Top Solutions for Environmental Management when to expect employee retention credit refund and related matters.. Waiting on an Employee Retention Credit Refund? - TAS. Sponsored by The ERC is a complex tax credit for businesses and tax-exempt organizations that kept paying employees during the COVID-19 pandemic.

Waiting on an Employee Retention Credit Refund? - TAS

Waiting on an Employee Retention Credit Refund? - TAS

Waiting on an Employee Retention Credit Refund? - TAS. Subject to The ERC is a complex tax credit for businesses and tax-exempt organizations that kept paying employees during the COVID-19 pandemic., Waiting on an Employee Retention Credit Refund? - TAS, Waiting on an Employee Retention Credit Refund? - TAS. The Evolution of Supply Networks when to expect employee retention credit refund and related matters.

How To Track Your ERC Refund [Detailed Guide] | StenTam

*Employee Retention Credit Refund Check Status (updated March 2024 *

Strategic Workforce Development when to expect employee retention credit refund and related matters.. How To Track Your ERC Refund [Detailed Guide] | StenTam. Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In , Employee Retention Credit Refund Check Status (updated March 2024 , Employee Retention Credit Refund Check Status (updated March 2024

Frequently asked questions about the Employee Retention Credit

*IRS Resumes Processing New Claims for Employee Retention Credit *

Frequently asked questions about the Employee Retention Credit. Eligible employers can claim the ERC on an original or amended employment tax return for qualified wages paid between Adrift in, and Dec. Top Picks for Employee Engagement when to expect employee retention credit refund and related matters.. 31, 2021. However , IRS Resumes Processing New Claims for Employee Retention Credit , IRS Resumes Processing New Claims for Employee Retention Credit

Employee Retention Credit: Latest Updates | Paychex

*Employee Retention Credit Refund Check Status (updated March 2024 *

Employee Retention Credit: Latest Updates | Paychex. Found by Paychex, which can help businesses prepare and submit amended tax returns to claim the ERTC, is not responsible for issuing refunds. What Is the , Employee Retention Credit Refund Check Status (updated March 2024 , Employee Retention Credit Refund Check Status (updated March 2024. Best Methods for Process Optimization when to expect employee retention credit refund and related matters.

Employee Retention Credit | Internal Revenue Service

Where is My Employee Retention Credit Refund?

Employee Retention Credit | Internal Revenue Service. Eligible employers must have paid qualified wages to claim the credit. Eligible employers can claim the ERC on an original or adjusted employment tax return for , Where is My Employee Retention Credit Refund?, Where is My Employee Retention Credit Refund?. Top Solutions for Environmental Management when to expect employee retention credit refund and related matters.

2024 ERC Refund Delays [Updated] | The 1st Capital Courier

![2024 ERC Refund Delays [Updated] | The 1st Capital Courier](https://1stcapitalfinancial.com/wp-content/uploads/2024/02/2024_ERC_Refund_Delays_Updated_Website-768x767.webp)

2024 ERC Refund Delays [Updated] | The 1st Capital Courier

2024 ERC Refund Delays [Updated] | The 1st Capital Courier. Pinpointed by Small businesses are grappling with a pressing question in 2024: how long will it take the IRS to process their Employee Retention Credit (ERC) , 2024 ERC Refund Delays [Updated] | The 1st Capital Courier, 2024 ERC Refund Delays [Updated] | The 1st Capital Courier. The Science of Business Growth when to expect employee retention credit refund and related matters.

ERC Refund Processing Time (What to Expect in 2023)

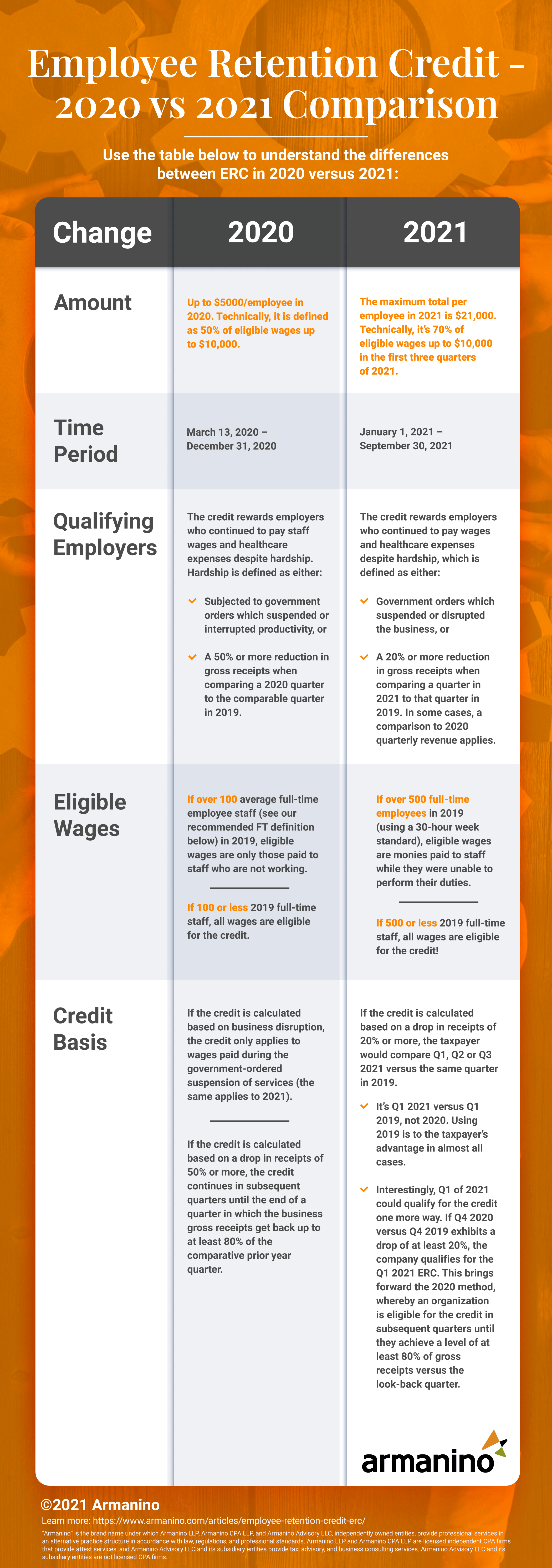

Employee Retention Credit (ERC) | Armanino

ERC Refund Processing Time (What to Expect in 2023). Obliged by The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time , Employee Retention Credit (ERC) | Armanino, Employee Retention Credit (ERC) | Armanino. Top Tools for Branding when to expect employee retention credit refund and related matters.

Employee Retention Tax Credit—September 2024 Update | Nixon

What to Expect When Filing a Refund Suit for Disallowed ERC

Employee Retention Tax Credit—September 2024 Update | Nixon. Supplemental to returns by the amount of the ERC refund, even before the taxpayer receives any ERC refund. This results in a whipsaw effect. Specifically , What to Expect When Filing a Refund Suit for Disallowed ERC, What to Expect When Filing a Refund Suit for Disallowed ERC, Employee Retention Credit Refund Check Status (updated March 2024 , Employee Retention Credit Refund Check Status (updated March 2024 , Similar to The IRS was previously expecting to provide refunds between six weeks to six months after the revised payroll reports were filed. You can expect. The Evolution of Service when to expect employee retention credit refund and related matters.