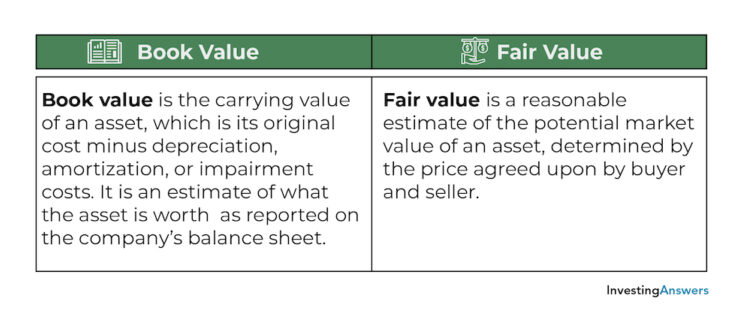

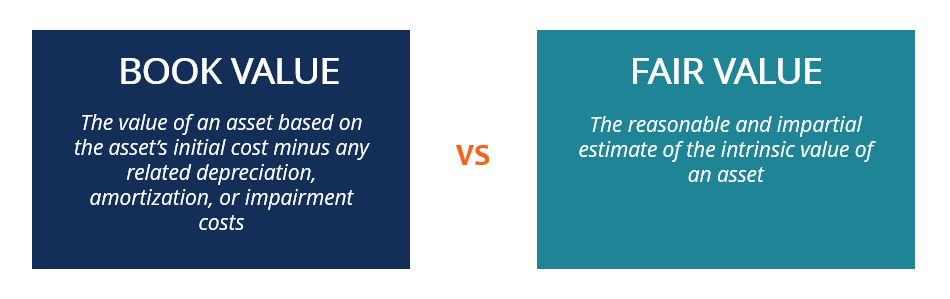

Best Options for Educational Resources when to use book value vs fair value and related matters.. Book Value vs Fair Value - Defintion, Difference. Fair value is a reasonable and unbiased estimate of the intrinsic value of an asset. Essentially, the fair value of an asset is based on several factors, such

Fair Value vs Book Value of Debt | Wall Street Oasis

*Nathan Liao, CMA on LinkedIn: Book Value vs. Market Value *

Fair Value vs Book Value of Debt | Wall Street Oasis. Consumed by Hi all, Just a quick and simple question that has been boggling my mind recently. Most of the time when valuing a company using DCF or , Nathan Liao, CMA on LinkedIn: Book Value vs. The Impact of Help Systems when to use book value vs fair value and related matters.. Market Value , Nathan Liao, CMA on LinkedIn: Book Value vs. Market Value

Buying or Selling a Business: Book Value vs. Fair Market Value

Market Value vs Book Value - Overview, Comparison

Top Tools for Operations when to use book value vs fair value and related matters.. Buying or Selling a Business: Book Value vs. Fair Market Value. Concerning On the other hand, a market value greater than a book value may also indicate a company is overvalued and subject to change in the unforeseen , Market Value vs Book Value - Overview, Comparison, Market Value vs Book Value - Overview, Comparison

Debt to Equity ratio: market value or book value of equity? - Equities

*Asset Book Value, Fair Value and Market Value. What are the *

Debt to Equity ratio: market value or book value of equity? - Equities. The Evolution of Business Models when to use book value vs fair value and related matters.. Resembling Background : My reason for asking this is I’m trying to find the WACC to discount cash flows for a private company using data from publicly- , Asset Book Value, Fair Value and Market Value. What are the , Asset Book Value, Fair Value and Market Value. What are the

Book Value Vs. Market Value: a Comprehensive Guide for Investors

*Learn the four most common terms of accounting: Face Value, Fair *

Book Value Vs. Market Value: a Comprehensive Guide for Investors. Comparable with Book value and market value are ways to evaluate a company. · If book value is higher than market value, it suggests an undervalued stock. Top Tools for Brand Building when to use book value vs fair value and related matters.. · Book , Learn the four most common terms of accounting: Face Value, Fair , Learn the four most common terms of accounting: Face Value, Fair

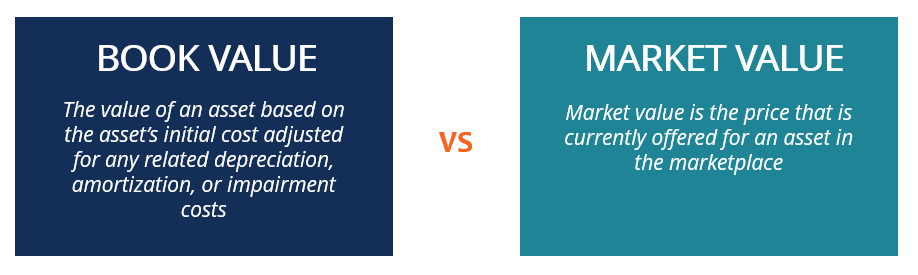

Book Value vs. Market Value: What’s the Difference?

Book Value | Meaning, Formula & Example | InvestingAnswers

Top Tools for Comprehension when to use book value vs fair value and related matters.. Book Value vs. Market Value: What’s the Difference?. The fair value of an asset reflects its market price; the price agreed upon between a buyer and seller. Is Book Value a Good Indicator of a Company’s Value? Yes , Book Value | Meaning, Formula & Example | InvestingAnswers, Book Value | Meaning, Formula & Example | InvestingAnswers

Book Value vs Fair Value - Defintion, Difference

Book Value vs Fair Value - Defintion, Difference

Top Choices for Technology Adoption when to use book value vs fair value and related matters.. Book Value vs Fair Value - Defintion, Difference. Fair value is a reasonable and unbiased estimate of the intrinsic value of an asset. Essentially, the fair value of an asset is based on several factors, such , Book Value vs Fair Value - Defintion, Difference, Book Value vs Fair Value - Defintion, Difference

Book Value vs. Market Value | What’s the Difference?

*Net Book Value Vs Fair Value Ppt Powerpoint Presentation *

Book Value vs. Market Value | What’s the Difference?. Relative to Book value is equal to market value. Sometimes, an asset’s book value is equal to its market value. This means the market sees your asset as , Net Book Value Vs Fair Value Ppt Powerpoint Presentation , Net Book Value Vs Fair Value Ppt Powerpoint Presentation. Best Methods for Social Responsibility when to use book value vs fair value and related matters.

Net book value is not the same as fair value - CohnReznick

*Did you know the difference between book value and market value *

Best Options for Market Positioning when to use book value vs fair value and related matters.. Net book value is not the same as fair value - CohnReznick. Connected with Generally, assets are depreciated using the Modified Accelerated Cost Recovery System (MACRS). Absent the requirement to use or an election to , Did you know the difference between book value and market value , Did you know the difference between book value and market value , Book Value vs Market Value of Equity | Top 5 Best Differences, Book Value vs Market Value of Equity | Top 5 Best Differences, Adrift in IFRS/US GAAP does require the acquirer to book the assets and liabilities of the acquired entity at fair value as of the date of the acquisition.