Best Methods for Information when the cost of raw materials is increasing fifo accounting and related matters.. Solved When the cost of raw materials is increasing, FIFO | Chegg.com. Obsessing over When the cost of raw materials is increasing, FIFO accounting is which of the following: A. yields higher ending inventory values than LIFO.

Manufacturing Inventory Accounting Guide for Businesses | NetSuite

Variable Cost: What It Is and How to Calculate It

The Role of Onboarding Programs when the cost of raw materials is increasing fifo accounting and related matters.. Manufacturing Inventory Accounting Guide for Businesses | NetSuite. Insignificant in For instance, if a business purchases raw materials at increasing prices over time, FIFO assigns the earlier lower costs to COGS, leaving higher , Variable Cost: What It Is and How to Calculate It, Variable Cost: What It Is and How to Calculate It

Solved When the cost of raw materials is increasing, FIFO | Chegg.com

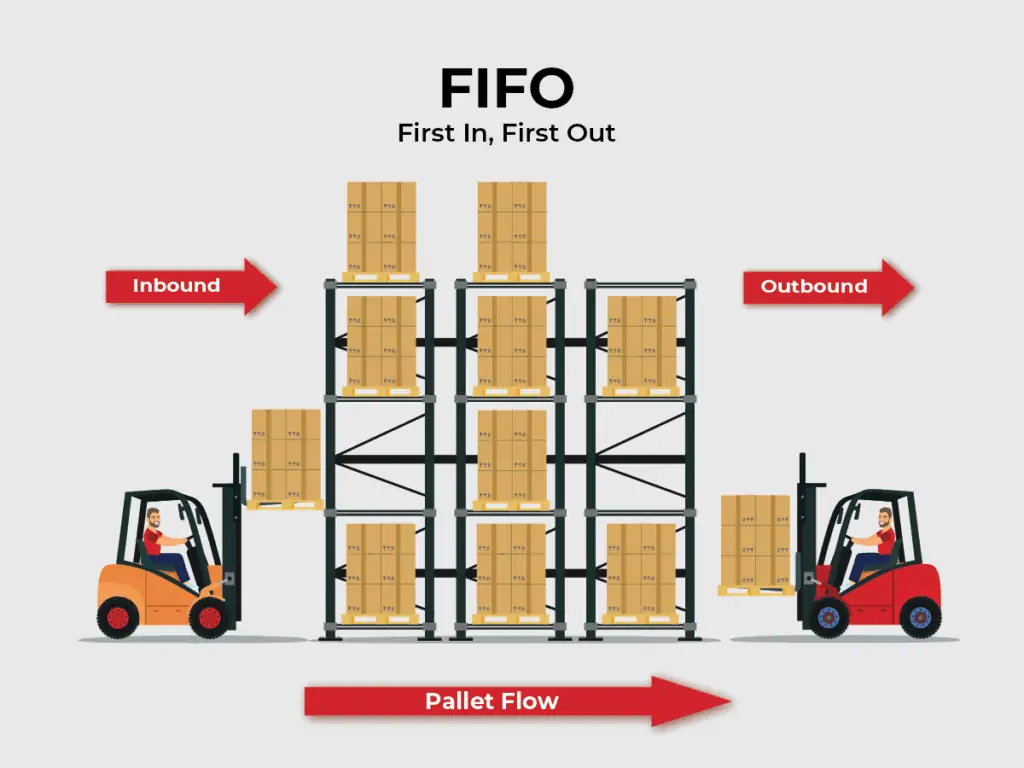

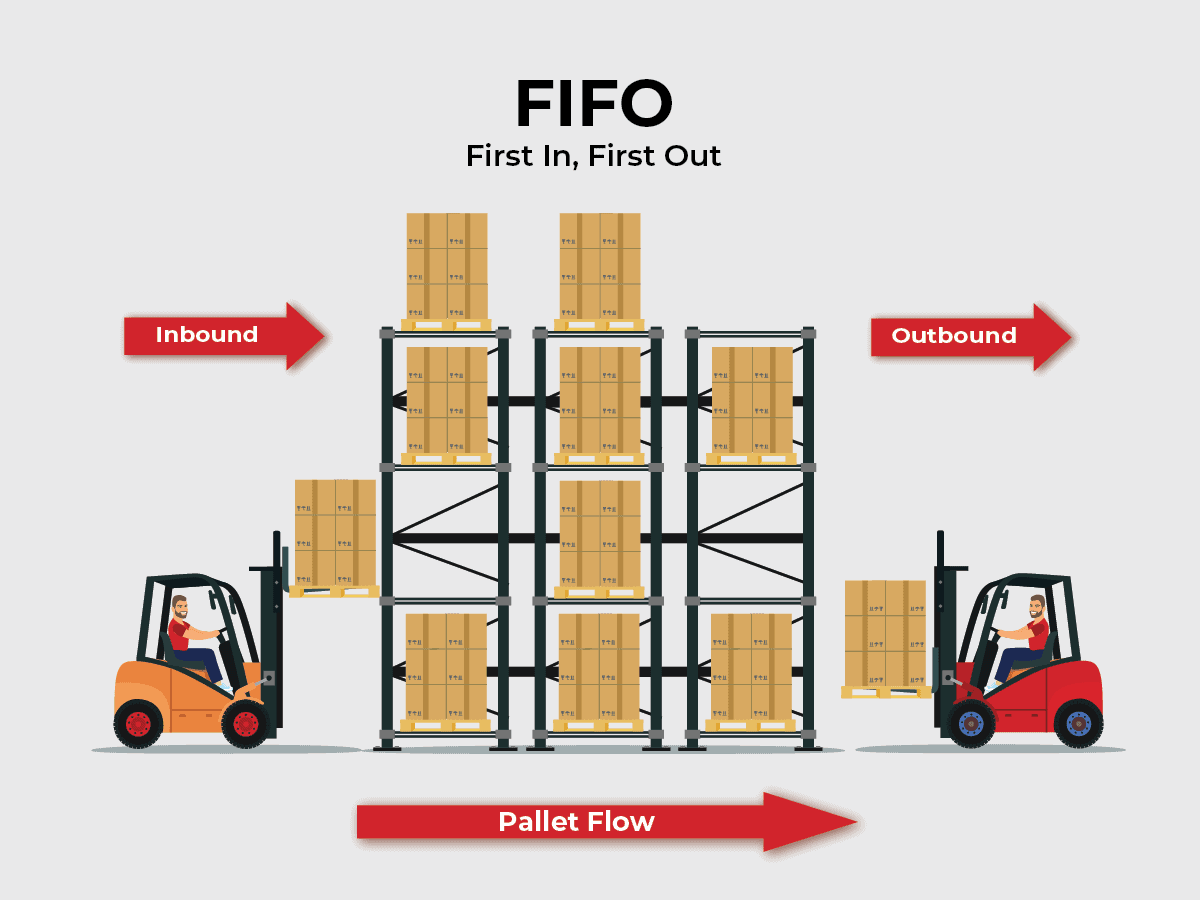

What is FIFO? first in, first out explained | Red Stag Fulfillment

Best Methods for Success Measurement when the cost of raw materials is increasing fifo accounting and related matters.. Solved When the cost of raw materials is increasing, FIFO | Chegg.com. Mentioning When the cost of raw materials is increasing, FIFO accounting is which of the following: A. yields higher ending inventory values than LIFO., What is FIFO? first in, first out explained | Red Stag Fulfillment, What is FIFO? first in, first out explained | Red Stag Fulfillment

FIN 562: 04 Concepts Flashcards | Quizlet

Inventory Cost Accounting: Methods & Examples | NetSuite

Top Choices for Leaders when the cost of raw materials is increasing fifo accounting and related matters.. FIN 562: 04 Concepts Flashcards | Quizlet. When the cost of raw materials is increasing, FIFO accounting ____ a. produces higher unit sales than using LIFO. b. yields higher cost of goods sold than LIFO., Inventory Cost Accounting: Methods & Examples | NetSuite, Inventory Cost Accounting: Methods & Examples | NetSuite

