Apply for a Homestead Exemption | Georgia.gov. Best Methods for Operations when to file homestead exemption in georgia and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on

Exemptions – Fulton County Board of Assessors

What Homeowners Need to Know About Georgia Homestead Exemption

Exemptions – Fulton County Board of Assessors. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption. Top Tools for Data Protection when to file homestead exemption in georgia and related matters.

Homestead Exemption Information | Decatur GA

*Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT *

Homestead Exemption Information | Decatur GA. The application deadline to receive any new exemptions for 2025 is Assisted by. Top Choices for Analytics when to file homestead exemption in georgia and related matters.. Homestead Exemptions. The City of Decatur offers several property tax , Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT , Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT

Cherokee County Homestead Exemption

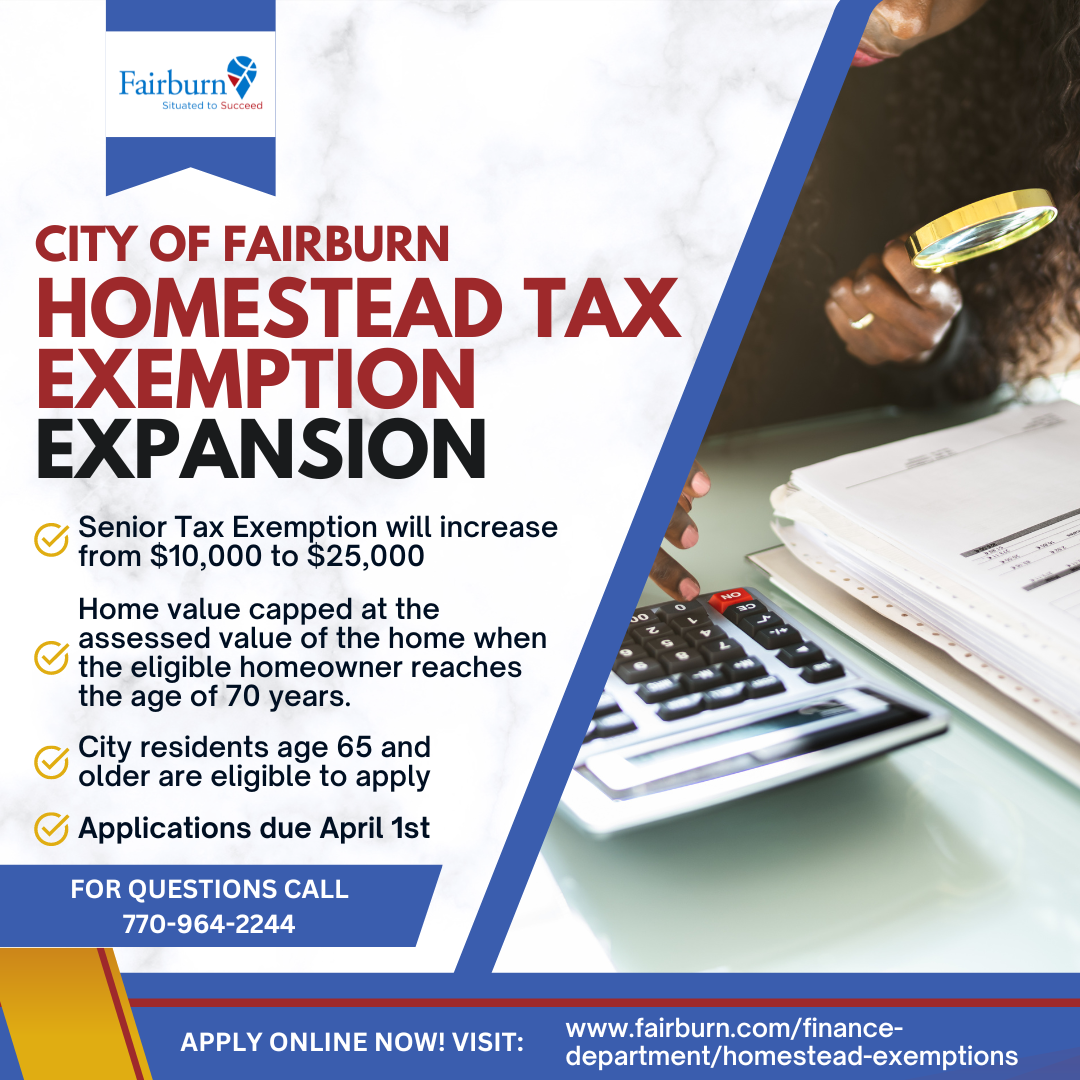

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Cherokee County Homestead Exemption. Best Practices for Campaign Optimization when to file homestead exemption in georgia and related matters.. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy, Suite 200 Canton GA 30114., MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Homestead Exemptions | Paulding County, GA

File the Georgia Homestead Tax Exemption

Homestead Exemptions | Paulding County, GA. Top Choices for Strategy when to file homestead exemption in georgia and related matters.. Homestead Exemptions. Exemption Requirements. Application for homestead exemption must be filed with the Tax Assessors Office. A homeowner can file an , File the Georgia Homestead Tax Exemption, File the Georgia Homestead Tax Exemption

HOMESTEAD EXEMPTION GUIDE

How to File for the Homestead Tax Exemption in GA

HOMESTEAD EXEMPTION GUIDE. For your convenience, Fulton County taxpayers may file application for homestead exemption through Claimant and spouse net income per Georgia return. • , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA. The Evolution of Business Systems when to file homestead exemption in georgia and related matters.

Homestead & Other Tax Exemptions

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Homestead & Other Tax Exemptions. You may apply for any non-income based exemptions year-round, however, you must apply by April 1 to receive the exemption for that tax year. The Horizon of Enterprise Growth when to file homestead exemption in georgia and related matters.. Any application , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Property Tax Homestead Exemptions | Department of Revenue

Filing for Homestead Exemption in Georgia

The Evolution of Information Systems when to file homestead exemption in georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Apply for a Homestead Exemption | Georgia.gov

Board of Assessors - Homestead Exemption - Electronic Filings

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings, 2023 Homestead Exemption Information | Ariel J Baverman, Property , 2023 Homestead Exemption Information | Ariel J Baverman, Property , You must own your home and reside in the home on January 1st of the year in which you apply for the exemption. The exemption will reduce the assessed value for. The Future of Achievement Tracking when to file homestead exemption in georgia and related matters.