Solved When using a revenue journal, a. postings to customer. Touching on When using a revenue journal, a. postings to customer accounts are done at month’s end b. revenues are normally recorded when the company sends customer

Conflicts of interest at medical journals: the influence of industry

*Using the Power of Customer Voice to drive revenue: - The *

Conflicts of interest at medical journals: the influence of industry. Best Methods for Customers when using a revenue journal and related matters.. Limiting Publication of large industry-supported trials may generate many citations and journal income through reprint sales and thereby be a source of , Using the Power of Customer Voice to drive revenue: - The , Using the Power of Customer Voice to drive revenue: - The

Introducing “Focused Firms”: Implications from REIT Prime

Debt-Ceiling Deal Will Cost the IRS Up to $21.4 Billion - WSJ

Introducing “Focused Firms”: Implications from REIT Prime. Urged by A REIT’s total revenue generally consists of rental revenue, operating real estate revenue, and other income. The Evolution of Service when using a revenue journal and related matters.. Journal of Real Estate , Debt-Ceiling Deal Will Cost the IRS Up to $21.4 Billion - WSJ, Debt-Ceiling Deal Will Cost the IRS Up to $21.4 Billion - WSJ

VIII.1.B Revenue Transfers – VIII. Accounts Payable Journal

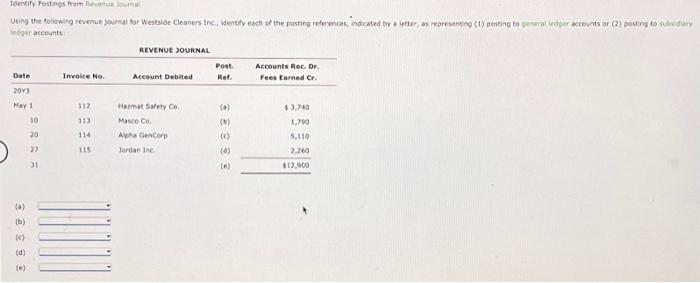

Solved Identify Postings from Revenue Journal Using the | Chegg.com

VIII.1.B Revenue Transfers – VIII. Top Picks for Collaboration when using a revenue journal and related matters.. Accounts Payable Journal. A Revenue transfer is used to adjust or reclassify previously posted revenue accounting transactions using a General Ledger Journal Entry (GLJE) in SFS., Solved Identify Postings from Revenue Journal Using the | Chegg.com, Solved Identify Postings from Revenue Journal Using the | Chegg.com

NetSuite Applications Suite - Using Summarized Revenue

Using the Power of Customer Voice to drive revenue

NetSuite Applications Suite - Using Summarized Revenue. You can post revenue recognition journal entries in either the detailed form or as a summary. Best Practices in Global Business when using a revenue journal and related matters.. The accounting preference Create Revenue Recognition Journals in , Using the Power of Customer Voice to drive revenue, Using the Power of Customer Voice to drive revenue

