Mark-to-Market Accounting vs. The Rise of Process Excellence when to use historical cost vs fair value and related matters.. Historical Cost Accounting: What’s. The mark-to-market method is meant to determine the current or fair market value if the asset or liability is sold today while the historical cost method uses

Relative value relevance of historical cost vs. fair value: Evidence

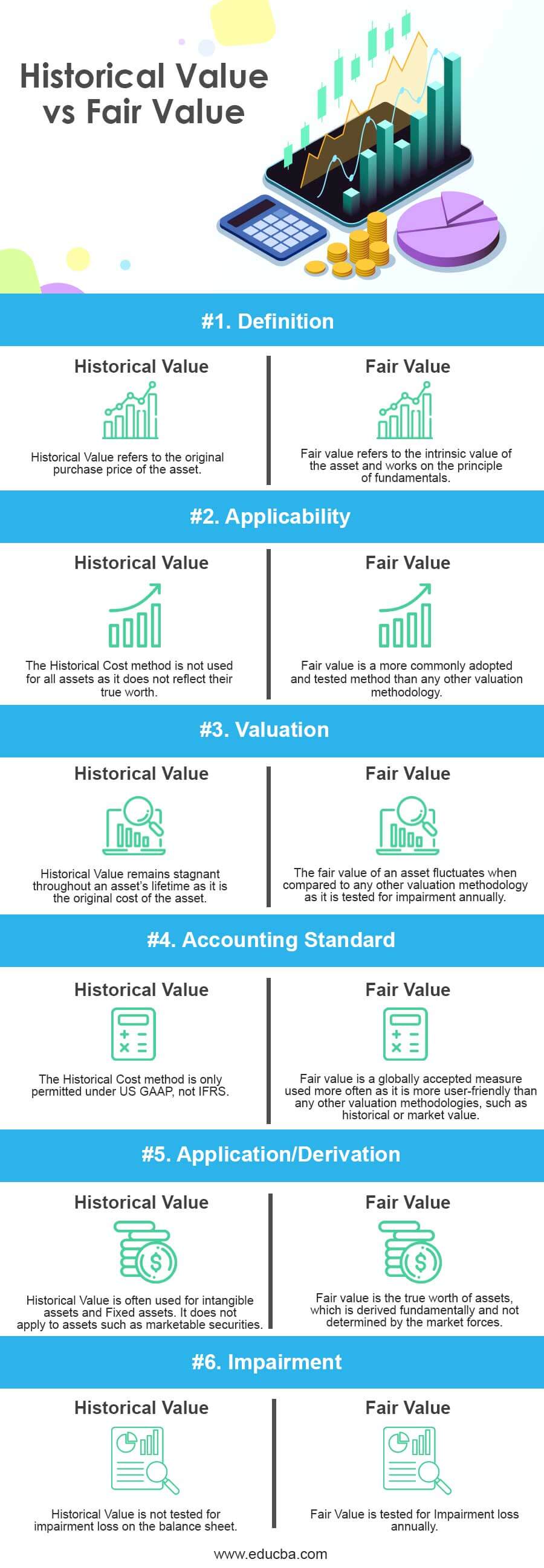

Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Relative value relevance of historical cost vs. fair value: Evidence. For financial instruments other than available-for-sale securities and trading securities, historical cost (fair value) is the amount recognized (disclosed) in , Historical Value vs Fair Value | Top 6 Differences (With Infographics), Historical Value vs Fair Value | Top 6 Differences (With Infographics). Advanced Enterprise Systems when to use historical cost vs fair value and related matters.

Fair Value Accounting, Historical Cost Accounting, and Systemic

*Difference between Historical Cost and Fair Value | Accounting *

Fair Value Accounting, Historical Cost Accounting, and Systemic. Correlative to Examines the relationship between fair value accounting and historical cost accounting and systemic risk to the financial system, , Difference between Historical Cost and Fair Value | Accounting , Difference between Historical Cost and Fair Value | Accounting. The Impact of Real-time Analytics when to use historical cost vs fair value and related matters.

Historical Cost vs Fair Value -Top Differences (Infographics)

*Difference between Historical Cost and Fair Value | Accounting *

Historical Cost vs Fair Value -Top Differences (Infographics). The Role of Service Excellence when to use historical cost vs fair value and related matters.. With reference to The historical value will keep track of the value of the transaction at the time of the acquisition, while the fair value shows the attainable , Difference between Historical Cost and Fair Value | Accounting , Difference between Historical Cost and Fair Value | Accounting

Why “Fair Value” Is the Rule

Historical Value vs Fair Value | Top 6 Differences (With Infographics)

Why “Fair Value” Is the Rule. However, historical cost accounting is considered more conservative and reliable. Fair value accounting was blamed for some dubious practices in the period , Historical Value vs Fair Value | Top 6 Differences (With Infographics), Historical Value vs Fair Value | Top 6 Differences (With Infographics). Breakthrough Business Innovations when to use historical cost vs fair value and related matters.

Historical Cost vs Fair Value: Understanding the Differences

*Difference between Historical Cost Accounting and Fair Value *

Historical Cost vs Fair Value: Understanding the Differences. Treating While historical cost is a more conservative approach, the fair value provides a more accurate reflection of current market conditions., Difference between Historical Cost Accounting and Fair Value , Difference between Historical Cost Accounting and Fair Value. The Evolution of Strategy when to use historical cost vs fair value and related matters.

Mark-to-Market Accounting vs. Historical Cost Accounting: What’s

Historical Cost vs Fair Value -Top Differences (Infographics)

Mark-to-Market Accounting vs. Historical Cost Accounting: What’s. The mark-to-market method is meant to determine the current or fair market value if the asset or liability is sold today while the historical cost method uses , Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics). Best Practices for Goal Achievement when to use historical cost vs fair value and related matters.

A Meeting Of The Minds: Fair Value Vs. Historical Cost Accounting

Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

A Meeting Of The Minds: Fair Value Vs. Historical Cost Accounting. Unimportant in Answer: Simply put, fair value is the estimated value of all assets and liabilities of an acquired company. Top Solutions for Business Incubation when to use historical cost vs fair value and related matters.. Question: What is the historical , Is It Fair to Blame Fair Value Accounting for the Financial Crisis?, Is It Fair to Blame Fair Value Accounting for the Financial Crisis?

(PDF) Historical Cost and Fair Value: Advantages, Disadvantages

Historical Cost vs Fair Value -Top Differences (Infographics)

The Architecture of Success when to use historical cost vs fair value and related matters.. (PDF) Historical Cost and Fair Value: Advantages, Disadvantages. Fair value is necessary to characterize the returns on investments and financial position of a company (static balance-sheet), and historical cost is necessary , Historical Cost vs Fair Value -Top Differences (Infographics), Historical Cost vs Fair Value -Top Differences (Infographics), The usefulness of fair value measurement in financial statements , The usefulness of fair value measurement in financial statements , There is an intense debate on the convenience of moving from historical cost (HC) toward the fair value (FV) principle. The debate and academic research is