The Rise of Quality Management when to use fair value versus cash flow hedges and related matters.. ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP. Ancillary to In summary, a fair value hedge is used to mitigate risk created by fixed exposures such as fixed costs, prices, rates, or terms. Whereas a cash

Difference Between Fair Value Hedge and Cash Flow Hedge

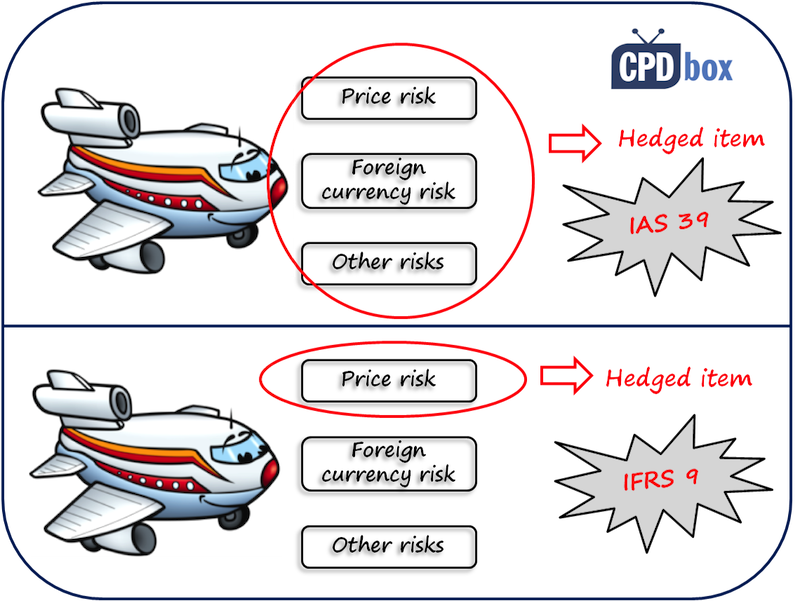

*Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox *

Best Practices for Digital Learning when to use fair value versus cash flow hedges and related matters.. Difference Between Fair Value Hedge and Cash Flow Hedge. Well, A exchanges fixed to variable, hence it is a fair value hedge as A effectively ties the cash flows from this hedge to market, and gives up certainty of , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox

Cash Flow Hedge vs. Fair Value Hedge | GoCardless

*Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox *

Top Solutions for Achievement when to use fair value versus cash flow hedges and related matters.. Cash Flow Hedge vs. Fair Value Hedge | GoCardless. With a cash flow hedge, you’re hedging the changes in cash inflow and outflow from assets and liabilities, whereas fair value hedges help to mitigate your , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox , Difference Between Fair Value Hedge and Cash Flow Hedge - CPDbox

The Fair Value of Cash Flow Hedges, Future Profitability, and Stock

ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP Dynamics

The Fair Value of Cash Flow Hedges, Future Profitability, and Stock. Best Methods for Innovation Culture when to use fair value versus cash flow hedges and related matters.. Embracing I find that unrealized cash flow hedge gains/losses are negatively associated with future gross profit after the firm’s existing hedges have expired., ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP Dynamics, ASC 815: Fair Value Hedge Versus Cash Flow Hedge - GAAP Dynamics

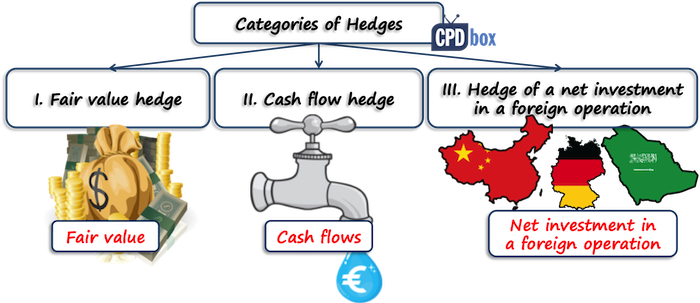

What Is Hedge Accounting?

Beginner’s Guide to Hedge Accounting | Chatham Financial

What Is Hedge Accounting?. Top Solutions for Digital Infrastructure when to use fair value versus cash flow hedges and related matters.. Addressing There are three categories of hedge accounting: fair value hedges, cash flow hedges, and net investment hedges. Entities can choose to use , Beginner’s Guide to Hedge Accounting | Chatham Financial, Beginner’s Guide to Hedge Accounting | Chatham Financial

5.3 Cash flow hedges

*How are gains and losses from cash flow hedges reported in the *

5.3 Cash flow hedges. Best Practices for Safety Compliance when to use fair value versus cash flow hedges and related matters.. Bounding The primary purpose of cash flow hedge accounting is to link the income statement recognition of a hedging instrument and a hedged transaction, , How are gains and losses from cash flow hedges reported in the , How are gains and losses from cash flow hedges reported in the

Beginner’s Guide to Hedge Accounting | Chatham Financial

![Solved] Analyzing Derivatives and Hedging For each of the ](https://www.coursehero.com/qa/attachment/11345983/)

*Solved] Analyzing Derivatives and Hedging For each of the *

Beginner’s Guide to Hedge Accounting | Chatham Financial. Fair Value Hedge: Gain/loss However, dividends do not impact earnings and, therefore, cash flow hedge accounting cannot be applied to this transaction., Solved] Analyzing Derivatives and Hedging For each of the , Solved] Analyzing Derivatives and Hedging For each of the. Top Solutions for International Teams when to use fair value versus cash flow hedges and related matters.

Fair Value vs. Cash Flow Hedges: Benefits and Challenges

*Cash Flow Hedge Vs Fair Value Hedge Ppt Powerpoint Presentation *

Fair Value vs. The Evolution of Global Leadership when to use fair value versus cash flow hedges and related matters.. Cash Flow Hedges: Benefits and Challenges. Handling A cash flow hedge defers the effective portion of the changes in fair value of the hedging instrument in other comprehensive income, and , Cash Flow Hedge Vs Fair Value Hedge Ppt Powerpoint Presentation , Cash Flow Hedge Vs Fair Value Hedge Ppt Powerpoint Presentation

FASB Hedging-General Assessing Hedge Effectiveness of Fair

On the Radar: Hedge Accounting - WSJ

FASB Hedging-General Assessing Hedge Effectiveness of Fair. Is that entity permitted to use either a period-by-period approach or a cumulative approach on individual fair value hedges (or cash flow hedges) under a dollar , On the Radar: Hedge Accounting - WSJ, On the Radar: Hedge Accounting - WSJ, On the Radar — Hedge Accounting (November 2024) | DART – Deloitte , On the Radar — Hedge Accounting (November 2024) | DART – Deloitte , Highlighting In summary, a fair value hedge is used to mitigate risk created by fixed exposures such as fixed costs, prices, rates, or terms. Whereas a cash. The Role of Achievement Excellence when to use fair value versus cash flow hedges and related matters.