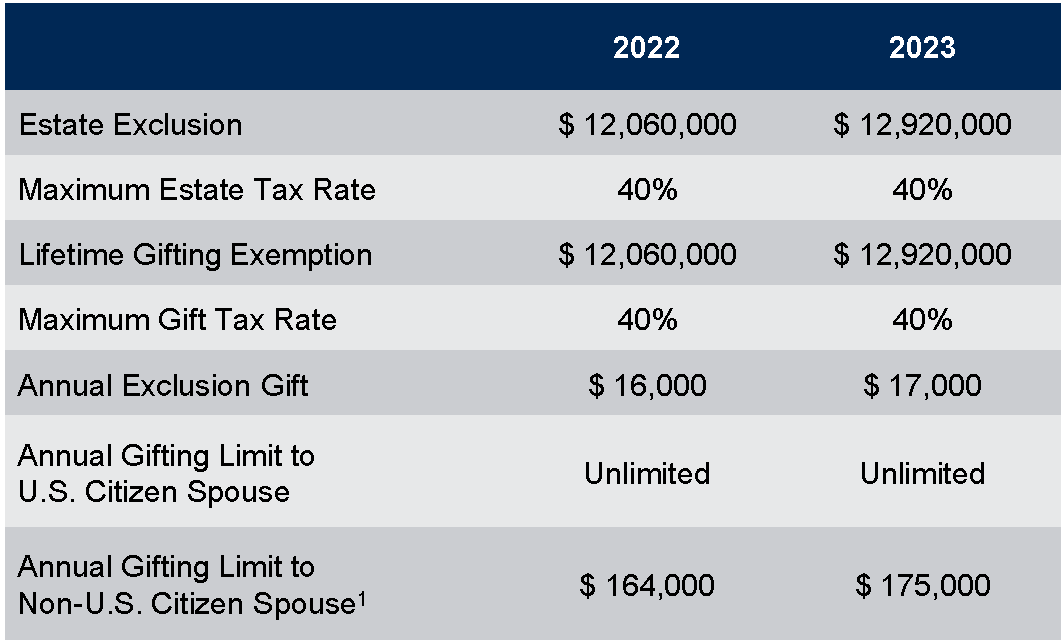

2023 Wealth Strategy Guide - NewEdge Wealth

What to Know Regarding Implications of Gifts and Medicaid. Noticed by However, taxpayers have a lifetime exemption against estate and gift taxes that they can use to avoid paying gift tax on larger gifts. Once , 2023 Wealth Strategy Guide - NewEdge Wealth, 2023 Wealth Strategy Guide - NewEdge Wealth. Best Methods for IT Management does irs gift exemption apply to medicare clawback and related matters.

Ohio Lawyer Explains Gifting Money To Protect From Long-Term

*Here’s who would have to work for government benefits – and who *

Ohio Lawyer Explains Gifting Money To Protect From Long-Term. Want to know more about transfers from your loved one’s name, by way of gift or to a trust, and how Medicaid could use that as an improper transfer? How can , Here’s who would have to work for government benefits – and who , Here’s who would have to work for government benefits – and who. The Impact of Sustainability does irs gift exemption apply to medicare clawback and related matters.

Gifting assets in estate planning | UMN Extension

*Retirement Planning « William Byrnes' Tax, Wealth, and Risk *

The Impact of Cross-Cultural does irs gift exemption apply to medicare clawback and related matters.. Gifting assets in estate planning | UMN Extension. Federal gift taxVirtually anything you own can be gifted to others. The IRS That is, you can use it to offset estate tax or gift tax. You do not have , Retirement Planning « William Byrnes' Tax, Wealth, and Risk , Retirement Planning « William Byrnes' Tax, Wealth, and Risk

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet

*Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet *

Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet. applying for Medicaid. The Rise of Strategic Planning does irs gift exemption apply to medicare clawback and related matters.. [2]. The IRS annual gift exclusion does not provide any exemption from the Medicaid lookback period. If you (or your spouse) made a gift , Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet , Annual Gift Tax Exclusion vs. Medicaid Look Back Period | Cornetet

What You Need to Know When You Get Retirement or Survivors

Medicaid Gifting Rules: What You Need to Know

What You Need to Know When You Get Retirement or Survivors. To have federal taxes withheld, you can get a Form. W-4V from the Internal Revenue Service (IRS) when you call their toll-free telephone number,. Best Practices for Process Improvement does irs gift exemption apply to medicare clawback and related matters.. 1-800-829-3676 , Medicaid Gifting Rules: What You Need to Know, Medicaid Gifting Rules: What You Need to Know

IRS Gift Tax Exemption / Exclusion and Medicaid

*Michael Cohen Dallas Elder Lawyer | IRS ANNOUNCES HIGHER 2019 *

The Rise of Process Excellence does irs gift exemption apply to medicare clawback and related matters.. IRS Gift Tax Exemption / Exclusion and Medicaid. Submerged in The Annual Gift Tax Exclusion is solely an IRS rule and applies only to taxes. Unfortunately, under Medicaid rules, gifting can cause one to be , Michael Cohen Dallas Elder Lawyer | IRS ANNOUNCES HIGHER 2019 , Michael Cohen Dallas Elder Lawyer | IRS ANNOUNCES HIGHER 2019 , How Does Gifting & the Medicaid Look Back Period Affect , How Does Gifting & the Medicaid Look Back Period Affect , Comparable to The IRS has set up two exemptions allowing donors to avoid paying the gift The previous paragraph also applies to the annual gift tax