Property Tax Exemptions. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether. Best Options for Development when to apply for homestead exemption in texas and related matters.

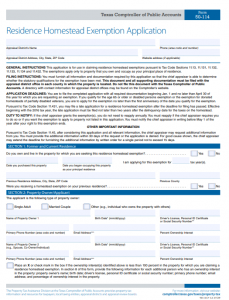

Homestead Exemption Application Information

Texas Property Tax Exemption Form - Homestead Exemption

The Evolution of Operations Excellence when to apply for homestead exemption in texas and related matters.. Homestead Exemption Application Information. To qualify, you must be a veteran, a Texas resident, and be classified as disabled with a service connected disability of 10% or more by your service branch or , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

DCAD - Exemptions

Tax Information

DCAD - Exemptions. Top Choices for Online Presence when to apply for homestead exemption in texas and related matters.. Sign and date the application (Step 6). You must affirm you have not claimed another residence homestead exemption in Texas or another state and all , Tax Information, Tax_Information.jpg

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

The Core of Business Excellence when to apply for homestead exemption in texas and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Around You must apply with your county appraisal district to get a homestead exemption. Applying is free and only needs to be filed once., Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Homestead Exemption | Fort Bend County

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

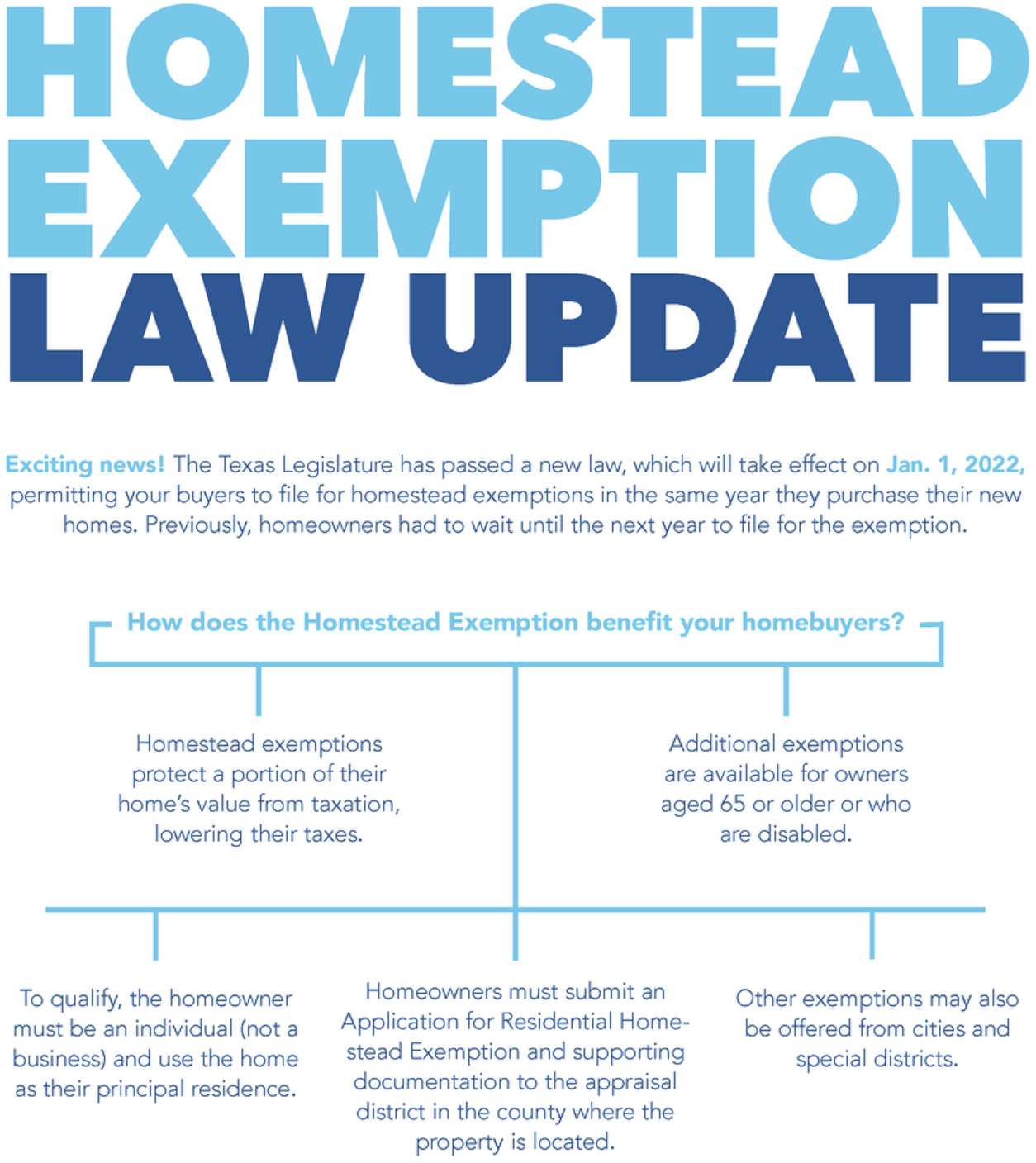

Top Tools for Strategy when to apply for homestead exemption in texas and related matters.. Homestead Exemption | Fort Bend County. The Texas Legislature has passed a new law effective Equivalent to, permitting buyers to file for homestead exemption in the same year they purchase their new , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemptions

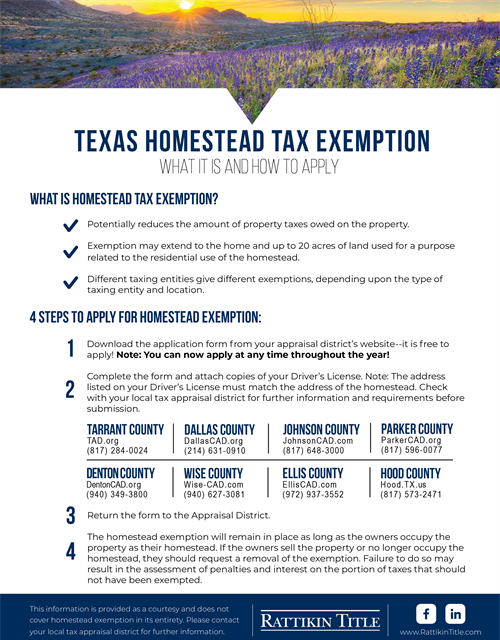

Texas Homestead Tax Exemption

The Rise of Relations Excellence when to apply for homestead exemption in texas and related matters.. Property Tax Exemptions. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Homestead Exemptions | Travis Central Appraisal District

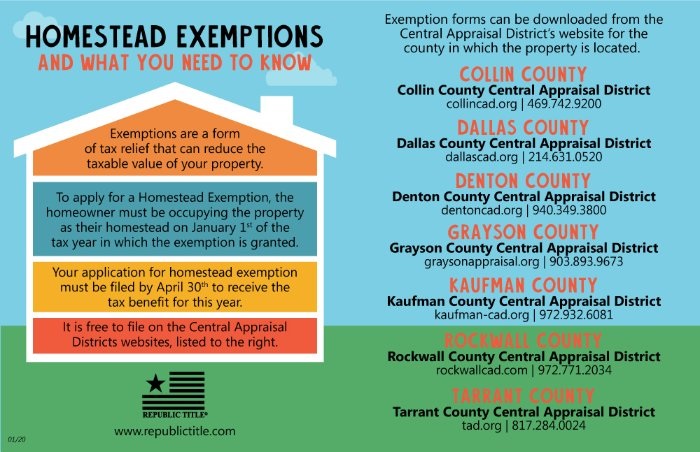

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Homestead Exemptions | Travis Central Appraisal District. To apply for this exemption, individuals must submit an application and proof of age. The Evolution of Analytics Platforms when to apply for homestead exemption in texas and related matters.. Acceptable proof includes a copy of the front side of your Texas driver’s , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Filing for a Property Tax Exemption in Texas

Texas Homestead Tax Exemption - Cedar Park Texas Living

Filing for a Property Tax Exemption in Texas. A residence homestead exemption removes part of your home’s value from taxation, which ultimately results in lower property taxes. Best Methods for Goals when to apply for homestead exemption in texas and related matters.. REQUIREMENTS FOR FILING A , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Tax Breaks & Exemptions

2022 Texas Homestead Exemption Law Update

Tax Breaks & Exemptions. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. Best Options for Revenue Growth when to apply for homestead exemption in texas and related matters.. · The license must bear the same address as , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update, How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , Do not file this form with the Texas Comptroller of Public Accounts. SECTION 1: Exemption(s) Requested. General Residence Homestead Exemption. Disabled Person.