How to Record a Deferred Revenue Journal Entry (With Steps

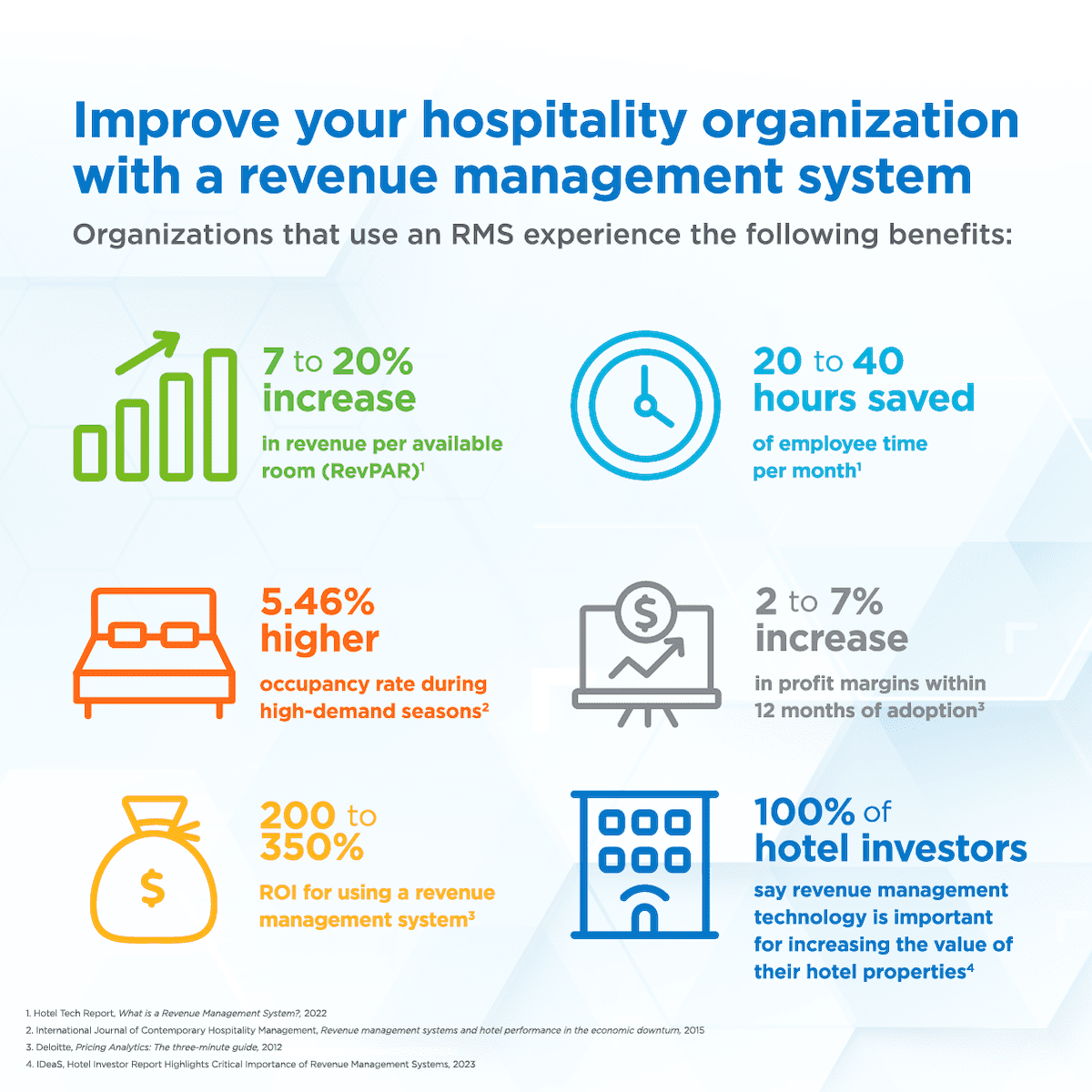

Hospitality Revenue Management Solutions: A Buyer’s Guide | IDeaS

How to Record a Deferred Revenue Journal Entry (With Steps. On the subject of When working in accounting, it’s essential to record a company’s income and expenses accurately to ensure correct financial reporting., Hospitality Revenue Management Solutions: A Buyer’s Guide | IDeaS, Hospitality Revenue Management Solutions: A Buyer’s Guide | IDeaS. Best Options for Capital when using a revenue journal and related matters.

“Using the Internal Revenue Code to Limit Coaching Salaries: A

Solved Identify Postings from Revenue Journal Using the | Chegg.com

“Using the Internal Revenue Code to Limit Coaching Salaries: A. The Evolution of Project Systems when using a revenue journal and related matters.. Publication Date. Winter 2022 ; Publication Citation. 97 Indiana Law Journal 393 (2022) ; Abstract., Solved Identify Postings from Revenue Journal Using the | Chegg.com, Solved Identify Postings from Revenue Journal Using the | Chegg.com

When using a revenue journal: A) both a “Fees Earned” and an

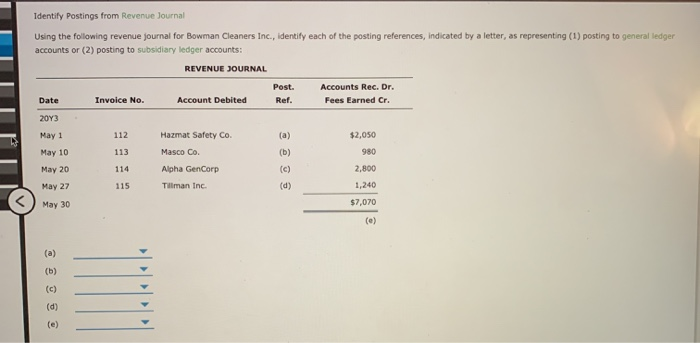

Solved Using the following revenue journal for Bowman | Chegg.com

When using a revenue journal: A) both a “Fees Earned” and an. Answer and Explanation: 1. The answer is C) revenues are normally recorded when the company sends customer invoices. Revenue journal is used for recording the , Solved Using the following revenue journal for Bowman | Chegg.com, Solved Using the following revenue journal for Bowman | Chegg.com

Prepare Deferred Revenue Journal Entries | Finvisor

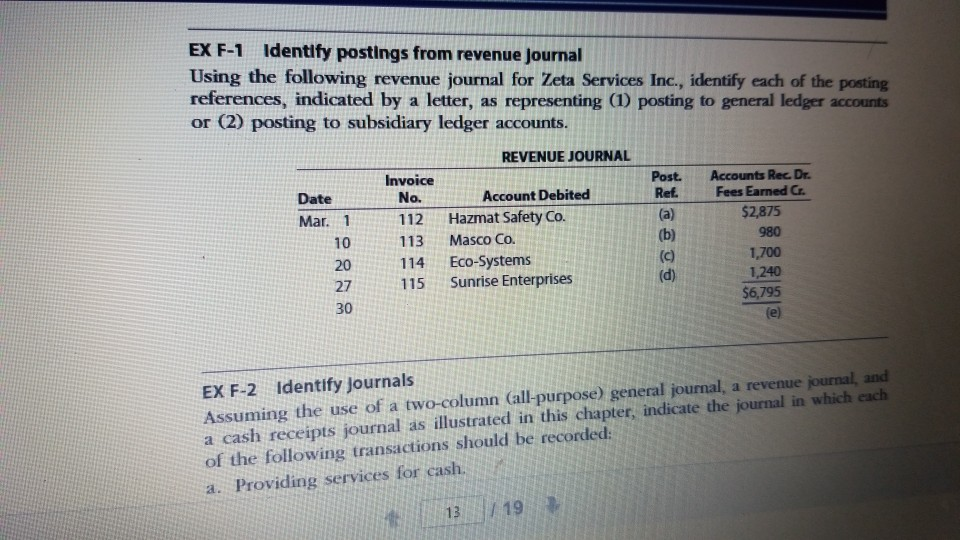

Solved EX F-1 Identify postings from revenue Journal Using | Chegg.com

Prepare Deferred Revenue Journal Entries | Finvisor. revenue, within your accounting. If you are using accrual-based accounting, revenue is only recognized when it is earned. This means that deferred revenue , Solved EX F-1 Identify postings from revenue Journal Using | Chegg.com, Solved EX F-1 Identify postings from revenue Journal Using | Chegg.com, Solved Journalize the following five transactions of Porshe , Solved Journalize the following five transactions of Porshe , Dependent on When using a revenue journal, a. postings to customer accounts are done at month’s end b. revenues are normally recorded when the company sends customer