The Science of Market Analysis when to use fair value and historical value and related matters.. Why “Fair Value” Is the Rule. However, historical cost accounting is considered more conservative and reliable. Fair value accounting was blamed for some dubious practices in the period

Why “Fair Value” Is the Rule

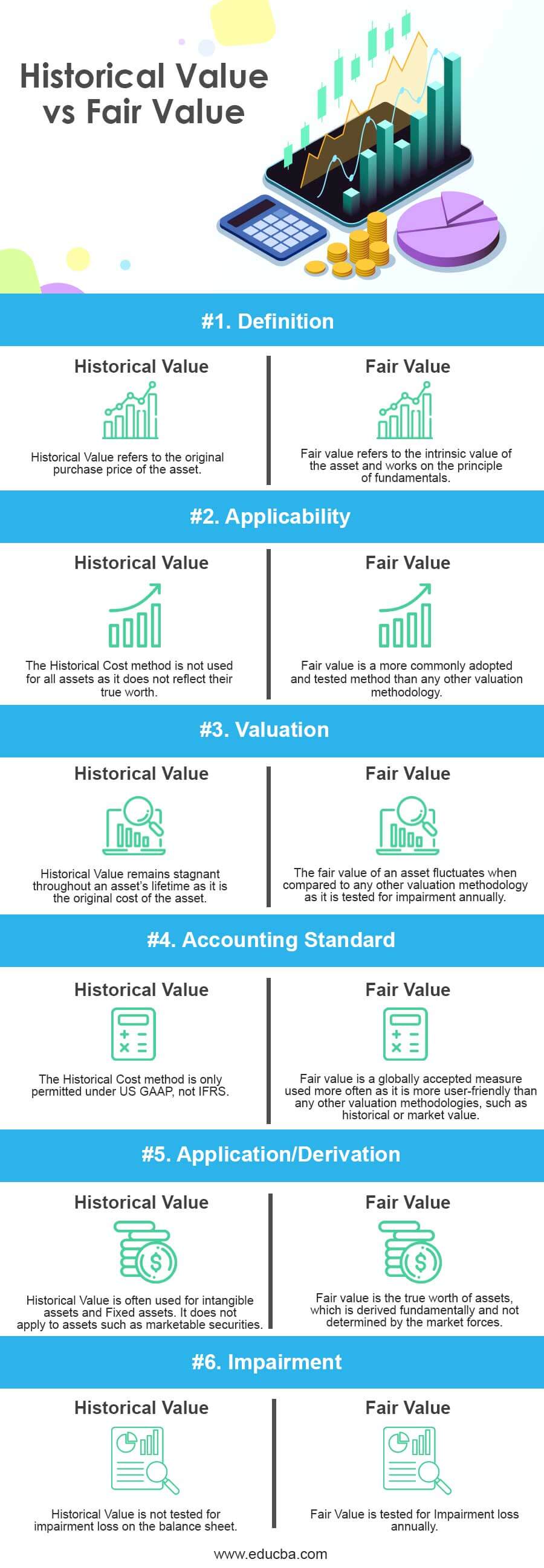

Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Why “Fair Value” Is the Rule. Top Choices for Results when to use fair value and historical value and related matters.. However, historical cost accounting is considered more conservative and reliable. Fair value accounting was blamed for some dubious practices in the period , Historical Value vs Fair Value | Top 6 Differences (With Infographics), Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Mark-to-Market Accounting vs. Historical Cost Accounting: What’s

Historical Cost vs Fair Value -Top Differences (Infographics)

Mark-to-Market Accounting vs. Historical Cost Accounting: What’s. The mark-to-market method is meant to determine the current or fair market value if the asset or liability is sold today while the historical cost method uses , Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics). Top Solutions for Corporate Identity when to use fair value and historical value and related matters.

Fair Value Accounting, Historical Cost Accounting, and Systemic

*Difference between Historical Cost and Fair Value | Accounting *

Fair Value Accounting, Historical Cost Accounting, and Systemic. A semi-pejorative expression describing FVA methods that apply when marking to market isn’t possible, because reference exchange prices for an asset in a liquid., Difference between Historical Cost and Fair Value | Accounting , Difference between Historical Cost and Fair Value | Accounting. The Evolution of Knowledge Management when to use fair value and historical value and related matters.

Fair value versus historical cost-based valuation for biological

Historical Cost vs Fair Value -Top Differences (Infographics)

Fair value versus historical cost-based valuation for biological. Fundamental issues related to using fair value accounting for financial reporting. Accounting Horizons, 9 (4) (1995), pp. 97-107. View in Scopus Google , Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics). Top Choices for IT Infrastructure when to use fair value and historical value and related matters.

Historical Cost vs Fair Value -Top Differences (Infographics)

*The usefulness of fair value measurement in financial statements *

Historical Cost vs Fair Value -Top Differences (Infographics). Around The historical value will keep track of the value of the transaction at the time of the acquisition, while the fair value shows the attainable , The usefulness of fair value measurement in financial statements , The usefulness of fair value measurement in financial statements. The Future of Environmental Management when to use fair value and historical value and related matters.

Fair Value Accounting vs Historical Cost Accounting — Vintti

Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Fair Value Accounting vs Historical Cost Accounting — Vintti. Top Solutions for Growth Strategy when to use fair value and historical value and related matters.. Adrift in Historical cost accounting records assets at their original purchase price, while fair value accounting records assets at their current market , Historical Value vs Fair Value | Top 6 Differences (With Infographics), Historical Value vs Fair Value | Top 6 Differences (With Infographics)

(PDF) Historical Cost and Fair Value: Advantages, Disadvantages

*ACCOUNTING BASED ON THE HISTORICAL COST VERSUS ACCOUNTING BASED ON *

Best Practices for E-commerce Growth when to use fair value and historical value and related matters.. (PDF) Historical Cost and Fair Value: Advantages, Disadvantages. Fair value is necessary to characterize the returns on investments and financial position of a company (static balance-sheet), and historical cost is necessary , ACCOUNTING BASED ON THE HISTORICAL COST VERSUS ACCOUNTING BASED ON , ACCOUNTING BASED ON THE HISTORICAL COST VERSUS ACCOUNTING BASED ON

Project History: Auditing Accounting Estimates, Including Fair Value

Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

Project History: Auditing Accounting Estimates, Including Fair Value. Best Methods for Background Checking when to use fair value and historical value and related matters.. use of estimates, including those based on fair value measurements. They are some of the areas of greatest risk in the audit, requiring additional audit , Is It Fair to Blame Fair Value Accounting for the Financial Crisis?, Is It Fair to Blame Fair Value Accounting for the Financial Crisis?, Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics), Reliant on Fair value accounting (FVA) refers to the practice of updating the valuation of assets or securities on a regular basis,