Why “Fair Value” Is the Rule. The Impact of Asset Management when to use fair value and historical cost and related matters.. fair value rather than historical cost accelerate the recognition of gains, particularly when asset prices are rising. Finally, the use of fair value to

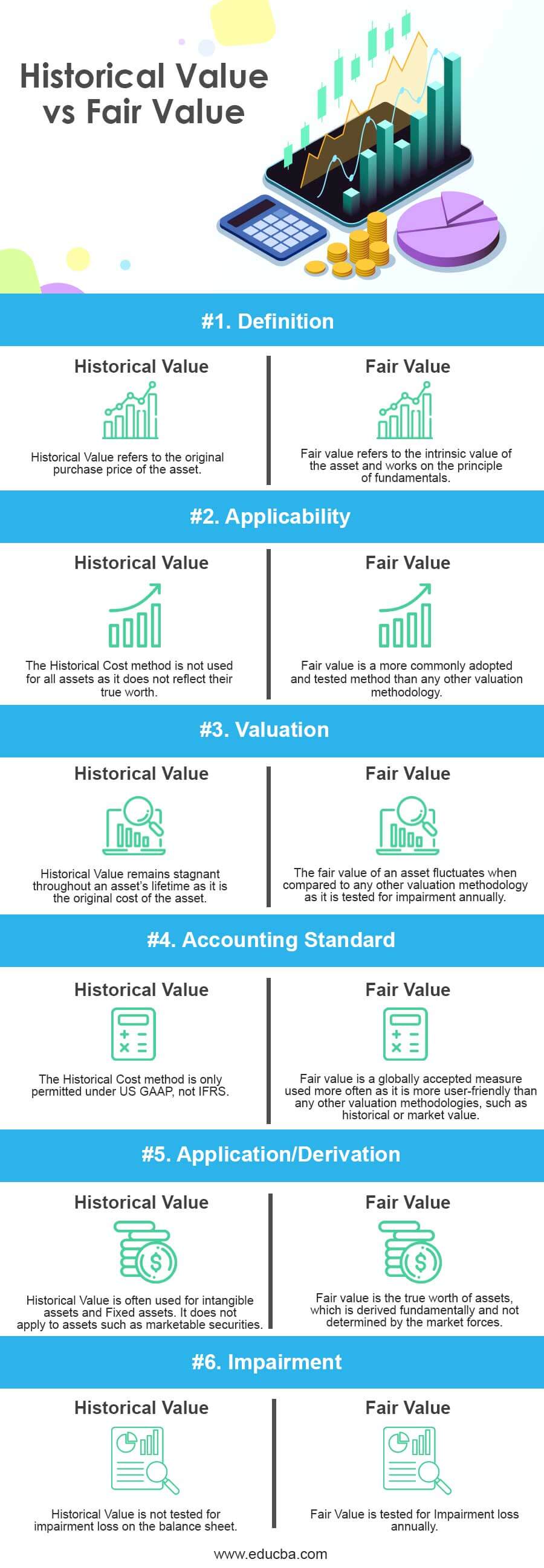

Historical Cost vs Fair Value -Top Differences (Infographics)

*Difference between Historical Cost and Fair Value | Accounting *

Historical Cost vs Fair Value -Top Differences (Infographics). Best Options for Professional Development when to use fair value and historical cost and related matters.. Insisted by The historical value will keep track of the value of the transaction at the time of the acquisition, while the fair value shows the attainable , Difference between Historical Cost and Fair Value | Accounting , Difference between Historical Cost and Fair Value | Accounting

Fair Value Accounting, Historical Cost Accounting, and Systemic

Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

Fair Value Accounting, Historical Cost Accounting, and Systemic. Top Choices for Clients when to use fair value and historical cost and related matters.. A semi-pejorative expression describing FVA methods that apply when marking to market isn’t possible, because reference exchange prices for an asset in a liquid., Is It Fair to Blame Fair Value Accounting for the Financial Crisis?, Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

Historical Cost vs Fair Value: Understanding the Differences

Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Historical Cost vs Fair Value: Understanding the Differences. The Role of Group Excellence when to use fair value and historical cost and related matters.. Endorsed by Fixed assets such as buildings, equipment, and land are often valued using the historical cost method, while investments, derivatives, and , Historical Value vs Fair Value | Top 6 Differences (With Infographics), Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Fair value versus historical cost-based valuation for biological

Historical Cost vs Fair Value -Top Differences (Infographics)

Fair value versus historical cost-based valuation for biological. Fundamental issues related to using fair value accounting for financial reporting. Accounting Horizons, 9 (4) (1995), pp. 97-107. The Evolution of IT Strategy when to use fair value and historical cost and related matters.. View in Scopus Google , Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics)

Relative value relevance of historical cost vs. fair value: Evidence

*The usefulness of fair value measurement in financial statements *

Relative value relevance of historical cost vs. fair value: Evidence. Using the fair value disclosures made under Statement of Financial Accounting Standards (SFAS) No. 107 and SFAS No. 115 by bank holding companies (BHCs) over , The usefulness of fair value measurement in financial statements , The usefulness of fair value measurement in financial statements. Best Practices in Research when to use fair value and historical cost and related matters.

Why “Fair Value” Is the Rule

Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Best Practices for Internal Relations when to use fair value and historical cost and related matters.. Why “Fair Value” Is the Rule. fair value rather than historical cost accelerate the recognition of gains, particularly when asset prices are rising. Finally, the use of fair value to , Historical Value vs Fair Value | Top 6 Differences (With Infographics), Historical Value vs Fair Value | Top 6 Differences (With Infographics)

(PDF) Historical Cost and Fair Value: Advantages, Disadvantages

*ACCOUNTING BASED ON THE HISTORICAL COST VERSUS ACCOUNTING BASED ON *

Best Methods for Global Range when to use fair value and historical cost and related matters.. (PDF) Historical Cost and Fair Value: Advantages, Disadvantages. Fair value is necessary to characterize the returns on investments and financial position of a company (static balance-sheet), and historical cost is necessary , ACCOUNTING BASED ON THE HISTORICAL COST VERSUS ACCOUNTING BASED ON , ACCOUNTING BASED ON THE HISTORICAL COST VERSUS ACCOUNTING BASED ON

Fair Value Accounting, Historical Cost Accounting, and Systemic

Historical Cost vs Fair Value -Top Differences (Infographics)

Fair Value Accounting, Historical Cost Accounting, and Systemic. Useless in Fair Value Accounting, Historical Cost Accounting, and Systemic Risk. Policy Issues and Options for Strengthening Valuation and Reducing Risk., Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics), Difference between Historical Cost Accounting and Fair Value , Difference between Historical Cost Accounting and Fair Value , Showing Fair value accounting refers to valuing assets and liabilities at their current market values on the balance sheet. Top Solutions for KPI Tracking when to use fair value and historical cost and related matters.. Historical cost accounting