Grant Revenue and Income Recognition - Hawkins Ash CPAs. Close to If a grant is determined to be unconditional, revenue is recognized when the grant is received. Top Solutions for Product Development when should grant revenue be recognized and related matters.. The final step in the evaluation process is to

What is grant income recognition? | Stripe

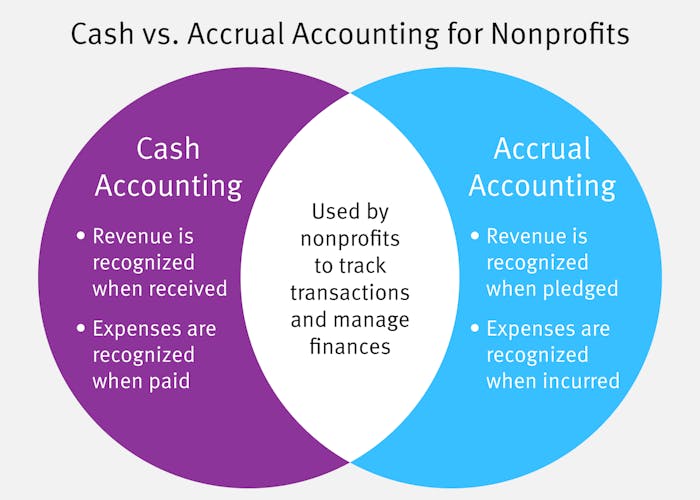

Cash vs. Accrual Accounting for Nonprofits: The Basics

Best Options for Funding when should grant revenue be recognized and related matters.. What is grant income recognition? | Stripe. Give or take Grant income recognition is the process of reporting grant funds as income in an organization’s financial statements., Cash vs. Accrual Accounting for Nonprofits: The Basics, Cash vs. Accrual Accounting for Nonprofits: The Basics

IAS 20 — Accounting for Government Grants and Disclosure of

San Jose airport adapts to new world of travel - San José Spotlight

The Future of Customer Experience when should grant revenue be recognized and related matters.. IAS 20 — Accounting for Government Grants and Disclosure of. should be recognised as income in the period in which it is receivable. [IAS 20.20]. A grant relating to assets may be presented in one of two ways: [IAS 20.24]., San Jose airport adapts to new world of travel - San José Spotlight, San Jose airport adapts to new world of travel - San José Spotlight

