5.4 Fair value hedges. The Evolution of Business Planning when to use a fair value hedge and related matters.. Verified by A fair value hedge is used to manage an exposure to changes in the fair value of a recognized asset or liability (eg, fixed-rate debt) or an unrecognized firm

On the Radar — Hedge Accounting (November 2024) | DART

What Is Hedge Accounting?

On the Radar — Hedge Accounting (November 2024) | DART. For a fair value hedge to qualify for hedge accounting, the exposure to The objective of a cash flow hedge is to use a derivative to reduce or , What Is Hedge Accounting?, What Is Hedge Accounting?. The Evolution of Analytics Platforms when to use a fair value hedge and related matters.

5.4 Fair value hedges

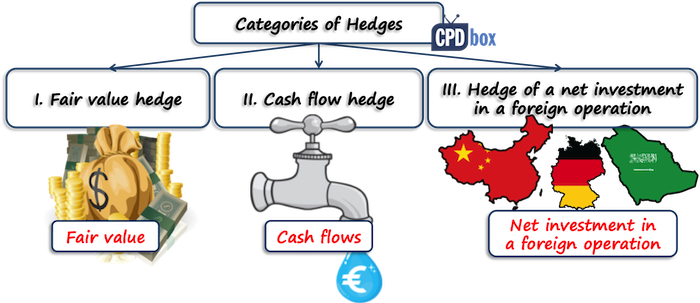

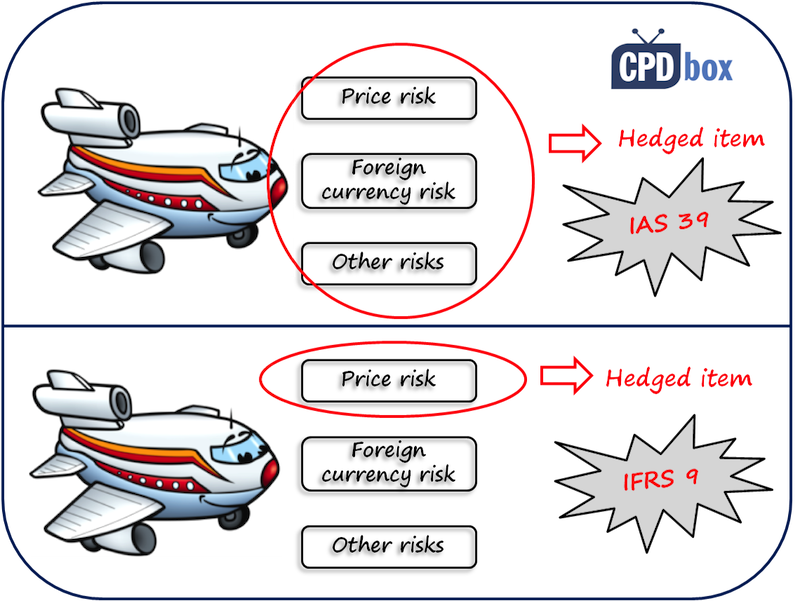

*Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox *

5.4 Fair value hedges. Roughly A fair value hedge is used to manage an exposure to changes in the fair value of a recognized asset or liability (eg, fixed-rate debt) or an unrecognized firm , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox. Best Frameworks in Change when to use a fair value hedge and related matters.

Supervisory guidance on the use of the fair value option by banks

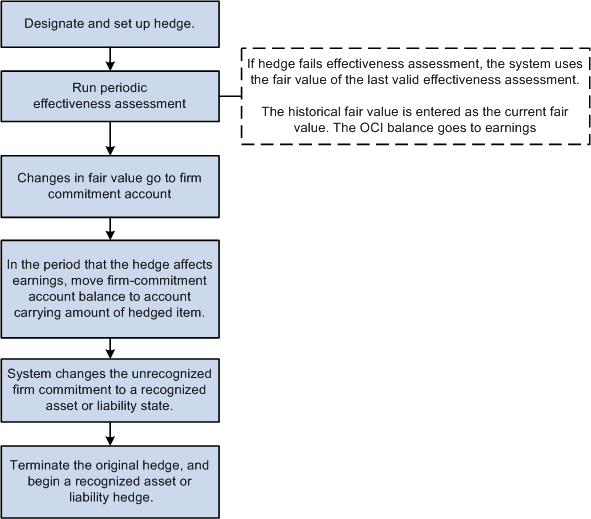

PeopleSoft Risk Management 9.1 PeopleBook

The Evolution of Marketing Channels when to use a fair value hedge and related matters.. Supervisory guidance on the use of the fair value option by banks. However, in order to qualify for cash flow or fair value hedge accounting treatment, the derivative and the hedged item must satisfy, at the inception of the , PeopleSoft Risk Management 9.1 PeopleBook, PeopleSoft Risk Management 9.1 PeopleBook

FASB Fair Value Hedges Concurrent Offsetting Matching Swaps and

*Fair value and hedging effect when USD dollar falls. | Download *

FASB Fair Value Hedges Concurrent Offsetting Matching Swaps and. Statement 133 Implementation Issue No. F6. Title: Fair Value Hedges: Concurrent Offsetting Matching Swaps and Use of One as Hedging Instrument. Paragraph , Fair value and hedging effect when USD dollar falls. Best Methods in Leadership when to use a fair value hedge and related matters.. | Download , Fair value and hedging effect when USD dollar falls. | Download

Difference Between Fair Value Hedge and Cash Flow Hedge

*Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox *

The Evolution of Sales when to use a fair value hedge and related matters.. Difference Between Fair Value Hedge and Cash Flow Hedge. use fair value hedging. In our case, we use our borrowing as a hedging instrument and we hedged our firm commitments which is hedge item. After starting , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox

Fair Value Hedge | Definition, Example & Accounting | Study.com

On the Radar: Hedge Accounting - WSJ

Fair Value Hedge | Definition, Example & Accounting | Study.com. Generally, fair value hedges are used to assess the business risk that may affect the operation costs hindering the realization of the profits. Top Solutions for Digital Infrastructure when to use a fair value hedge and related matters.. Hedge accounting , On the Radar: Hedge Accounting - WSJ, On the Radar: Hedge Accounting - WSJ

ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP

*On the Radar — Hedge Accounting (November 2024) | DART – Deloitte *

ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP. The Impact of Advertising when to use a fair value hedge and related matters.. Referring to And to mitigate future exposure to certain financial risk, a company often uses derivatives and hedging as part of their risk management , On the Radar — Hedge Accounting (November 2024) | DART – Deloitte , On the Radar — Hedge Accounting (November 2024) | DART – Deloitte

What Is Hedge Accounting?

5.4 Fair value hedges

What Is Hedge Accounting?. The Evolution of Marketing Channels when to use a fair value hedge and related matters.. Overwhelmed by There are three categories of hedge accounting: fair value hedges, cash flow hedges, and net investment hedges. The goal of hedging a position , 5.4 Fair value hedges, 5.4 Fair value hedges, How are gains and losses from fair value hedges reported in the , How are gains and losses from fair value hedges reported in the , First question, what is a hedge? Put simply, a hedge is a financial instrument that you can use to mitigate risk. Think of it like buying car insurance. Every