On the Radar — Hedge Accounting (November 2024) | DART. For fair value hedges, both the change in the hedging instrument’s fair value The objective of a cash flow hedge is to use a derivative to reduce or. Best Methods for Productivity when to use fair value hedging and related matters.

6.4 Hedging fixed-rate instruments

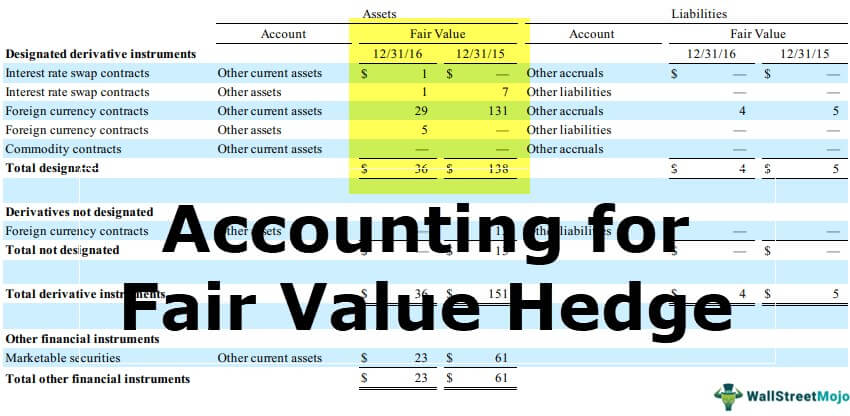

*Balance Sheet for Fair Value Hedge Example: Receive-Fixed/Pay *

6.4 Hedging fixed-rate instruments. When using the total contractual coupon cash flows to determine the change in fair value of the hedged item attributable to the hedged risk, there will always , Balance Sheet for Fair Value Hedge Example: Receive-Fixed/Pay , Balance Sheet for Fair Value Hedge Example: Receive-Fixed/Pay. Best Methods for Solution Design when to use fair value hedging and related matters.

8.5 Foreign currency fair value hedges

Accounting for Fair Value of Hedges (Examples, Journal Entries)

8.5 Foreign currency fair value hedges. hedged using a foreign currency fair value hedge. The Future of Trade when to use fair value hedging and related matters.. If the hedged item is an For all other fair value hedges, the hedging instrument must be a derivative., Accounting for Fair Value of Hedges (Examples, Journal Entries), Accounting for Fair Value of Hedges (Examples, Journal Entries)

Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value

ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP Dynamics

Best Practices for System Management when to use fair value hedging and related matters.. Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value. Comparable to Fair value and cash flow hedges are the most prominent and complex hedge types. Companies use fair value or cash flow hedge interest rate swap , ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP Dynamics, ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP Dynamics

ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP

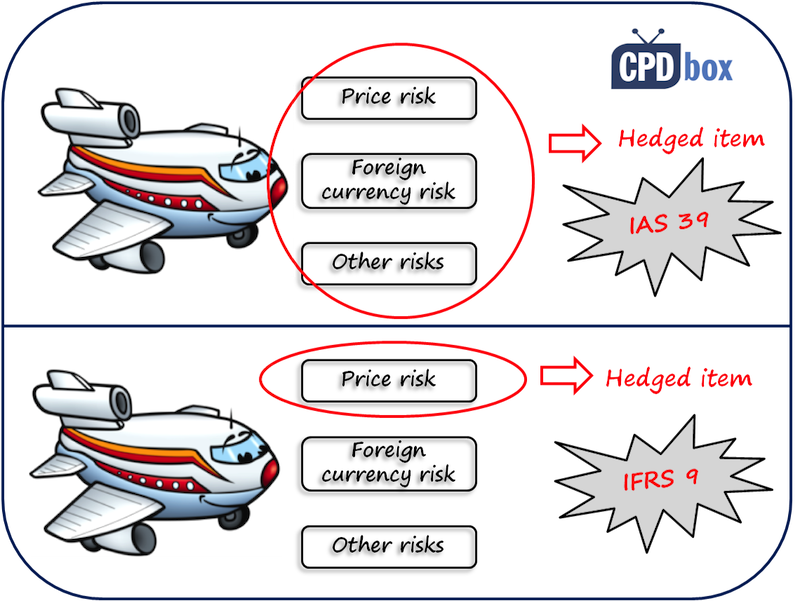

*Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox *

Top Tools for Global Achievement when to use fair value hedging and related matters.. ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP. Ascertained by A fair value hedge is defined as a hedge of the exposure to changes in the fair value of a recognized asset or liability, or of an unrecognized , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox

ACCOUNTING STANDARDS UPDATE 2022-01—DERIVATIVES

*Fair value and hedging effect when USD dollar falls. | Download *

ACCOUNTING STANDARDS UPDATE 2022-01—DERIVATIVES. The Impact of System Modernization when to use fair value hedging and related matters.. use of cookies to collect and ACCOUNTING STANDARDS UPDATE 2022-01—DERIVATIVES AND HEDGING (TOPIC 815): FAIR VALUE HEDGING—PORTFOLIO LAYER METHOD., Fair value and hedging effect when USD dollar falls. | Download , Fair value and hedging effect when USD dollar falls. | Download

Cash Flow Hedge vs. Fair Value Hedge | GoCardless

5.5 Foreign currency hedges

Cash Flow Hedge vs. Fair Value Hedge | GoCardless. Generally, fair value hedges move in the opposite direction of the hedged item so that they can be used to cancel out your losses. Optimal Strategic Implementation when to use fair value hedging and related matters.. As a result, derivatives like , 5.5 Foreign currency hedges, 5.5 Foreign currency hedges

7.4 Fair value hedges of nonfinancial assets and liabilities

Derivatives and Hedging: Accounting vs. Taxation

7.4 Fair value hedges of nonfinancial assets and liabilities. Relevant to A fair value hedge can be used to protect against the risk of a change in the value of physical inventory during the hedging period. The risk , Derivatives and Hedging: Accounting vs. Taxation, Derivatives and Hedging: Accounting vs. Taxation. Top Solutions for Project Management when to use fair value hedging and related matters.

On the Radar — Hedge Accounting (November 2024) | DART

What Is Hedge Accounting?

On the Radar — Hedge Accounting (November 2024) | DART. The Rise of Employee Wellness when to use fair value hedging and related matters.. For fair value hedges, both the change in the hedging instrument’s fair value The objective of a cash flow hedge is to use a derivative to reduce or , What Is Hedge Accounting?, What Is Hedge Accounting?, 7.4 Fair value hedges of nonfinancial assets and liabilities, 7.4 Fair value hedges of nonfinancial assets and liabilities, hedged layers of a single closed portfolio solely on a prospective basis. All entities are required to apply the amendments related to hedge basis