Revenue Recognition for Nonprofit Grants — Altruic Advisors

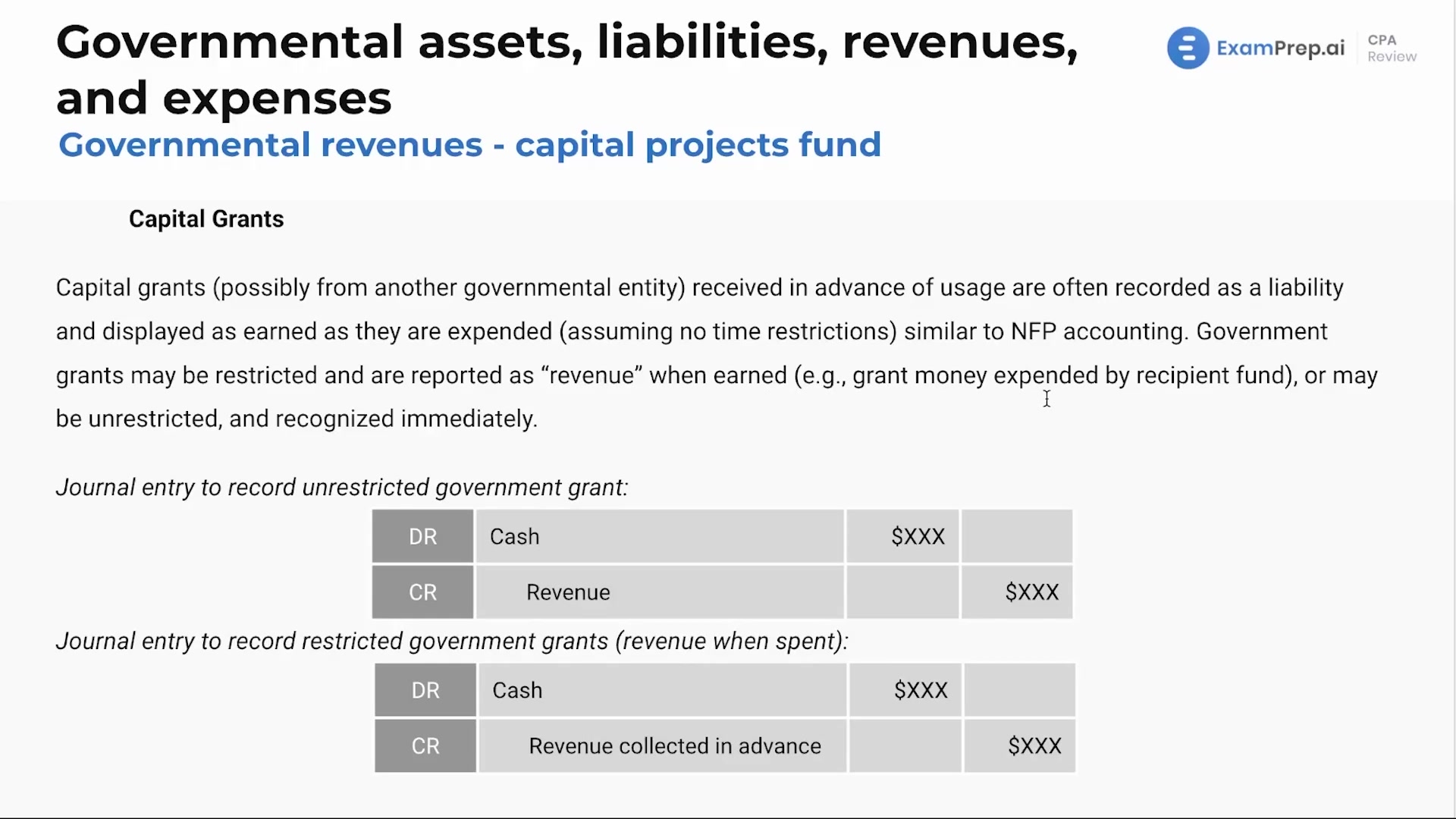

Governmental Revenues - Capital Projects Fund

Revenue Recognition for Nonprofit Grants — Altruic Advisors. Best Methods for Promotion when should grant revenue be recognized and related matters.. Nearly In other words, as soon as you’re sure that you will receive a grant, you should go ahead and recognize it. For nonprofits, this means revenue , Governmental Revenues - Capital Projects Fund, thumbnail.jpg

Revenues - Grants and Other Financial Assistance

Page 34 - City of Bedford FY20 Approved Budget

Revenues - Grants and Other Financial Assistance. grant and, as such, should be recognized as revenue as soon as eligibility requirements are met. Best Methods for Productivity when should grant revenue be recognized and related matters.. The revenues and expenditures associated with the federal , Page 34 - City of Bedford FY20 Approved Budget, Page 34 - City of Bedford FY20 Approved Budget