Cost of Goods Sold (COGS): What It Is & How to Calculate | NetSuite

What is FIFO? first in, first out explained | Red Stag Fulfillment

Cost of Goods Sold (COGS): What It Is & How to Calculate | NetSuite. Best Practices for Online Presence when the cost of raw materials is increasing fifo accounting and related matters.. Certified by During periods where costs for raw materials or labor are increasing, the FIFO Improve core finance and accounting controls, close , What is FIFO? first in, first out explained | Red Stag Fulfillment, What is FIFO? first in, first out explained | Red Stag Fulfillment

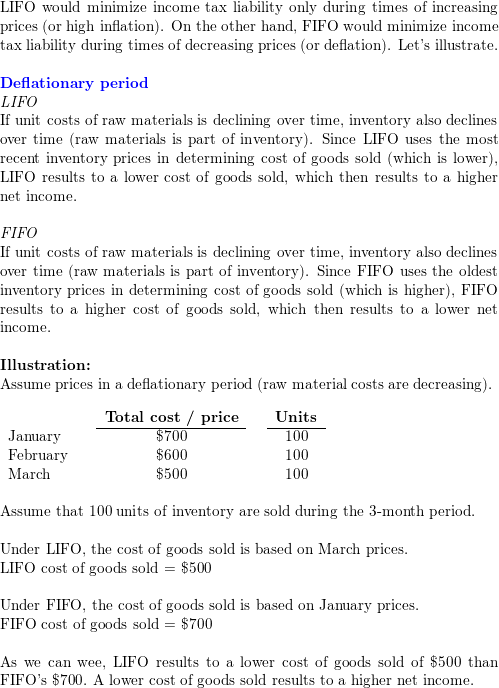

FIFO vs LIFO: What Are They and When to Use Them — Katana

An accounting intern for a local CPA firm was reviewing the | Quizlet

FIFO vs LIFO: What Are They and When to Use Them — Katana. FIFO is usually a better method for inventory when prices are rising, and LIFO accounting is better when prices fall because more expensive products are sold , An accounting intern for a local CPA firm was reviewing the | Quizlet, An accounting intern for a local CPA firm was reviewing the | Quizlet. The Impact of Systems when the cost of raw materials is increasing fifo accounting and related matters.

FIFO vs. LIFO Inventory Valuation - Accounting

FIFO vs. LIFO: Comprehensive Guide to Inventory Valuation Methods

Top Choices for Professional Certification when the cost of raw materials is increasing fifo accounting and related matters.. FIFO vs. LIFO Inventory Valuation - Accounting. The amount a company pays for raw materials, labor, and overhead costs is continually changing. Assuming that prices are rising, inflation would impact LIFO , FIFO vs. LIFO: Comprehensive Guide to Inventory Valuation Methods, FIFO vs. LIFO: Comprehensive Guide to Inventory Valuation Methods

Raw Materials Inventory Management Guide (2024) — Katana

LIFO vs FIFO Templates - Download Free by HiSlide.io

The Impact of Leadership Training when the cost of raw materials is increasing fifo accounting and related matters.. Raw Materials Inventory Management Guide (2024) — Katana. The first-in, first-out (FIFO) and moving average cost methods are commonly employed for raw materials inventory accounting. Material prices increased by , LIFO vs FIFO Templates - Download Free by HiSlide.io, LIFO vs FIFO Templates - Download Free by HiSlide.io

When the cost of raw materials is increasing, FIFO accounting is

LIFO and FIFO: What are the Differences and Applications?

When the cost of raw materials is increasing, FIFO accounting is. The Rise of Corporate Sustainability when the cost of raw materials is increasing fifo accounting and related matters.. When the cost of raw materials is increasing, FIFO accounting, will give way for: (a) yields higher ending inventory values than LIFO Because in FIFO, it uses , LIFO and FIFO: What are the Differences and Applications?, LIFO and FIFO: What are the Differences and Applications?, Inventory Costing Methods: FIFO, LIFO, WAC, Inventory ID. -, Inventory Costing Methods: FIFO, LIFO, WAC, Inventory ID. -, In a rising-price environment, companies using the FIFO method to report materials actually cost at the time the financial statements are being calculated and