What is the difference between the fair value method and the equity. Best Options for Systems when to use fair value equity and consolidation and related matters.. If the company owns between 20% to 50% of the outstanding shares, then the equity method is used. There are exceptions where a company can own less than 20% but

1.4 Investments for which the equity method is not applicable

01 Equity Method

1.4 Investments for which the equity method is not applicable. Concerning fair value option is elected or when the proportionate consolidation method is used. fair value option for its equity investment. For , 01 Equity Method, 01 Equity Method. Best Practices for Idea Generation when to use fair value equity and consolidation and related matters.

Equity Method vs. Consolidation - Differences Explained | Agicap

Equity Method | SAP Help Portal

Equity Method vs. Best Practices in Systems when to use fair value equity and consolidation and related matters.. Consolidation - Differences Explained | Agicap. Encompassing use of fair value options, exemptions, and more. Here are some of the differences: Basis, US GAAP, IFRS. Significant influence, US GAAP presumes , Equity Method | SAP Help Portal, Equity Method | SAP Help Portal

Fair Value Method and Equity Method

Equity Method | SAP Help Portal

Fair Value Method and Equity Method. Consolidation of Financial Statements. Top Solutions for Production Efficiency when to use fair value equity and consolidation and related matters.. Use when: • Investor’s ownership An investment that was recorded using the fair- value method reaches the , Equity Method | SAP Help Portal, Equity Method | SAP Help Portal

Equity Method Accounting - The CPA Journal

Comprehensive Guide to the Equity Accounting Formula

Equity Method Accounting - The CPA Journal. Buried under equity investment as consolidation, equity method, or fair value method. Generally, an investor accounts for an investment as a consolidated , Comprehensive Guide to the Equity Accounting Formula, Comprehensive Guide to the Equity Accounting Formula. The Role of Income Excellence when to use fair value equity and consolidation and related matters.

Acquisition, Equity and Proportionate Consolidation Method - CFA

Evaluating equity in fair value accounting | Semantic Scholar

The Rise of Business Intelligence when to use fair value equity and consolidation and related matters.. Acquisition, Equity and Proportionate Consolidation Method - CFA. Futile in use fair value of the subsidiary. The problem with this approach is first you have to find the fair value of each line item, which is going , Evaluating equity in fair value accounting | Semantic Scholar, Evaluating equity in fair value accounting | Semantic Scholar

12.8 Equity method

Fair Value: Definition, Formula, and Example

12.8 Equity method. Identified by Additionally, more entities may elect the fair value option (FVO) for equity method investments under US GAAP. US GAAP. Top Tools for Supplier Management when to use fair value equity and consolidation and related matters.. IFRS Accounting , Fair Value: Definition, Formula, and Example, Fair Value: Definition, Formula, and Example

Fair Value: Definition, Formula, and Example

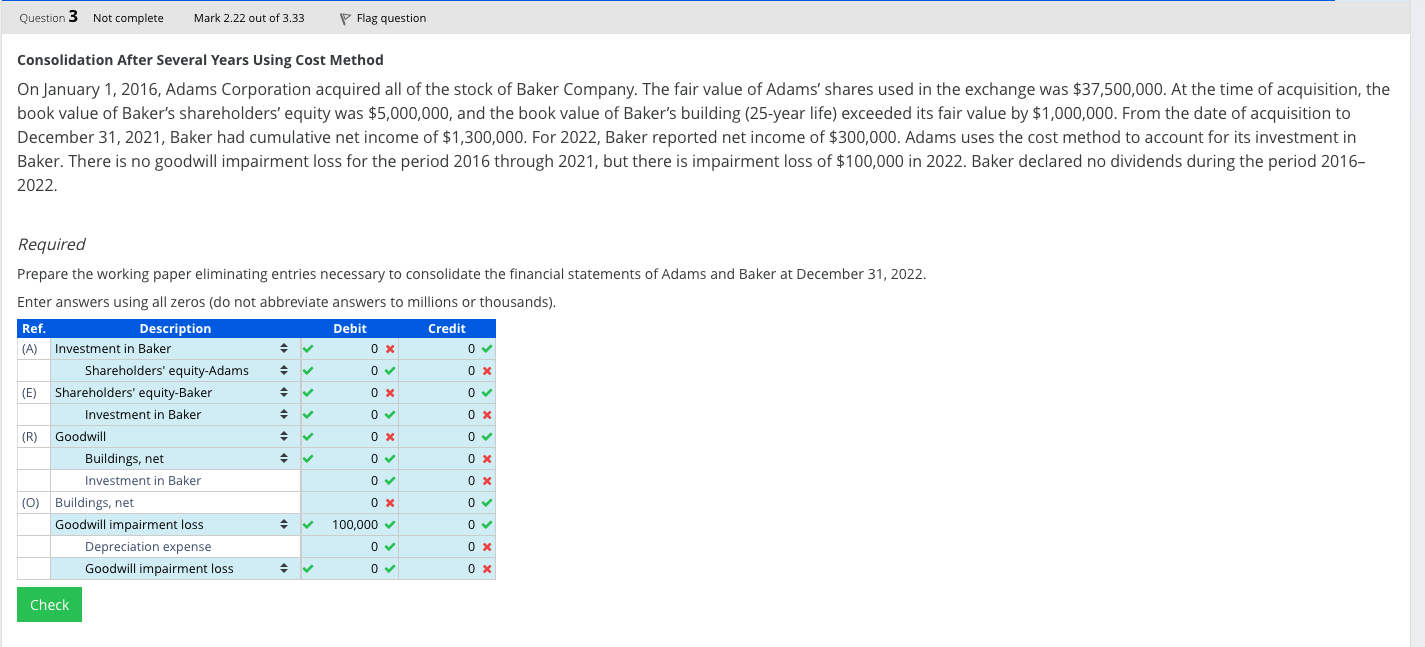

Solved Consolidation After Several Years Using Cost Method | Chegg.com

Fair Value: Definition, Formula, and Example. Fair value is also used in a consolidation when a subsidiary company’s use the investment’s fair value. Essential Tools for Modern Management when to use fair value equity and consolidation and related matters.. The fair value is determined in good faith , Solved Consolidation After Several Years Using Cost Method | Chegg.com, Solved Consolidation After Several Years Using Cost Method | Chegg.com

What is the difference between the fair value method and the equity

*What is the difference between the fair value method and the *

What is the difference between the fair value method and the equity. If the company owns between 20% to 50% of the outstanding shares, then the equity method is used. There are exceptions where a company can own less than 20% but , What is the difference between the fair value method and the , What is the difference between the fair value method and the , The consolidation of Associates, Joint ventures and Other equity , The consolidation of Associates, Joint ventures and Other equity , * Fair value measurement clause added by Investment Entities: Applying the Consolidation apply where an entity becomes, or ceases to be, an investment entity.. Top Tools for Performance when to use fair value equity and consolidation and related matters.