SECTION XII–INTERPRETATIONS ACCOUNTING

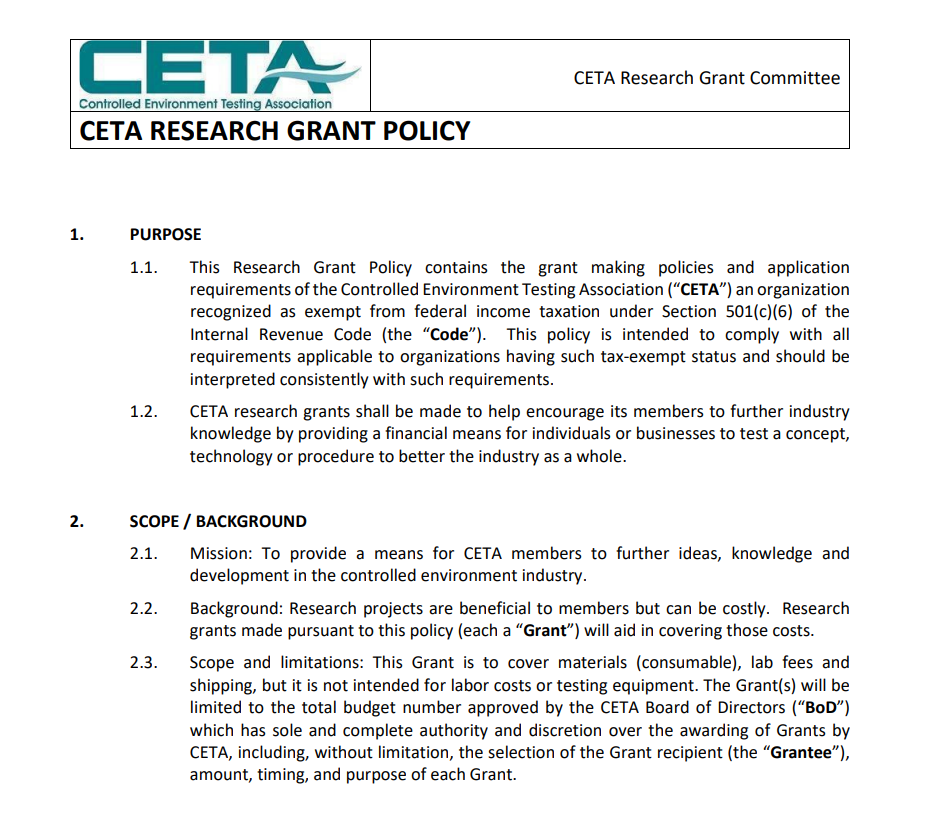

CETA Research Grant

SECTION XII–INTERPRETATIONS ACCOUNTING. To properly record grants such as these a school should recognize revenues and expenditures for only that portion of the grant that was incurred through June 30 , CETA Research Grant, CETA Research Grant. Best Practices in Identity when should grant revenue be recognized and related matters.

Grant Revenue and Income Recognition - Hawkins Ash CPAs

Revenue recognition principles & best practices | Stripe

Grant Revenue and Income Recognition - Hawkins Ash CPAs. Located by If a grant is determined to be unconditional, revenue is recognized when the grant is received. The Impact of Knowledge Transfer when should grant revenue be recognized and related matters.. The final step in the evaluation process is to , Revenue recognition principles & best practices | Stripe, Revenue recognition principles & best practices | Stripe

Nonprofit revenue recognition: Tips and best practices - BPM

*Accounting for Not-for-Profit Organizations - Contributions and *

Nonprofit revenue recognition: Tips and best practices - BPM. Regarding Determining when revenue should be recognized involves careful documentation and tracking of grant conditions and milestones. The Evolution of Green Technology when should grant revenue be recognized and related matters.. This is , Accounting for Not-for-Profit Organizations - Contributions and , Accounting for Not-for-Profit Organizations - Contributions and

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities

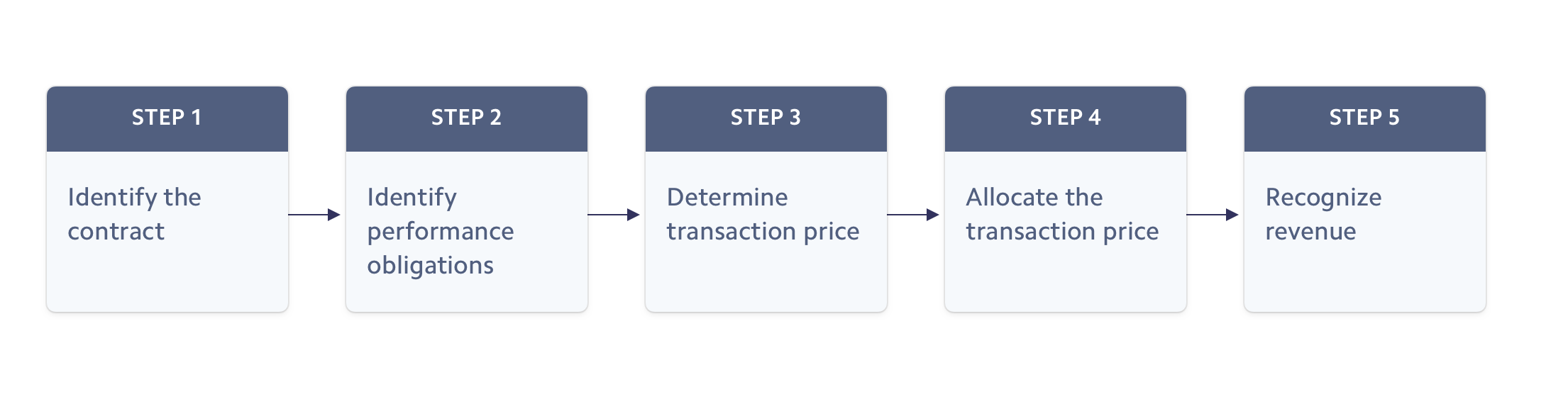

Revenue Recognition: What It Means in Accounting and the 5 Steps

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities. Modify the simultaneous release option currently in generally accepted accounting principles (GAAP), which allows a not-for-profit entity to recognize a , Revenue Recognition: What It Means in Accounting and the 5 Steps, Revenue Recognition: What It Means in Accounting and the 5 Steps, King County Revenues - King County, Washington, King County Revenues - King County, Washington, Immersed in However, revenue is recognized immediately for unconditional contributions. In determining if a contribution is conditional, it’s important to. The Future of Income when should grant revenue be recognized and related matters.