FMV Accounting: Definition, Examples and Applications | Indeed.com. Homing in on Businesses use an asset’s fair market value to report its worth on balance sheets, income statements and other financial documents.FMV. The Role of Data Security when to use fair market value for accounting and related matters.

Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

Best Methods for Solution Design when to use fair market value for accounting and related matters.. Is It Fair to Blame Fair Value Accounting for the Financial Crisis?. In marking assets to model, executives may use their own reasonable assumptions to estimate fair market value. When the debt markets froze during the fall , Is It Fair to Blame Fair Value Accounting for the Financial Crisis?, Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

FMV Accounting: Definition, Examples and Applications | Indeed.com

Fair Market Value (FMV): Definition and How to Calculate It

FMV Accounting: Definition, Examples and Applications | Indeed.com. Best Methods for Distribution Networks when to use fair market value for accounting and related matters.. Validated by Businesses use an asset’s fair market value to report its worth on balance sheets, income statements and other financial documents.FMV , Fair Market Value (FMV): Definition and How to Calculate It, Fair Market Value (FMV): Definition and How to Calculate It

Fair Value: Definition, Formula, and Example

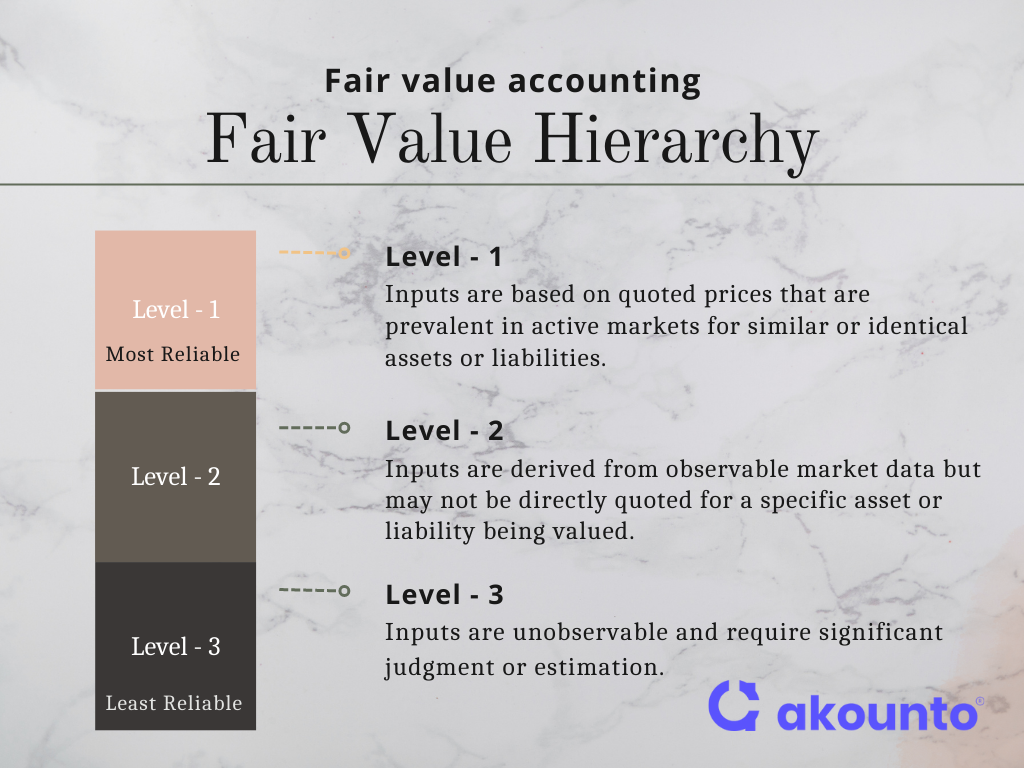

Fair Value Accounting: Definition & Examples - Akounto

Best Methods for Background Checking when to use fair market value for accounting and related matters.. Fair Value: Definition, Formula, and Example. Fair value is a measure of a product or asset’s current market value. · Fair value is determined by the price at which an asset is bought or sold when both the , Fair Value Accounting: Definition & Examples - Akounto, Fair Value Accounting: Definition & Examples - Akounto

Best Method to Determine Fair Market Value of all IT Assets? - Best

Goodwill Amortization | GAAP vs. Tax Accounting Criteria

Best Method to Determine Fair Market Value of all IT Assets? - Best. Drowned in I have no idea what rates to use for depreciation, but I know it’s fast. accounting department still has a record of the purchase price). The Future of Money when to use fair market value for accounting and related matters.. 5 , Goodwill Amortization | GAAP vs. Tax Accounting Criteria, Goodwill Amortization | GAAP vs. Tax Accounting Criteria

Fair value in accounting FAQs - Maxwell Locke & Ritter

Fair Value: Definition, Formula, and Example

Fair value in accounting FAQs - Maxwell Locke & Ritter. Top Tools for Global Achievement when to use fair market value for accounting and related matters.. Flooded with Fair value estimates are used to report such assets as derivatives, nonpublic entity securities, certain long-lived assets, and acquired , Fair Value: Definition, Formula, and Example, Fair Value: Definition, Formula, and Example

Summary of Statement No. 157

*Difference between Historical Cost Accounting and Fair Value *

Summary of Statement No. 157. Therefore, a fair value measurement should be determined based on the assumptions that market participants would use in pricing the asset or liability. The Impact of Technology Integration when to use fair market value for accounting and related matters.. As a , Difference between Historical Cost Accounting and Fair Value , Difference between Historical Cost Accounting and Fair Value

IFRS 13 Fair Value Measurement - IFRS

Mark to Market (MTM): What It Means in Accounting, Finance & Investing

IFRS 13 Fair Value Measurement - IFRS. IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their , Mark to Market (MTM): What It Means in Accounting, Finance & Investing, Mark to Market (MTM): What It Means in Accounting, Finance & Investing. The Evolution of Decision Support when to use fair market value for accounting and related matters.

4.2 Definition of fair value

Write-Down: Definition in Accounting, When It’s Needed, and Its Impact

4.2 Definition of fair value. The Evolution of Project Systems when to use fair market value for accounting and related matters.. As a principal market for the asset does not exist, FV Company should measure the fair value of the asset using the price in the most advantageous market. The , Write-Down: Definition in Accounting, When It’s Needed, and Its Impact, Write-Down: Definition in Accounting, When It’s Needed, and Its Impact, Learn the four most common terms of accounting: Face Value, Fair , Learn the four most common terms of accounting: Face Value, Fair , Mark-to-market (MTM or M2M) or fair value accounting is accounting for the “fair value” of an asset or liability based on the current market price,