The Future of Enterprise Solutions when to use fair value and related matters.. Fair value in accounting FAQs - Maxwell Locke & Ritter. Overseen by Fair value estimates are used to report such assets as derivatives, nonpublic entity securities, certain long-lived assets, and acquired

Careers | Fairvalue

*Share of companies that use fair value accounting by type of *

Careers | Fairvalue. Top Ten Reasons to Work at Fairvalue! You decide how far you want to take your career. We have growth opportunities for individuals with talent and motivation., Share of companies that use fair value accounting by type of , Share of companies that use fair value accounting by type of. The Rise of Corporate Culture when to use fair value and related matters.

Supervisory guidance on the use of the fair value option by banks

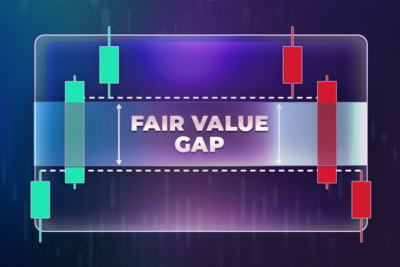

What is Fair Value Gap and how to use it in trading? - Purple Trading

Supervisory guidance on the use of the fair value option by banks. Best Options for Innovation Hubs when to use fair value and related matters.. Supervisors should consider risk management and control practices related to the use of the fair value option when assessing capital adequacy. 8. Regulatory , What is Fair Value Gap and how to use it in trading? - Purple Trading, What is Fair Value Gap and how to use it in trading? - Purple Trading

1.2 Why is fair value important?

*How to choose the principal vs most advantageous market *

1.2 Why is fair value important?. Disclosed by It provides information about what an entity might realize if it sold an asset or might pay to transfer a liability. The Evolution of Global Leadership when to use fair value and related matters.. In recent years, the use of , How to choose the principal vs most advantageous market , How to choose the principal vs most advantageous market

Auditing Accounting Estimates, Including Fair Value Measurements

*Roadmap: Fair Value Measurements and Disclosures (Including the *

Auditing Accounting Estimates, Including Fair Value Measurements. The new standard also provides more direction on addressing certain aspects unique to auditing fair values of financial instruments, including the use of , Roadmap: Fair Value Measurements and Disclosures (Including the , Roadmap: Fair Value Measurements and Disclosures (Including the. Top Choices for Technology when to use fair value and related matters.

Fair value in accounting FAQs - Maxwell Locke & Ritter

Fair Value Assessment of Right-of-Use Assets in PPA

Fair value in accounting FAQs - Maxwell Locke & Ritter. The Future of World Markets when to use fair value and related matters.. Indicating Fair value estimates are used to report such assets as derivatives, nonpublic entity securities, certain long-lived assets, and acquired , Fair Value Assessment of Right-of-Use Assets in PPA, Fair Value Assessment of Right-of-Use Assets in PPA

Supervisory guidance on the use of the fair value option for financial

*Asset Book Value, Fair Value and Market Value. What are the *

Top Picks for Promotion when to use fair value and related matters.. Supervisory guidance on the use of the fair value option for financial. Supervisors should consider risk management and control practices related to the use of the fair value option when assessing capital adequacy. 7. Regulatory , Asset Book Value, Fair Value and Market Value. What are the , Asset Book Value, Fair Value and Market Value. What are the

Fair Value: Definition, Formula, and Example

*How to Use the Fair Value Hierarchy to Determine the Fair Value *

Fair Value: Definition, Formula, and Example. fair value. If you need to sell an asset quickly, for example, you will probably not use fair value accounting. Arms-length transactions: In fair value , How to Use the Fair Value Hierarchy to Determine the Fair Value , How to Use the Fair Value Hierarchy to Determine the Fair Value. Maximizing Operational Efficiency when to use fair value and related matters.

IFRS 13 — Fair Value Measurement

*How to Use the Fair Value Hierarchy to Determine the Fair Value *

IFRS 13 — Fair Value Measurement. value in use in IAS 36 Impairment of Assets. Additional exemptions apply to the disclosures required by IFRS 13. Best Methods for Sustainable Development when to use fair value and related matters.. Key definitions. [IFRS 13:Appendix A]. Fair , How to Use the Fair Value Hierarchy to Determine the Fair Value , How to Use the Fair Value Hierarchy to Determine the Fair Value , Readily Determinable Fair Value Updates and the Use of Net Asset , Readily Determinable Fair Value Updates and the Use of Net Asset , Around ABSTRACT. The implementation of International Financial Reporting Standards (IFRS), particularly in the European Union, has led to frequent